Nvidia exceeded Q4 earnings forecasts, driven by generative AI’s tipping point, CEO Jensen Huang announced. The positive results buoy AI tokens and overall market sentiment.

One of the largest manufacturers of graphics processing units (GPUs), Nvidia, announced a 265% growth in income year over year in response to the growing demand for artificial intelligence (AI) hardware worldwide.

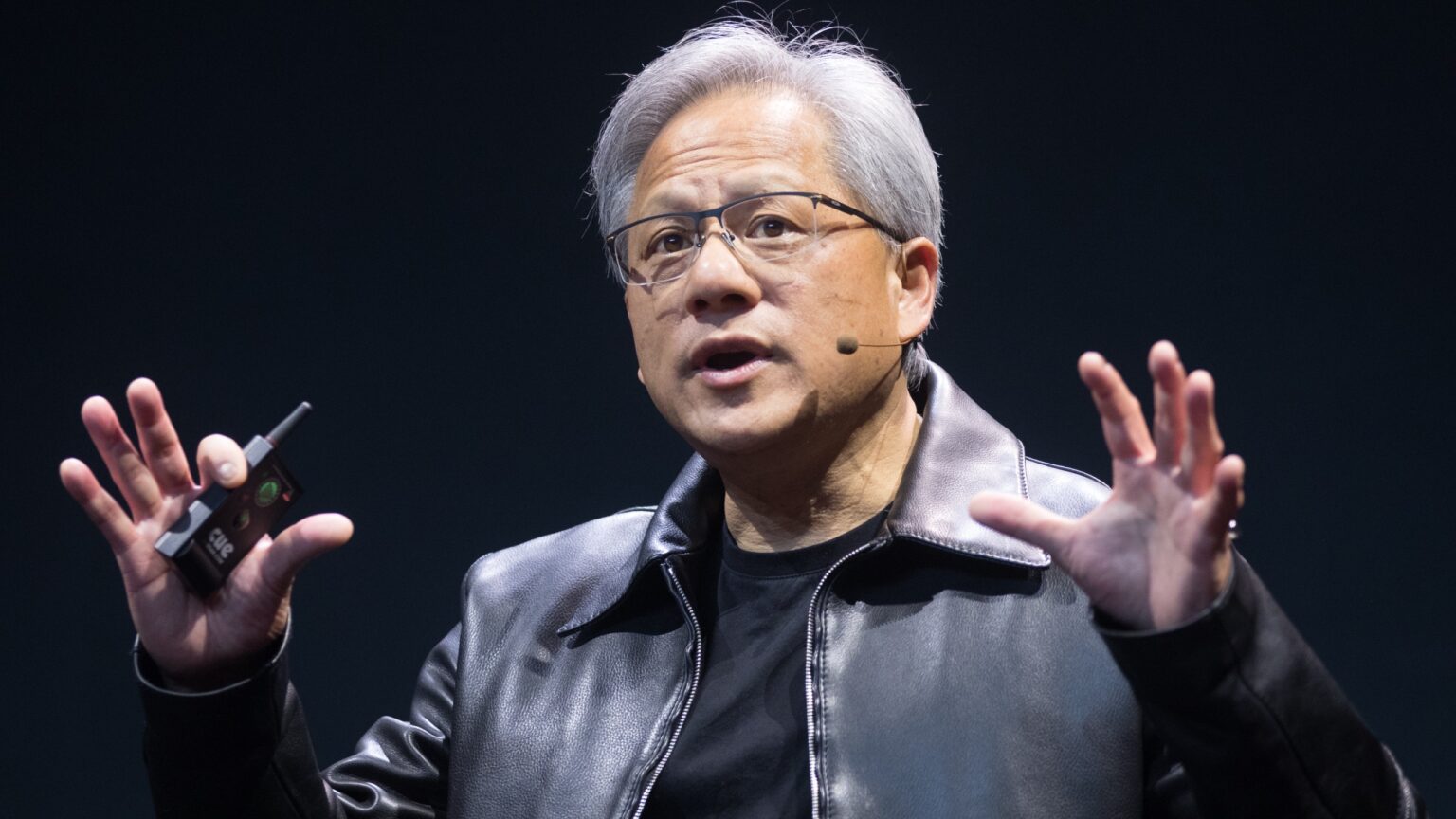

The most recent financial reports for the fourth quarter show that Nvidia generated $22.1 billion in sales, up 22% from the third quarter and 265% from the previous year. The founder and CEO of Nvidia, Jensen Huang, credited the spike in sales to the increased demand for generative AI and quicker computing throughout the globe. With a $1.67 trillion market value, the chipmaker is now bragging.

Nvidia overtakes Tesla as most-traded stock, while AI boosts revenue 265%: Nvidia also overtook Elon Musk’s Tesla as Wall Street’s most-traded stock in the United States over the last 30 trading sessions. https://t.co/EMs0xSfnoj #CryptoNews #crypto #Bitcoin pic.twitter.com/KpKr29ojY5

— @zimisss (@zimisss) February 22, 2024

Nvidia overtakes Elon Musk’s Tesla

Nvidia overtook Elon Musk’s Tesla to become one of Wall Street’s most-traded stocks. According to a report, about $30 billion worth of Nvidia shares were exchanged among traders in the last 30 trading sessions, compared to an average of roughly $22 billion for Tesla in the same timeframe.

Additionally, on Jan. 27, Musk said that Tesla intends to spend more than $500 million to procure artificial intelligence (AI) hardware from Nvidia in 2024 alone. He said that the table stakes for being competitive in AI are at least several billion dollars per year at this point.

The governor is correct that this is a Dojo Supercomputer, but $500M, while obviously a large sum of money, is only equivalent to a 10k H100 system from Nvidia.

Tesla will spend more than that on Nvidia hardware this year. The table stakes for being competitive in AI are at…

— Elon Musk (@elonmusk) January 26, 2024

Also, Tesla has plans to purchase AI-related hardware from Nvidia’s biggest GPU manufacturing competitor, AMD.

Nvidia surpasses Q4 earnings expectations

Giant chipmaker Nvidia exceeded its already high fourth-quarter earnings expectations, boosting the broader equity markets and tokens related to artificial intelligence (AI).

Nvidia said on Wednesday that its fourth-quarter profits per share were $5.16, going above the average analyst estimate of $4.59 per share. In addition, the chipmaker reported revenue of $22.1 billion, which came in higher than Wall Street’s estimate of $20.4 billion.

.@NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2024

Record quarterly revenue of $22.1 billion, up 22% from Q3, up 265% from year ago

Record quarterly Data Center revenue of $18.4 billion, up 27% from Q3, up 409% from year ago

Record full-year revenue of… pic.twitter.com/intO68E389

— Bojan Tunguz (@tunguz) February 21, 2024

AI tokens surge

A spike in AI tokens followed Nvidia’s results. The gains for SingularityNet (AGIX), FetchAI (FET), and Render (RNDR) were above 20%, 10%, and 8%, respectively. Based on CoinGecko statistics, the total market capitalization of AI tokens has topped $16.5 billion. By contrast, the largest and most liquid cryptocurrency benchmark, CoinDesk 20 (CD20), has experienced a 2.7% decline.

According to Jensen Huang, founder and CEO of NVIDIA, accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide, across companies, industries, and nations.

Nvidia also predicted revenue of $24 billion in the first quarter, above experts’ projections of $22.2 billion.

The beat comes as shares of the maker of chips that have fueled the artificial intelligence (AI) revolution rose by more than 200% over the last year, taking the market cap of the company to nearly $1.7 trillion at one point, surpassing the value of tech giants Amazon and Google. Due to how strong the surge has been, Goldman Sachs called it “the most important stock on planet Earth.”

*Goldman's Trading Desk Calls Nvidia 'Most Important Stock' on Earth.

Hoje teremos um TC Cast daqueles. Vamos falar de Cripto com os mestres @Boghosian e Jorge Souto e ainda do cenário de IA e o short na "ação mais importante do mundo" rs pic.twitter.com/FW1XBujHwT

— Kevin Gervasoni (@KevinGervasoni) February 21, 2024

In Wednesday’s post-market trade, the shares of the chipmaker increased by almost 7%, while S&P 500 futures gained 0.5% and bitcoin (BTC) decreased by 1.2%.

and then

and then