FET, the novel token of Fetch.ai, an AI lab with a mission to democratizes access to AI technology, has exploded by over 500% on the back of trending products and usage across the globe.

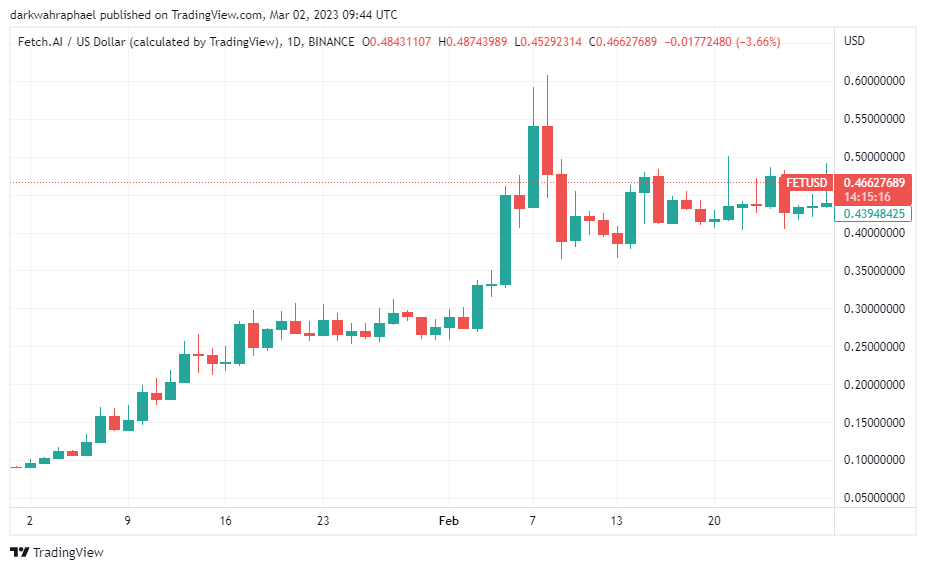

As a low-cap digital asset, FET opened 2023 with a trading price of $0.09166 with a relatively lower trading volume of about $5.5 million, corresponding to a market capitalization of $75 million.

Thriving on the resurrection of AI, big data, metaverse tokens and metaverse stocks, FET rose by 200% to close the first month of the year with a trading price of $0.2758.

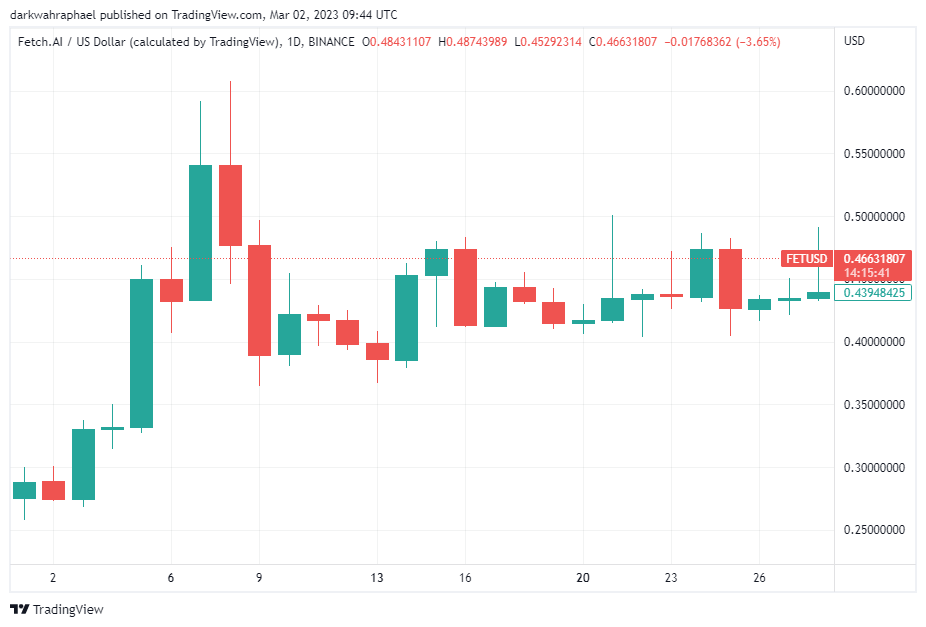

FET makes early gains in 2023

In the crypto market, digital currencies normally follow the price patterns of the two largest digital assets by market capitalization, Bitcoin (BTC) and Ethereum (ETH). While SingularityNET (AGIX) is not among mainstream cryptocurrencies, it is the biggest AI token by market value, and a spike or plunge in its price is felt across the entire sector.

In the first week of February, SingularityNET forged a new partnership with Cardano, a major blockchain protocol which continues to achieve milestones. This alliance positively affected the price of its novel token AGIX and spread through the AI token space.

After opening February at $0.2757, FET, like AGIX, rose significantly in value to a monthly and yearly high price of $0.6004 on Feb. 8.

As a result, investors that held FET from Jan. 1 to the eighth day of February saw gains of 550%. While the token tested a monthly low of $0.2585 on the first day of the month, it ended the period with a much-improved price of $0.4396. In 28 days, FET increased by 59%.

Bullish forecasts for FET

According to analysts at Investors Observer, FET is among a list of cryptocurrencies that commands a long-term technical score of 92 based on factors like support and resistance levels and its historical trading patterns.

The strength of such factors is why David Cox at CryptoNewsZ has bullish forecasts for FET, which he foresees reaching a maximum price of $2.74 by 2030.

After bringing in 380% in returns year-to-date (YTD), FET holders have seen a substantial rise in their portfolios.

Will increased patronage of the platform, coupled with soaring AI usage, continue to prime the price of FET? Only time will tell.

and then

and then