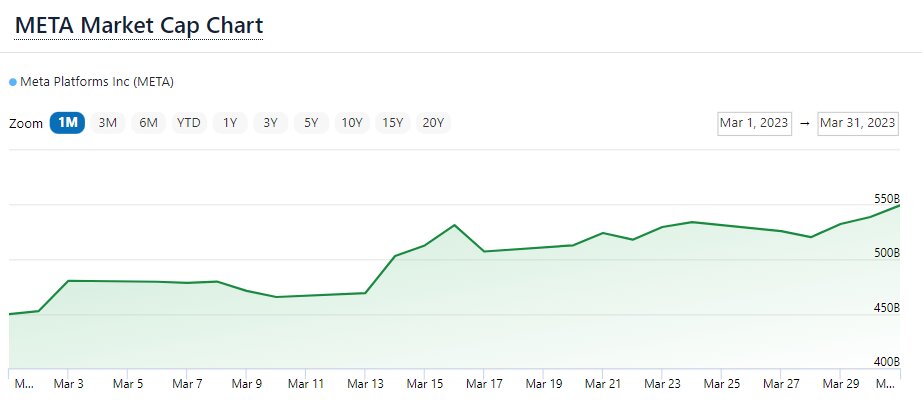

META, the ticker symbol of the parent company behind Facebook and Instagram saw a significant rise in market capitalization during March after around $78 billion was added to the firm’s value. This has come as a surprise to many stock analysts since Meta Platforms Inc. made several decisions about its metaverse-related activities within the period that was supposed to see the opposite effect on its market value.

META has been among the go-to metaverse stocks for many investors ever since Mark Zuckerberg, the Chief Executive Officer (CEO) of Facebook Company rebranded the firm to Meta Platforms Inc. in October 2021.

Despite the difficulty in the mainstream adoption of the metaverse by individuals across the globe coupled with the suspension of metaverse divisions by Disney and Microsoft during the last days of March, $78 billion was added to the company’s market capitalization in 31 days.

METAs stock shot up by 20% despite ending support for Instagram and Facebook NFTs

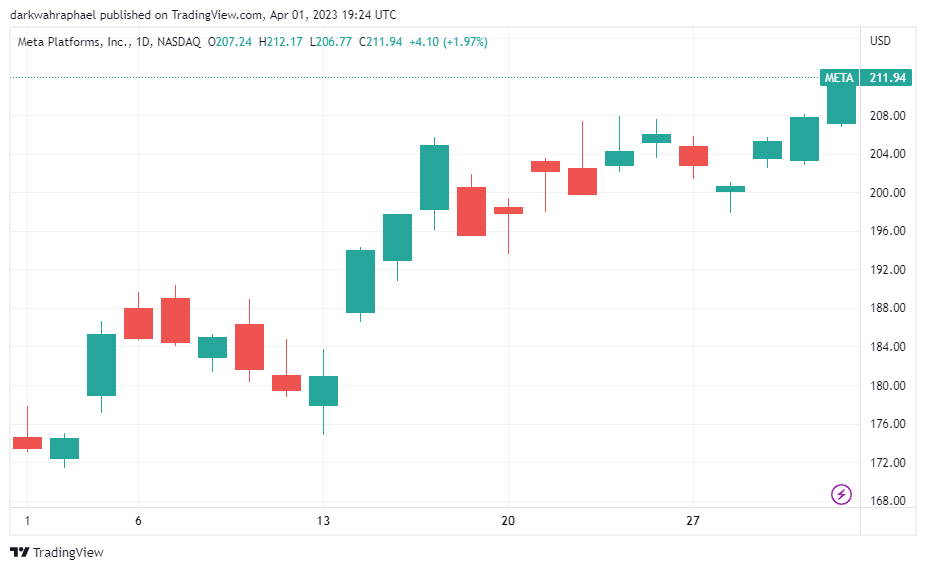

META opened the third month of the year on March 1 with a trading price of $174.59, rose slightly to an intraday high price of $177.85, fell mildly to an intraday low of $173.05, and eventually closed the day with an improved value of $173.42.

The trading volume for the day was around $31 million which corresponded to a market capitalization of approximately $454 billion.

On March 13, Stephane Kasriel, the Head of Commerce and Financial Services at Meta disclosed that the multinational technology conglomerate is ending support with the integration of non-fungible tokens (NFTs) on popular social media platforms Instagram and Facebook.

This came as a shock to many NFT enthusiasts who had taken to the social media platforms to explore the digital collectibles industry.

The sharing of NFTs began in May 2022 when Meta announced that select creators and collectors will be able to share their digital art on Instagram.

In August 2022, the company added support for wallet connections from Coinbase Global (the company behind crypto exchange Coinbase) and Dapper (the firm behind NBA Top Shot and NFL ALL DAY) and this helped users post NFTs minted on the blockchain of Flow. Within the same month, the sharing service was expanded to Facebook users.

Despite the impact, this move had on the NFT industry, especially, the consistency in global NFT market sales, Kasriel’s tweet showed that the firm is headed in another direction.

“Creating opportunities for creators and businesses to connect with their fans and monetize remains a priority, and we are going to focus on areas where we can make an impact at scale, such as messaging and monetization opps for Reels,” he added.

While many stakeholders forecasted some sort of adverse reaction to METAs price, the stock was not impacted negatively. On March 13, METAs price at the market close was $180.90, and this was higher than the opening price and intraday low values of $177.96 and $174.82 respectively.

During the last week of March, Nick Clegg, Meta’s Head of Global Affairs eased investor fears by insisting that the metaverse is still the future of computing, and the company is going to stick with it.

META reached a monthly high price of $208.09 on March 30 and closed the darkest month in the history of the metaverse in terms of layoffs in 2023 with a new price of $210.13.

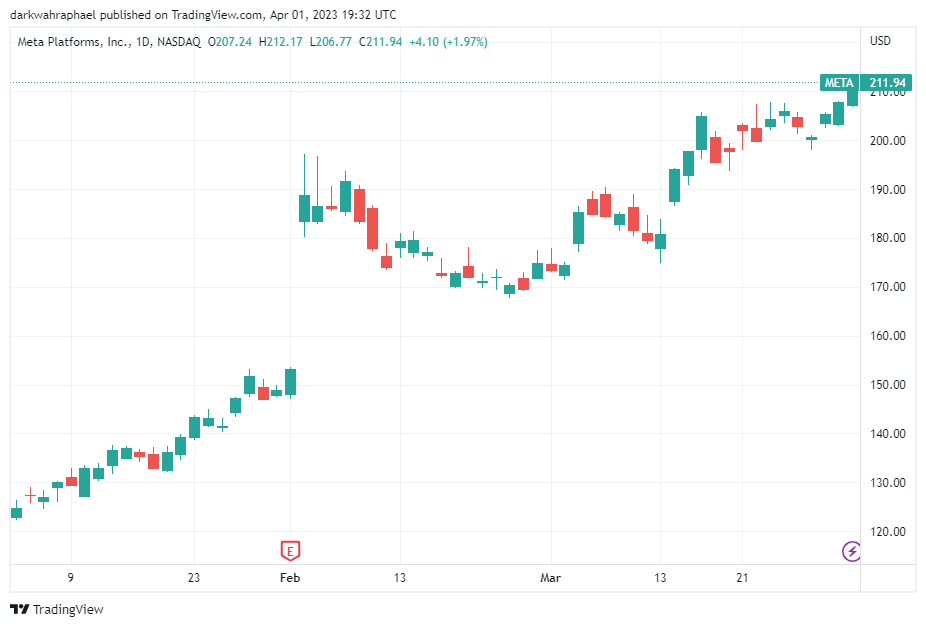

META soared more than 70% in Q1 2023

META stock brightened the portfolios of holders with 71% gains during the first quarter of 2023. This helped erased the losses suffered throughout 2022 when the company’s market value plunged by more than 60% after its bet on the success and adoption of the metaverse failed which led to mass layoffs.

After losing $13.2 billion on Reality Labs in 2022 and cutting down the price of its Quest Virtual Reality (VR) Headset to attract customers, only time will tell if Meta Platforms Inc. will continue to lead the metaverse revolution.

and then

and then