Shareholders of the shell company Digital World Acquisition Corp voted to acquire Donald Trump’s social media network Truth Social and take it public, potentially generating billions for the former U.S. president.

After the merger, Donald Trump will own nearly 60% of the new entity, worth more than $3 billion at Digital World’s $40 share price at Friday’s (Mar. 22) opening, when investors approved the plan.

It is a windfall for Trump as he seeks a return to the White House. Truth Social could start trading on the Nasdaq stock exchange this week, at a valuation of $5 billion, the Wall Street Journal reports.

Also read: 5 Social Media Platforms Seeking to Dethrone Twitter

Buying Truth Social

Digital World (Dwac) is a special purpose acquisition company, or SPAC – a firm created for the singular purpose of buying another. Since going public in 2021, Dwac’s primary goal was to purchase Trump Media & Technology Group , which owns Truth Social.

Trump started Truth Social after he was banned from Twitter, now X, and Facebook following the Jan. 6, 2021 Capitol Hill riots. While both sites have reinstated Trump’s account, he continues to post almost exclusively on his own platform.

On Saturday, hours after the Dwac deal approval, he told millions of his followers on social media that “I love Truth Social”. It came amid shareholder concerns about the platform, which posted losses of about $50 million and under $3.5 million revenue during the first nine months of 2023. The merger could reportedly provide more than $200 million cash to Truth Social.

There’s worry that the merged entity, dubbed Trump Media, might not deliver value for investors, and whether Trump, who is facing several high profile court cases, would cash-in on his shares early.

The former U.S. president is looking at civil legal judgments worth over $500 million in New York federal and state courts, including bills related to those cases and four criminal prosecutions.

Recently, lawyers representing Donald Trump said in a court filing that the presidential hopeful did “not have the cash to obtain an appeal bond to secure a $454 million fraud judgment in one of those cases,” according CNBC.

Under the terms of the merger, Trump is not allowed to sell his 80 million shares, or his 58% stake in the newly formed company, for six months.

Digital World shares decline

However, the new board of directors, which includes his son Donald J. Trump Jnr, could remove the temporary ban, giving him leeway to sell the shares to raise money for his legal woes. Once Trump sells, this could trigger other minority shareholders to sell their stock, precipitating a decline of the firm, experts say.

“With Trump Media, I expect that it will collapse but whether it’s going to occur a week from now or two years from now and how rapidly… those things are really difficult to predict,” said University of Florida finance professor Jay Ritter, as reported by the BBC.

Trump Media is expected to start trading on the Nasdaq stock exchange under the ticker “DJT,” which stands for Donald J. Trump, as early as this week, according to industry media.

The Digital World – Truth Social merger was first announced in October 2021, but quickly ran into trouble with U.S. regulators, who accused the companies of misleading investors by not disclosing the two held merger talks before Dwac went public.

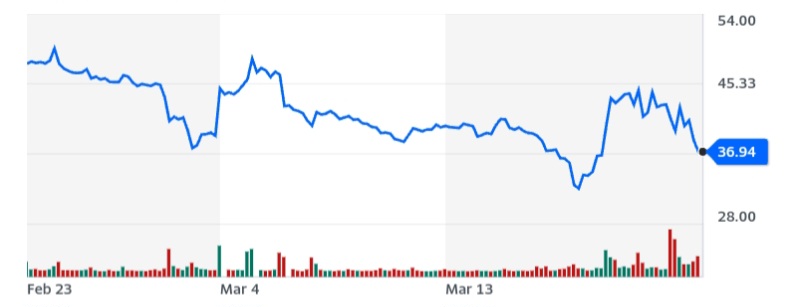

Shares of Dwac were up about 10% before the vote on Friday. After the approval, the stock fell as much as 14% to $36.94, according to Yahoo Finance. The share hit an all-time high of $53.72 on Jan. 23, spurred by high expectations of the merger.

Truth Social, a right-wing social media network, is a clone of Twitter. Posts are called “truths,” and reposts “re-truths.” Until late 2022, Google blocked downloads of the Truth Social app from its digital store for what it called “violent content.”

Launched in February 2022, the platform boasts a user base of around two million, but it is also a playground for racists, bigots and the like, according to people who have used Truth Social.

and then

and then