Cryptocurrency exchange Bitstamp is set to cease Ethereum staking offerings for its American clientele starting September 25, 2023.

As other regions like the European Union embrace clearer crypto regulations, US investors and exchanges are left navigating a murky scene. According to the report, Bitstamp pinpointed “current regulatory dynamics in the US” as the primary driver behind their decision.

Crypto exchange Bitstamp will stop offering Ethereum staking services to U.S. customers starting September 25. Customers will continue to receive staking rewards until September 25, 2023, after which all staked assets will be unstaked and the rewards, along with the principal,…

— Wu Blockchain (@WuBlockchain) August 23, 2023

Navigating the US regulatory waters

The announcement excludes US-based users, who have until the stated deadline to continue accruing rewards on their staked Ethereum. Post-September 25, Bitstamp will unburden these assets, ensuring users find their staked Ethereum and any related rewards returned to their accounts.

The termination of Ethereum staking isn’t Bitstamp’s maiden venture into modifying its service palette. Earlier in August, they suspended services for seven cryptocurrencies, prominent among them being Polygon (MATIC) and Solana (SOL). Even though the details weren’t given, people in the industry believe these actions were taken early because the SEC might see these assets as “unregistered securities.” Bitstamp stated;

“Update for our US users. Starting August 29: AXS, CHZ, MANA, MATIC, NEAR, SAND, and SOL trading will be halted after evaluating recent market developments. Execute any open trades. Holding and withdrawing tokens afterwards will be unaffected.”

Notably, major players like Binance and Coinbase have already been entangled in the regulatory web, with lawsuits alleging violations of securities protocols. Another notable casualty was Kraken, slapped with a $30 million penalty and subsequent discontinuation of their staking services earlier this year.

Ethereum staking: Riding high despite odds

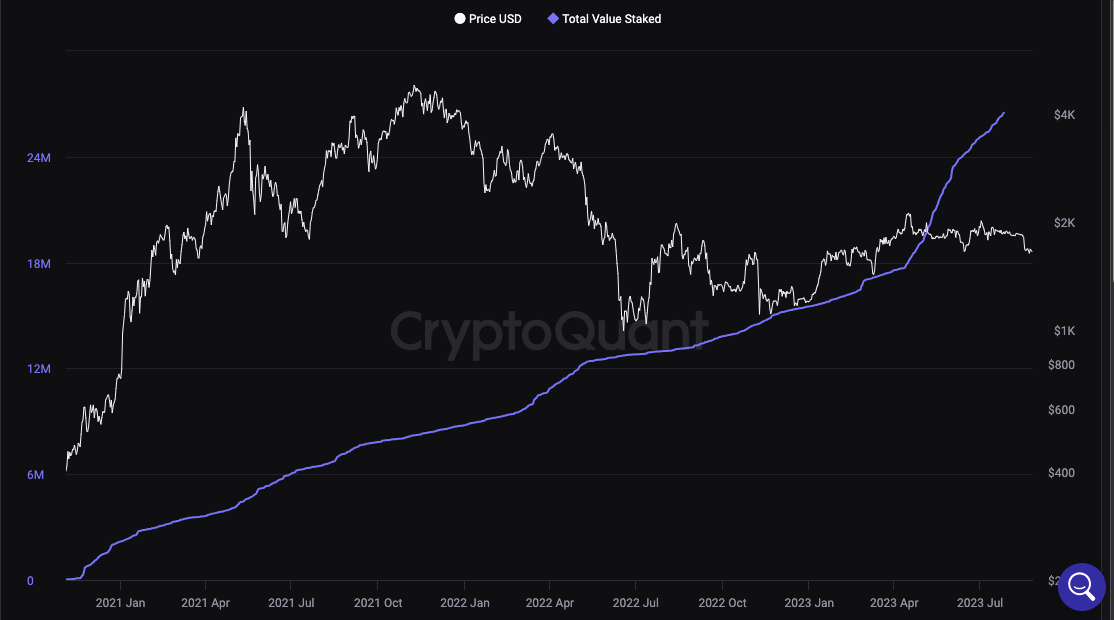

Although the crypto market suffered a jolt recently, Ethereum’s on-chain metrics exude resilience. Contrary to apprehensions surrounding the Shanghai-Capella fork’s potential negative implications on Ethereum’s price, the fork surprisingly ignited an increased demand for Ethereum. Current statistics underscore this sentiment, with a 5.7% monthly increase in the total value staked, mounting from 26.3 million ETH to 27.8 million.

Source: CryptoQuant

Industry pundits suggest that investors maintain a broader perspective, especially considering the burgeoning popularity of liquid staking tokens (LSTs) which can temper short-term volatility.

The Ethereum conundrum: Commodity or security?

A pivotal question dogging the US regulatory circuit is the classification of Ethereum’s native cryptocurrency, Ether. Trailing only Bitcoin in market capitalization, the ambiguity of its categorization has sparked debates. SEC Chair Gary Gensler previously validated Bitcoin’s status as a commodity but remained elusive on Ether’s classification. Meanwhile, the Commodity Futures Trading Commission has consistently regarded Ether in the commodity bracket.

Such distinctions are imperative, especially when evaluating the Decentralized Finance (DeFi) ecosystem. Post-Ethereum’s Shanghai upgrade in April, which facilitated unstaking for validators, liquid staking witnessed a significant boost. Currently, liquid staking protocols oversee approximately $21 billion in total value. This dominance in the DeFi space could be jeopardized if the SEC intensifies its crackdown on staking providers.

As of writing, Ethereum was trading for $1,651.76, experiencing a slight 1.30% dip over a 24-hour period. Its market capitalization was around $200 billion, cementing its position as the second-largest digital asset on CoinMarketCap. With a circulating supply of 120,214,260 ETH, the crypto community waits with bated breath to gauge Ether’s trajectory in light of evolving regulations and market dynamics.

and then

and then