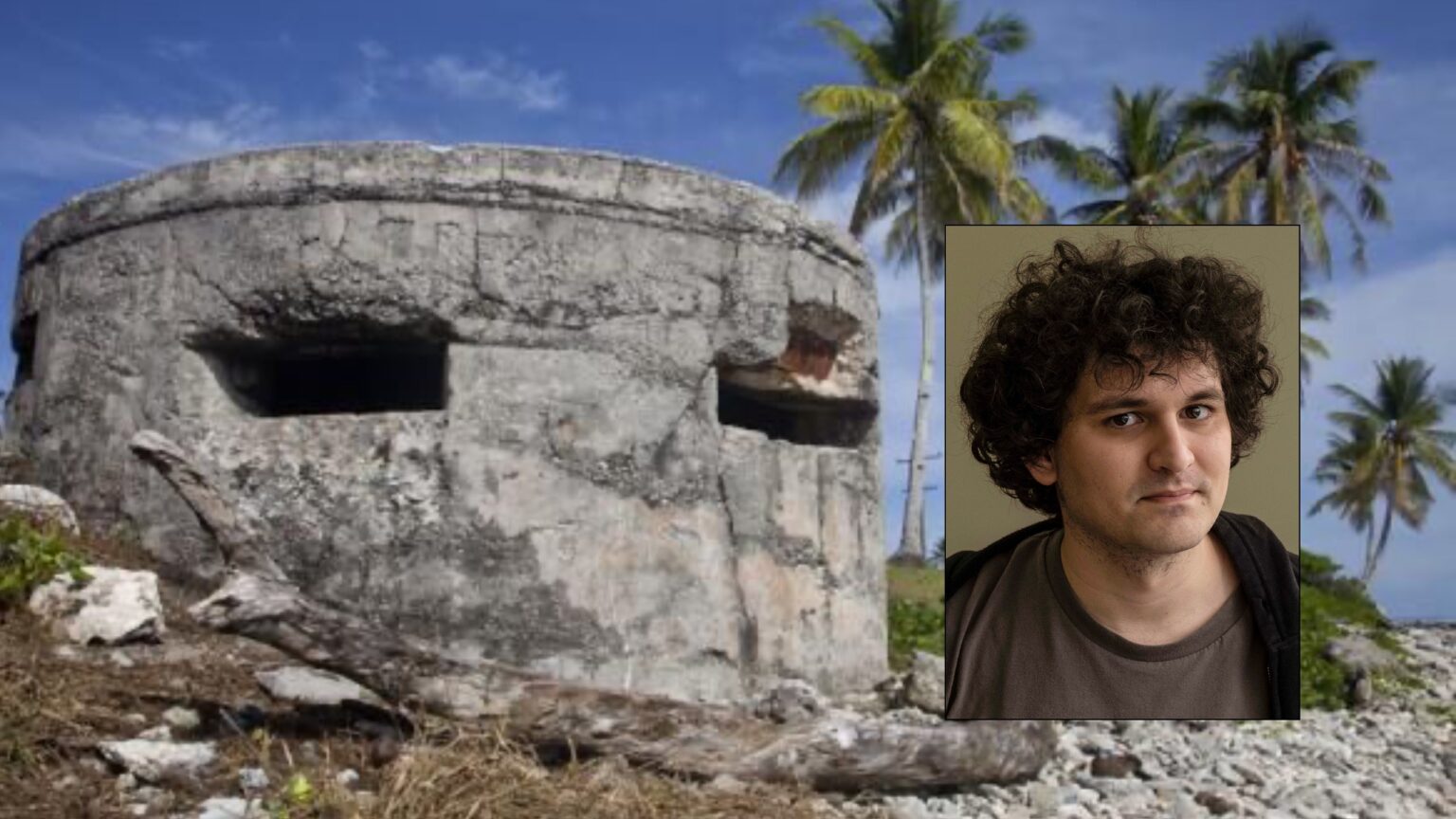

Crypto swingman Sam Bankman-Fried (SBF) planned to purchase the island nation of Nauru and build a bunker there to protect his colleagues in the effective altruism movement in the event of an apocalypse, new court documents show.

Filed in a federal bankruptcy court in Delaware, U.S., on July 20, the lawsuit states that SBF and his team would move into a bunker on the small Pacific nation to wait out the end of the world, far from the madding crowd.

Also read: Web3 Studio Toonstar Debuts Animated Comedy Based on FTX’s Dramatic Fall

The Bankman-Fried family hideaway

According to court filings, the plan to buy Nauru was hatched by Bankman-Fried’s brother Gabriel, in 2021. The court documents include a memo written by an official from the FTX Foundation, the charity arm of FTX, and Gabriel.

The memo outlined a plan to ensure the survival of FTX and Alameda Research employees and executives who subscribed to the philosophy of effective altruism in the event of a global cataclysm. Effective altruism preaches the gospel of using data to amass wealth for good.

Per the memo, the grand plan was “to purchase the sovereign nation of Nauru in order to construct a ‘bunker/shelter’ that would be used for some event where 50%-99.99% of people die [to] ensure that most EAs (effective altruists) survive.”

It also revealed plans to develop “sensible regulation around human genetic enhancement, and build a lab there.”

“Probably there are other things it’s useful to do with a sovereign country, too,” added the memo.

Nauru is a tiny island country in the northeast of Australia, with a population of around 10,000 people. The island is known for its phosphate deposits, which were once a major source of income for the country.

However, the phosphate reserves have been depleted, and Nauru is now one of the poorest countries in the world. Nauru has a history of state-sanctioned money laundering. In the late 1990s, Russian banks washed $70 billion using banks on the island to avoid paying taxes.

Money laundering was not a criminal offense in Nauru at the time, but Uncle Sam later designated the nation a money-laundering state, leading to the closure of the country’s central bank in 2006. Today, Nauru uses the Australian dollar as its official currency.

Organized crime behind effective altruism

It is no surprise why the Bankman-Fried brothers settled for Nauru for their end-of-the-world hideaway. But more importantly, the revelation put a wet blanket around lover-gambler SBF’s claim of effective altruism.

“Their [FTX executives] whole goal was to maximize wealth,” a former Alameda employee previously told Forbes. “They never lived in a world where they weren’t risking a lot.”

In 2022, Bankman-Fried also confessed to the New York Times that he used the philosophy as a cover for speculative accumulation. His former girlfriend and Alameda CEO Caroline Ellison, sarcastically renamed her blog “Fake Charity Nerd Girl.”

According to the July 20 court filings, the FTX Foundation “served little purpose other than to enhance the public stature of Defendants.” Lawyers alleged that the Foundation received grants directly from bank accounts that contained customer funds.

As Fortune reported, the lawsuit described the FTX Foundation’s projects as “frequently misguided and sometimes dystopian.” One example includes a $30,000 grant to one person to write a book about how to figure out “humans’ utility functions.”

FTX debacle turning point in crypto

The FTX debacle was a turning point in crypto. It signaled that “the business world is in dire need of trustless tech rather than corruptible leaders who could make the most disastrous of decisions for personal gain, at the expense of millions or even billions of people.”

The latest lawsuit is part of a series of lawsuits filed by the FTX bankruptcy estate to recover over $8 billion in user funds that sank with the catastrophic collapse of Bankman-Fried’s cryptocurrency empire last year.

Led by former Enron bankruptcy expert John Ray, the suit seeks 48 counts related to the fraudulent transfer of funds by FTX executives: Bankman-Fried, CTO Gary Wang, head of engineering Nishad Singh, and Alameda CEO Ellison, Fortune reported.

and then

and then