Metaverse tokens with more than $1 billion in market capitalization plunged more than 90% in value throughout 2022 due to an industry-wide tanking of the crypto and metaverse markets.

Among them, ApeCoin (APE), Flow (FLOW), The Sandbox (SAND), Decentraland (MANA), Axie Infinity (AXS), Enjin Coin (ENJ), and Internet Computer (ICP) which brought so many gains to sophisticated and unsophisticated traders and investors in 2021 were hit hardest.

Also read: Metaverse Investing: Tokens or Stocks?

APE, the novel token of the ApeCoin ecosystem built on the success of the Bored Ape Yacht Club (BAYC) and its sister project the Mutant Ape Yacht Club (MAYC) and the Bored Ape Kennel Club (BAKC) shed 90% of its value in 2022.

APE was launched on March 17, 2022, and reached a peak of $39.40 on the same day. A total of 150 million APE was airdropped from March to mid-June to BAYC and MAYC NFT holders to help promote the coin to millions of traders and investors.

Ape and Gucci collaborates

Eventually, APE gained the support of major exchanges such as Binance, OKX, BitMart, Coinbase Pro, and Huobi Global among more than 60 crypto trading platforms.

As the primary token which will be overseeing all future activities in the ApeCoin ecosystem which includes the Otherside Metaverse and upcoming blockchain-based games, APE was accepted by fashion brand Gucci in August as a payment option for its products through a partnership with blockchain payment technology BitPay.

Aside from Gucci, TIME Magazine also accepted ApeCoin as payment for digital subscribers earlier in the year.

Despite these milestones, the collapse of TerraUSD (UST), an algorithmic stablecoin by Terraform Labs did not help the fortunes of the token in May. FTXs collapse and subsequent bankruptcy in November plunged APE further into deep losses for investors that bought the token during its peak. On Dec.31, APE was exchanging hands for $3.64, ten times below its yearly high.

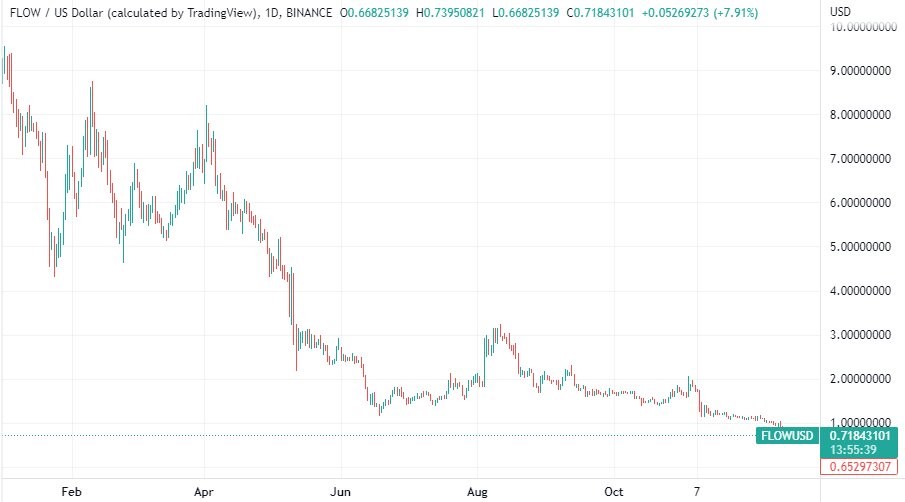

The Flow blockchain has been an integral part of the non-fungible token (NFT) industry as well as the transition into the metaverse. Unlike other blockchains such as Ethereum, Algorand, and Avalanche that has multiple use cases, Flow is primarily tailored to the needs of NFTs.

After opening at $8.80 on Jan. 1, Dapper Labs, the development team behind the protocol finally launched NFL ALL DAY in a partnership with the National Football League (NFL) and National Football League Players Association (NFLPA) in August.

NBA Top Shot highlights NFT platform

NFL ALL DAY which is similar to NBA Top Shot is an exclusive digital video highlight NFT platform that allows fans to buy, own, and trade officially licensed digital video highlights NFTs called Moments. These moments feature some of the greatest NFL players and most sought-after plays in the modern game and throughout the sport’s history.

While NFL ALL DAY added more than $70 million to the total NFT sales on the Flow blockchain in 2022, its sister project in the form of the NBA’s Top Shot failed to impress. Top Shot’s total sales of approximately $211 million throughout 2022 were below February 2021’s $224 million.

With decreasing sales due to falling global NFT market sales, traders responded negatively to FLOW. After reaching a peak of $9.44 on Jan. 2, FLOW closed 2022 with a new price of $0.6535, a 93% plunge in market capitalization from $2.9 billion to $677 million.

Metaverse Token the Sandbox (SAND) Was Not Spared

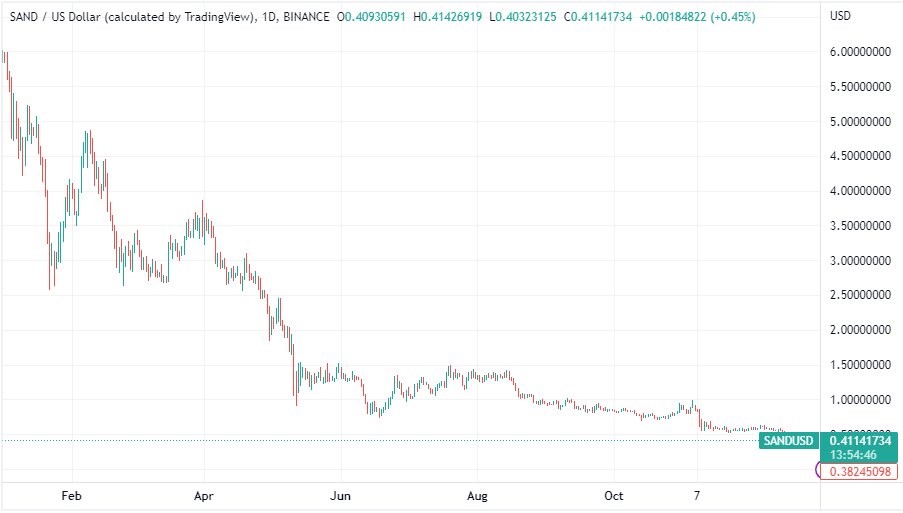

The Sandbox began 2022 strong with a trading price of $5.85. During the first month of 2022, the Sandbox announced a $50 million fund for what it called its startup metaverse accelerator program. Projects were allotted $250,000 in investments and additional incentives were given to the top-performing projects and this included The Sandbox (SAND) digital asset and LAND, a digital real estate housed in The Sandbox’s metaverse.

The Sandbox became a behemoth metaverse platform in 2022 as Warner Music Group partnered with the platform to create music-themed LAND in January.

Aside from this, the Sandbox partnered with another NFT project called the World of Women to drive the mentorship of females through education in March.

Within the same month, multinational universal bank and financial services holding company HSBC entered the metaverse via the Sandbox to offer educational finance games to its clients.

Several new metaverse platforms saw the light

The second half of the year saw new partnerships formed with the latest coming through Playboy. Playboy announced in July that it will be creating a MetaMansion social game inside the Sandbox with NFT collectibles and special experiences for the Playboy community.

Despite the new milestones other metaverse platforms will be envious of, the damage done by Terra and later FTX which culminated in the search for Do Kwon and the arrest of Sam Bankman-Friend respectively reflected negatively in the value of SAND, the novel token of the Sandbox.

While the Sandbox brought in more than $90 million in NFT sales in 2022, there was a significant decline of 93% in SAND’s price from a peak of $6.01 on Jan. 1 to $0.383 on Dec. 31.

Other coins followed along down

Other metaverse coins such as MANA, AXS, ENJ, and ICP also saw double-digit percentage losses throughout 2022.

ICP, the cryptocurrency of Internet Computer, a project which aims to decentralize everything on the internet plunged by 83%.

ENJ, the novel token of Enjin Coin, an ecosystem of interconnected blockchain-based gaming products shed 90% of its value while AXS, the native asset of Axie Infinity, the highest-selling NFT by all-time sales also went down by 93% due to a drop in the average sale value of Axie NFTs.

MANA, the token behind Decentraland, a virtual destination for the buying and selling of virtual land, estate, and avatars also plummeted by 90% due to an industry-wide bloodbath that has wiped more than $2 trillion off the total market capitalization of the entire decentralized finance market.

and then

and then