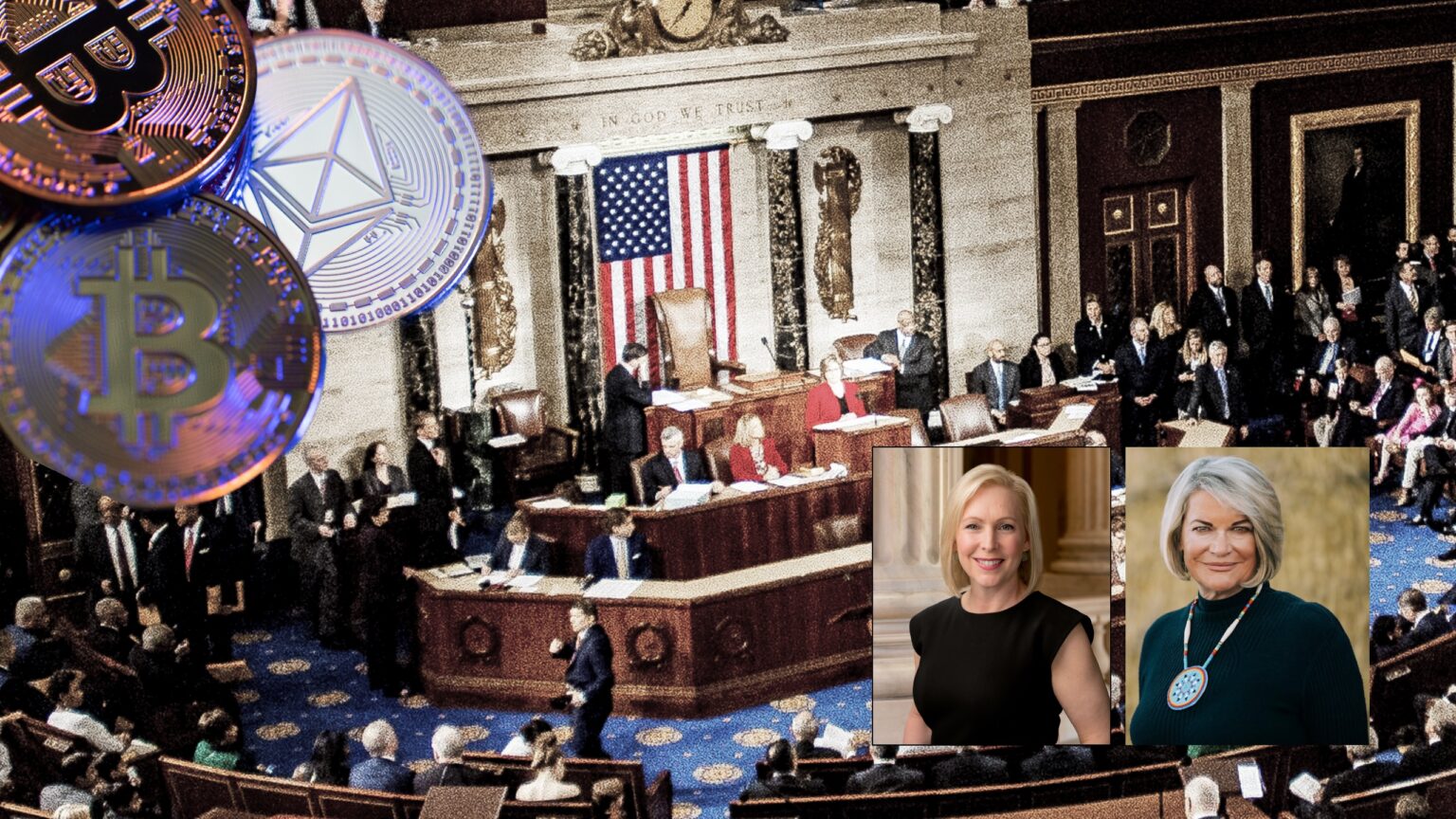

Despite the ongoing ambiguity within the U.S. legislative landscape concerning cryptos, Senators Cynthia Lummis and Kirsten Gillibrand’s proposed bill addressing the matter has been met with resistance from influential figures within the crypto space.

Mr. Huber, a voice within the Ripple (XRP) community, has vocally critiqued the senators’ stance, particularly their categorizing of most cryptocurrencies as commodities. According to Huber on X, the two are trying to deceive the public.

You are trying lying. You are trying to deceive the public. pic.twitter.com/DxuZZtjxdV

— Mr. Huber🔥🦅🔥 (@Leerzeit) July 26, 2023

The bill, co-sponsored by Senators Lummis, a Wyoming Republican, and Gillibrand, a Democrat from New York, allegedly seeks to clarify and regulate the burgeoning crypto industry in the U.S. while significantly emphasizing consumer protection. This comes in response to a series of high-profile failures within the crypto industry in 2022, including the collapse of crypto stablecoin TerraUSD (UST) and the implosion of trading giant FTX.

This legislation signifies a potentially far-reaching attempt at crypto regulation to emerge from the U.S. Senate, especially in light of last year’s unsuccessful attempt. However, the bill has been criticized by figures within the crypto community, like Mr. Huber, due to its approach to categorizing cryptocurrencies.

Commodities or securities?

In a recent interview, Sen. Lummis stated that most cryptocurrencies should be classified as commodities, subjecting them to the CFTC’s regulatory oversight for transactions involving both the spot and futures markets. In contrast, Senator Gillibrand argues that many cryptos should be regarded as securities, which would place a sizable portion of regulatory monitoring on the SEC’s shoulders.

Their proposed bill introduces a novel approach to this issue, drawing a clear border between securities oversight and the rest, effectively setting up separate domains for the SEC and CFTC in the crypto world.

However, according to Mr. Huber, this categorization could be deceptive to the public and potentially detrimental to the crypto industry. He criticizes the senators’ stance, citing the lack of a clear distinction between different types of cryptocurrencies, potentially leading to confusion and regulatory missteps.

Navigating regulatory waters

The bill’s proposed approach also addresses the criticisms from last year’s version, which saw most digital assets as intangible “ancillary assets” and, thus, commodities under the CFTC’s jurisdiction. This led to SEC Chair Gary Gensler ramping up scrutiny over the crypto industry, charging industry heavyweights like Binance and Coinbase with violating securities laws. This raised concerns about the potential overreach of the SEC’s authority within the crypto space.

Senator Lummis acknowledged these concerns, stating that such incidents underscore the urgent need for precise regulation within the crypto industry. She referred to instances where crypto companies like Kraken and Coinbase had requested more straightforward regulatory guidelines from the SEC, only to face enforcement actions instead.

The potential exodus

Amidst the ambiguity in the U.S. regulatory framework, fears are mounting among lawmakers and investors that the absence of clear regulatory rules may prompt cryptocurrency companies to move their businesses overseas. According to NBC News, a comprehensive study by JPMorgan recently underscored the importance of legislators establishing an exhaustive regulatory strategy for the cryptocurrency industry, outlining precise roles and responsibilities for the SEC and the CFTC.

However, the difficulty lies in skillfully walking the tightrope between stimulating innovative growth and safeguarding consumer interests. Given the extensive consequences of the proposed bill and the debates it has sparked, it’s unclear how Senators Lummis and Gillibrand plan to balance these contradictory demands in the context of the ever-evolving cryptocurrency sector.

and then

and then