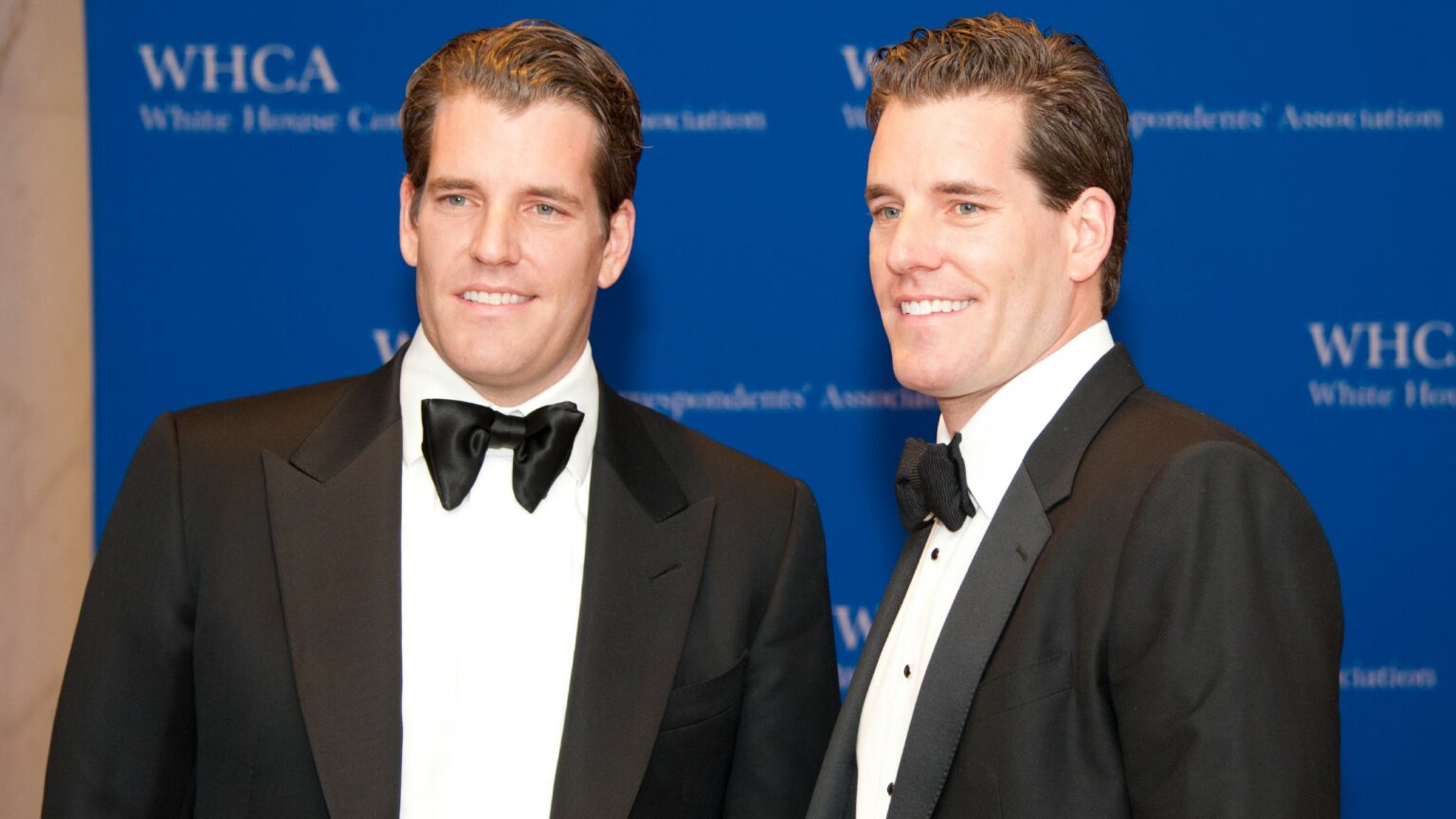

The landscape of the cryptocurrency industry is no stranger to controversies. The recent dispute between Gemini’s co-founder Cameron Winklevoss and the Digital Currency Group’s (DCG) CEO Barry Silbert is a striking case in point.

Now John E Deaton, the founder of CryptoLaw and an advocate for the cryptocurrency XRP, has commented on the ongoing dispute. Deaton’s intervention on Tuesday lends a fresh perspective to the issue, suggesting Winklevoss should take legal action if he can substantiate his claims. Winklevoss alleges deceptive practices and substantial unsettled debts from the subsidiary.

I just read this open letter. As someone who files lawsuits, my question is, if Cameron can prove what he claims, why not

just file the damn suit? I learned a long time ago, in a moment of crisis, when integrity and honor mean everything, and someone shows you who he really is,… https://t.co/ICFq0rjFi7— John E Deaton (@JohnEDeaton1) July 4, 2023

The Winklevoss-Silbert controversy

Cameron Winklevoss, a co-founder at Gemini, has been involved in a public dispute with DCG’s Barry Silbert for some time. The disagreement centers around Genesis, a DCG-controlled crypto lending division, which Winklevoss accuses of owing significant debts and being involved in underhanded activities.

Winklevoss went as far as to suggest there is a deep-seated “culture of lies and deceit” created by Silbert and his associates at DCG.

The uproar caught the public eye when Winklevoss took to Twitter to lay out his grievances. He insisted on Genesis’s duty to repay affected customers, pinpointing the company’s alleged insolvency. According to Winklevoss, Genesis currently holds $1.2 billion in assets, all linked to distressed customers.

Earn Update: An Open Letter to @BarrySilbert pic.twitter.com/ErsYpcEjQD

— Cameron Winklevoss (@cameron) July 4, 2023

Amidst these claims, Winklevoss also highlighted that Genesis owes a sizable debt to various parties, most notably Gemini. The purported debt, related to funds borrowed from the Gemini Earn program, allegedly remains unsettled, with a staggering amount of $900 million outstanding.

Other voices in the crypto space

Ryan Selkis, the founder of the crypto analytics platform Messari, has also voiced his concerns on the issue. Selkis expressed disappointment over the apparent tactics the Securities and Exchange Commission (SEC) employed to protect banks while potentially disadvantaging retail shareholders. Selkis suggests that such maneuvers might be a cover-up for DCG’s financial problems, thus adding another layer to the ongoing controversy. In a tweet, he says;

“The SEC under @GaryGensler is allowing an SEC reporting company (Grayscale and its GBTC & ETHE trusts) to milk retail shareholders for 2% per year and 40% asset impairment in order to pay lawyers and restructuring bankers to cover for Grayscale’s sister company’s insolvency. Sad!”

This dispute underscores the need for transparency, regulation, and accountability in the cryptocurrency industry. Deaton’s advice in favor of legal action may yet come to pass.

The development of this case could set precedents for how disputes are handled within crypto. As Deaton’s intervention highlights, the growing cryptocurrency industry is not devoid of significant disagreements, which can considerably impact the sector’s reputation and growth trajectory.

and then

and then