The number of daily bitcoin transactions hit a fresh high over the weekend, just days after Grayscale published a report praising the effect of Ordinals on the crypto network.

On Saturday, the average number of daily transactions over the previous seven days stood at 396,350, highlighting the growing usage of the blockchain which powers the world’s leading digital asset. A day later, Ordinals set its own milestone with over 300,000 inscriptions recorded.

Late last week, the asset management company tackled the thorny topic of Ordinals, which has elicited a mixed response from the bitcoin company. The ‘Market Byte’ article said the protocol represents “one of the larger opportunities for bitcoin adoption, especially as the bitcoin network has historically been viewed as a rigid blockchain ecosystem.”

Bullish on bitcoin

Despite its short lifespan, the Ordinals protocol that lets users create NFTs on bitcoin has already made a significant impact on the network, with the number of inscriptions recently soaring past 2.5 million.

Despite its enormous success, many hard-line bitcoiners are opposed to the protocol, arguing that it clutters the blockchain and detracts from its primary use-case as a peer-to-peer digital currency.

While the Grayscale blog acknowledges these criticisms, it contends that bitcoin-based NFTs are positive for two key reasons. Namely, they boost mining fees and “potentially contribute to a cultural transformation within the bitcoin community.”

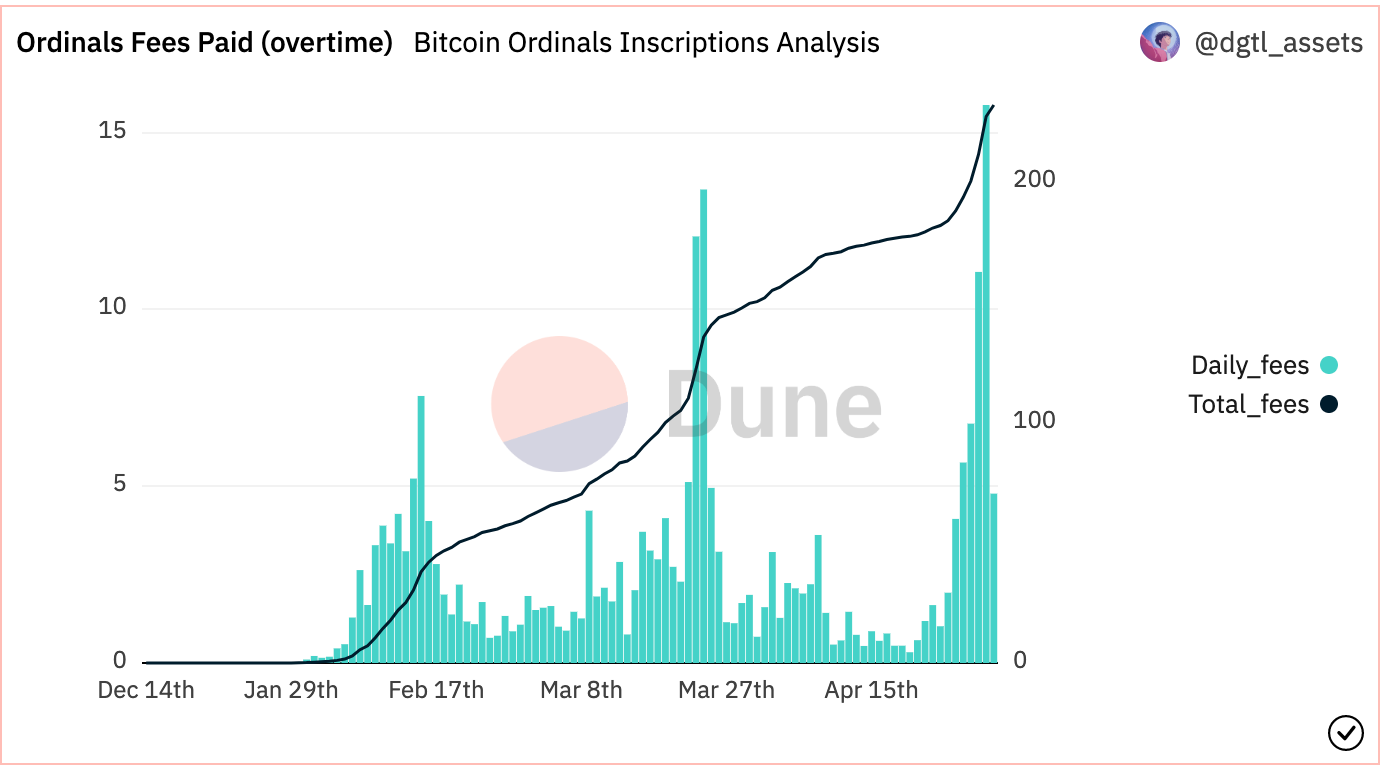

The point about mining fees is inarguable: according to Dune Analytics, miners have pocketed over $6.6 million from the trend since Ordinals launched in January. But how might Ordinals positively transform the bitcoin community, according to Grayscale?

The asset manager predicts that the success of Ordinals is “likely to promote a development-oriented community and culture in support of the bitcoin network.” In short, more interest and activity should result in better network security and an improved long-term outlook for the top cryptocurrency.

Ordinals enables users to ‘inscribe’ elements like images, text, PDFs, video, and audio files onto satoshis, the smallest denomination of bitcoin, giving those particular satoshis NFT-like status. The emergence of Ordinals has given rise to the term ‘BRC-20’, a token standard that stores a script file on the bitcoin network and permits token transactions between users.

Bitcoin’s recent hot streak

Bitcoin has enjoyed a healthy start to 2023, having climbed for four straight months through April – its longest such streak since a six-month advance to March 2021.

The top cryptocurrency has gained around 70% since last year’s low, and is hovering in the $28.5k range at the time of writing.

BRC-20 started as a late-night twitter thread that theorized a crazy idea of how to do fungible tokens on Bitcoin via the ordinals protocol.

Here we are 54 days later and BRC-20 tokens have a combined market cap of over $150M.

Building on Bitcoin is cool again. pic.twitter.com/TmKdaBpLm4

— Leonidas (@LeonidasNFT) May 1, 2023

Grayscale isn’t the only entity bullish on BTC. At last week’s Consensus 2023 conference, ex-Coinbase CTO Balaji Srinivasan reiterated his optimistic stance, having previously predicted the currency’s value could reach $1 million by June 17. Though he rowed back on that projection, he said government money printing would continue to boost bitcoin’s value.

Geoff Kendrick, head of FX research at Standard Chartered, is a little more restrained than Srinivasan: he says the price of bitcoin could surge to $100k by the end of 2024, a consequence of banking turmoil, the next bitcoin halving, and the forecasted end of Fed rate hikes.

and then

and then