Nasdaq has filed a proposal to list shares of BlackRock’s newly registered Ethereum Trust.

This move comes hot on the heels of BlackRock’s Ethereum Trust registration, fueling speculation about the potential launch of an Ethereum-based exchange-traded fund (ETF).

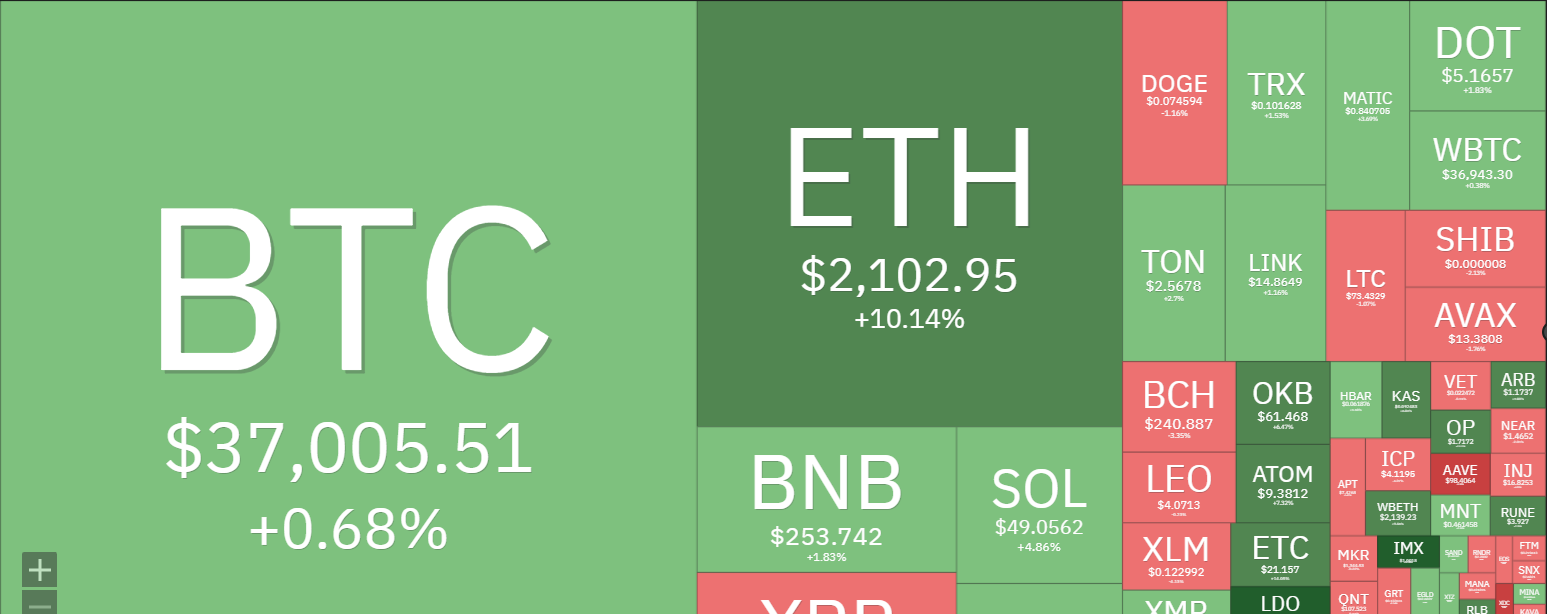

The announcement has already had a palpable impact on the crypto market, with Ethereum’s price surging to $2,102. Concurrently, Bitcoin reached an 18-month peak, hitting $37,004 during this press.

Source: Coin 360

Despite the buzz, BlackRock has maintained discretion regarding its plans for an Ethereum ETF, following a similar pattern after their Bitcoin trust registration.

BlackRock and the crypto market dynamics

The crypto market pattern mirrors Bitcoin’s performance in June, which saw a significant 20% increase after BlackRock filed for a spot Bitcoin ETF. Although Bitcoin experienced volatility subsequently, it has overall sustained a 45% increase since the initial surge.

According to a Forbes report, investors should approach the current situation with caution. The immediate price surge of Ethereum does not alter its fundamental attributes or market trajectory. Instead, a more measured approach is recommended, focusing on gradual exposure to the spot market. This, per Forbes, can be done through centralized exchanges, which, despite their convenience, carry certain risks, such as a lack of transparency and higher transaction fees.

Regulatory hurdles and market speculation

According to people familiar with the matter, the U.S. Securities and Exchange Commission (SEC) plays a crucial role in the potential future of crypto ETFs. To date, the SEC has not approved any spot crypto ETFs, citing concerns about fraud and market manipulation, particularly in the Bitcoin market.

7️⃣ Spot vs. Futures ETFs:

👉 While the SEC hasn't approved any spot #crypto ETFs, in late 2021, they did approve several #Bitcoin futures funds. pic.twitter.com/4v0FpmNnSz

— Keyur Rohit (@CryptoKingKeyur) August 21, 2023

However, according to experts, BlackRock’s move could signal a changing landscape. The SEC has up to 240 days to review and decide on the product, which could delay the potential launch of any Ethereum ETF until the following fall.

Further, the regulatory status of Ethereum differs from that of Bitcoin. While Bitcoin is broadly agreed upon as a non-security, Ethereum’s classification remains unclear. SEC Chairman Gary Gensler has avoided a definitive stance on whether Ethereum is a security, an ambiguity that could further delay the approval process for an Ethereum ETF.

The future of crypto ETFs and trading

Several ETF providers have applied for spot Bitcoin ETFs, anticipating the SEC’s eventual approval. BlackRock’s filing for an Ethereum trust and potential ETF adds another layer to this evolving narrative. However, the approval of such products remains uncertain. As Forbes puts it, if the SEC approves a spot Bitcoin ETF, it could set a precedent for Ethereum and other cryptocurrencies.

Alternatives to direct crypto investment

For those cautious about direct investment in cryptocurrencies, alternatives exist. According to Forbes, several ETH futures-based exchange-traded funds track Bitcoin’s spot price, offering indirect exposure to the crypto market. These funds can be accessed through traditional brokerage accounts, negating the need for direct crypto handling and its associated risks. However, investors must be aware of additional costs, such as rollover expenses and expense ratios.

BlackRock’s registration of an Ethereum Trust and Nasdaq’s proposal to list its shares mark a pivotal moment in cryptocurrency investment. While it fuels optimism and speculation about the future of crypto ETFs, investors should remain prudent, considering the regulatory uncertainties and inherent market risks. The potential impact of such developments on the broader financial market and investment strategies continues to be a subject of keen interest and scrutiny.

and then

and then