The metaverse has become the hottest ticket in exchange traded funds (ETF), with 35 metaverse-themed vehicles launched.

This is according to data released by Morningstar, who further claim that metaverse funds are the most popular sub-theme of ETFs ever.

Follow the money into the metaverse

Metaverse funds are taking off despite widespread cynicism and mockery in the mainstream press.

According to Morningstar the 35 metaverse ETFs trump internet ETFs (32), blockchain ETFs (29) and cloud computing ETFs (23).

Talking to FT, Kenneth Lamont, the senior fund analyst for passive strategies at Morningstar described the uptake as “the quickest ever.”

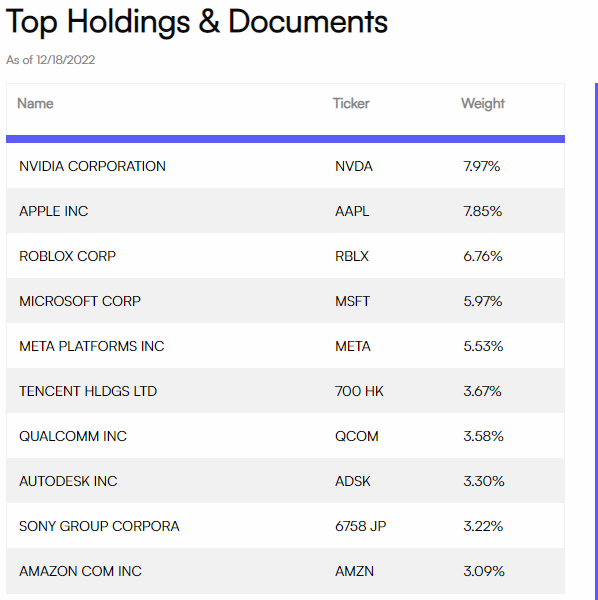

An exchange traded fund (ETF) is a financial product that represents an asset or basket of assets. The assets in an ETF can include stocks, bonds, currencies, futures contracts, and even commodities, and can be traded on the stock exchange. An example of a metaverse ETF might therefore be a basket of shares in Nvidia, Meta or Roblox among others.

Matthew Ball, who led the creation of the $400 million Roundhill Ball Metaverse ETF, the first of its kind, remains bullish on the metaverse as a whole.

“It has always been our view that the metaverse is a multitrillion dollar, multi-decade opportunity,” said Ball. “There was no scenario in which we didn’t see a flood of other ETFs coming to market. It’s the next generation internet. I would call it a master theme in the decades to come.”

Interest is growing fast

Such is the rapid growth of metaverse ETFs that three launched in Europe within the space of just two days. Legal & General Investment Management, Fidelity International, and Franklin Templeton all launched their own metaverse ETFs in early September.

Market excitement for this investment class is huge, but gaining exposure to the industry is not completely without problems. One potential issue for large investors is that there are few pure investments in the metaverse at the stock market level.

This is because many of the firms involved in the metaverse, such as Apple, Meta, Nvidia and Microsoft, have diverse business interests. None are purely metaverse firms. Purely metaverse investment options such as Roblox are less common on the stock exchange.

In the crypto markets, these types of metaverse-only bets are easier to find, with crypto tokens including MANA and SAND at the vanguard of a host of investable metaverse projects.

and then

and then