As bitcoin (BTC) surged to new highs last week, a new survey from Pew Research Center shows that a large number of Americans are still skeptical about the safety and reliability of cryptocurrency.

Bitcoin reached $30,397 on Apr. 11 – its highest level in 10 months – and up 84% from $16,540 at the start of the year. As of writing, the benchmark token is trading 1.4% down at $29,898, according to CoinGecko data. Since the beginning of this month, bitcoin has gained 7% and rose 23% in March.

Other leading crypto assets including ethereum (ETH), ripple (XRP) and cardano (ADA) have all seen major gains in recent months, helping to push the total crypto market capitalization by over $400 billion to $1.24 trillion.

Also read: Bitcoin Soars 84% To Reach 2023 High as Fed Expected to End Rate Hikes

Investors wary of bitcoin

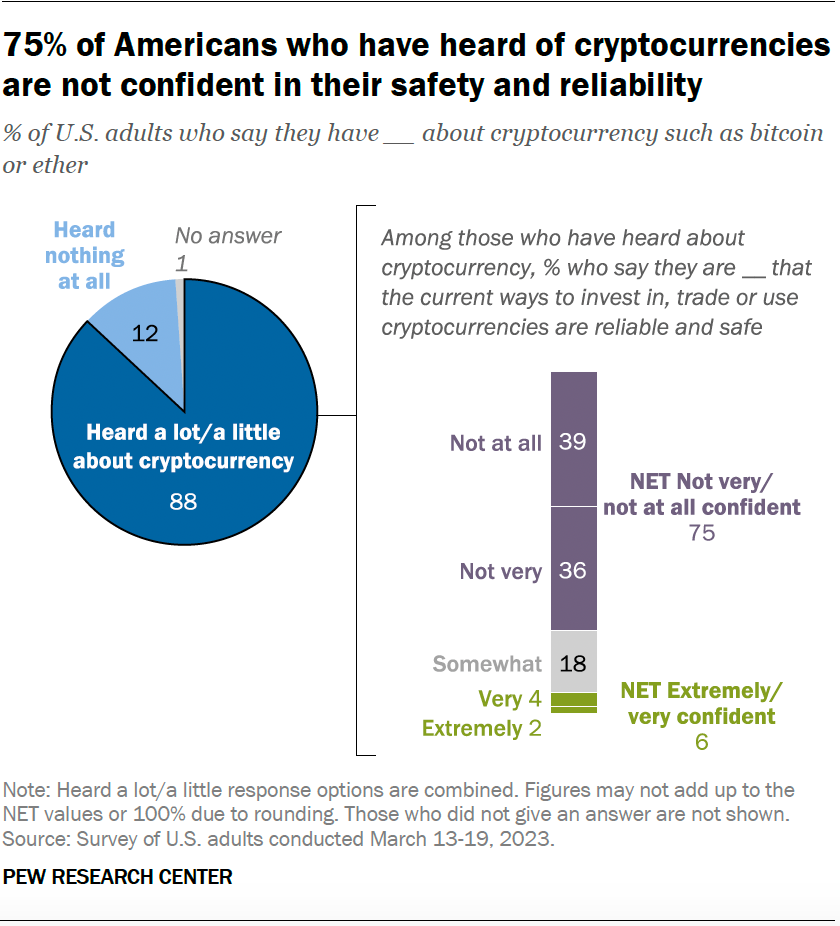

Despite the bull run, the Pew Research Center survey found that 75% of American adults who have previously invested in digital assets such as bitcoin are “not very or not at all confident” in the technology’s safety or reliability.

The survey polled over 10,700 U.S. adults between March 13-19, and were asked questions such as: “How much, if anything, have you heard about cryptocurrency such as Bitcoin or Ether?”

Findings suggest that while interest in crypto may be growing, many Americans remain wary of the uncertainties surrounding digital assets. However, the survey only covers those who have previously invested in cryptocurrencies, and does not reflect the sentiments of the broader population.

Roughly four-in-ten adults who have heard about cryptocurrency, or 39%, say they are not at all confident and an additional 36% are not very confident in the reliability and safety of cryptocurrencies.

The report notes that concerns over security and volatility are among the key factors contributing to Americans’ lack of confidence in cryptocurrencies. It also suggests that regulatory and legal issues may be contributing to the uncertainty surrounding digital assets.

Pew said: “When asked about the potential downsides of cryptocurrencies, people in the survey expressed concerns about their security, their volatility, and the potential for illicit activities such as money laundering or scams. Some also said they worry about market manipulation, lack of regulation and a lack of understanding of how cryptocurrencies work.”

The more concerning statistic, though, was this: The proportion of U.S. adults that have ever traded, invested in or used cryptocurrency has increased by just one percentage point to 17%, compared to September 2021, based on the current urvey and Pew’s prior research.

“Sure, the fact that bitcoin’s price has been trending upward means there are more buyers than sellers, but Pew’s findings suggest it’s just been the same people buying and selling over the past 18 months,” said The Information’s tech analyst Akash Pasricha.

“Crypto adoption, which many blockchain startups will tell you is their main goal, isn’t getting any higher. And the way things are going, it might stay that way for a while.”

Crypto’s dismal performance

Despite its recent gains, bitcoin remains 57% off its all-time-high of $69,000 reached on Nov. 10, 2021. The decline was fast-tracked by the multi-billion-dollar collapse of the Terra blockchain and Sam Bankman-Fried’s FTX empire last year.

Both events led to massive losses for investors, dent in confidence and increased regulatory scrutiny over the crypto industry.

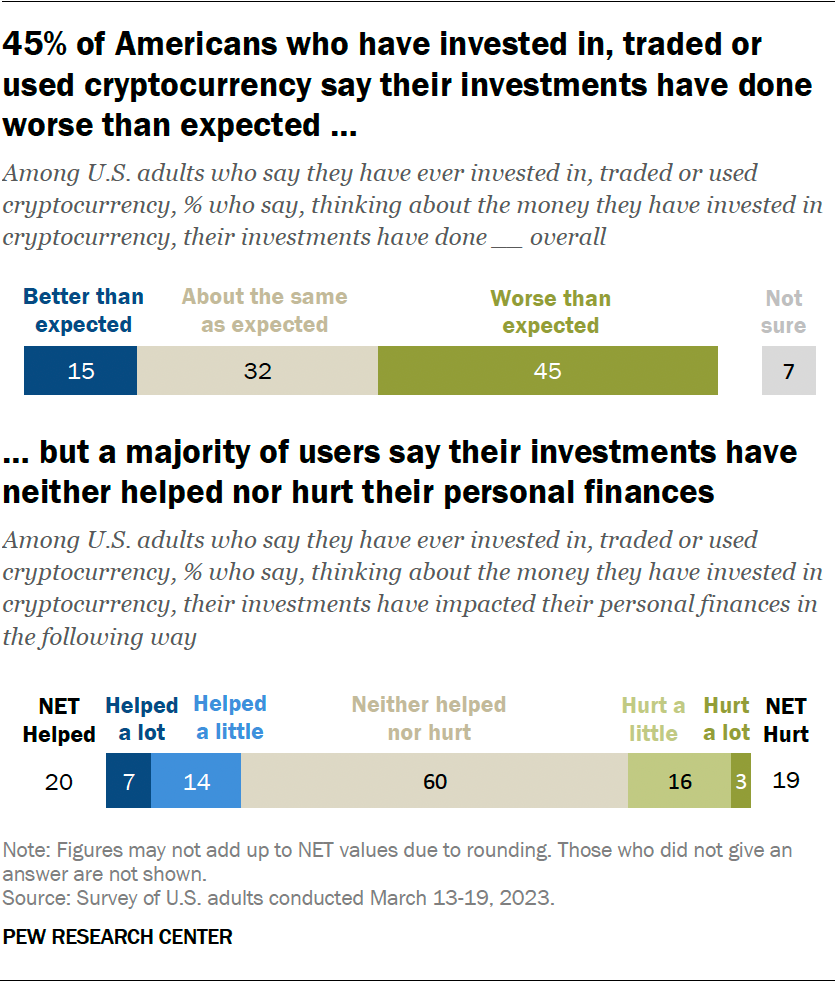

As shown below, 45% of U.S. crypto investors report that their investments have performed worse than they expected, a result that is statistically unchanged since July 2022, when the Center last asked about this.

Despite these concerns, the survey also found that more than half of American adults have heard at least something about cryptocurrencies, and around 14% personally own digital assets. This suggests that while skepticism may still abound, cryptocurrencies are becoming more mainstream and are attracting interest from a growing number of Americans.

The report also notes that cryptocurrencies are seen as a potential tool for financial inclusion and as a way to bypass traditional financial institutions. It states that: “People who use or are interested in cryptocurrencies see them as potentially useful for financial transactions that cut out traditional banks or other financial institutions (41% of those who have heard of cryptocurrencies say this).”

The Pew survey shows that while cryptocurreny may still have a long way to go before they become widely accepted, is is attracting some attention and interest from Americans. However, concerns over safety, regulation, and volatility must be addressed before digital assets can gain wider acceptance and adoption.

and then

and then