OpenAI CEO Sam Altman is embarking on a journey to secure $100 billion in funding, targeting a new venture in the fiercely competitive AI chip market.

He aims to establish a contender against industry giants Nvidia and Taiwan Semiconductor Manufacturing Co. (TSMC). However, Altman’s path is fraught with substantial barriers, including intricate patents, a scarcity of skilled workers, and the substantial financial requirements of this undertaking.

AI chip contenders face daunting ‘moats’ https://t.co/5kLG9FH5sy | opinion

— Financial Times (@FT) November 28, 2023

Nvidia and TSMC dominate their respective markets, holding approximately 95% and 90% of the GPU and advanced chip markets globally. Their dominance is in market share and profitability, with TSMC enjoying gross margins near 60% and Nvidia at an impressive 74%. The scale of their operations is massive: TSMC boasts annual sales of $76 billion.

The strategic necessity of vertical integration

Amidst a global shortage of Nvidia’s AI chips, the appeal of vertical integration grows. As AI models become increasingly sophisticated, the demand for GPUs intensifies, making stable access to these processors critical. This necessity has spurred major technology companies to develop chips optimized for specific workflows, especially for data center servers essential for AI.

Notably, Nvidia’s success isn’t solely attributed to cost-efficient chip production but also to its ability to provide comprehensive solutions across various industries. Their HGX H100 systems, a collection of 35,000 parts priced around $300,000 each, exemplify this. The system accelerates workloads for many applications, from financial analytics to complex AI tasks. This versatility and integration of hardware with software libraries, backed by thousands of patents, pose a significant challenge to new entrants.

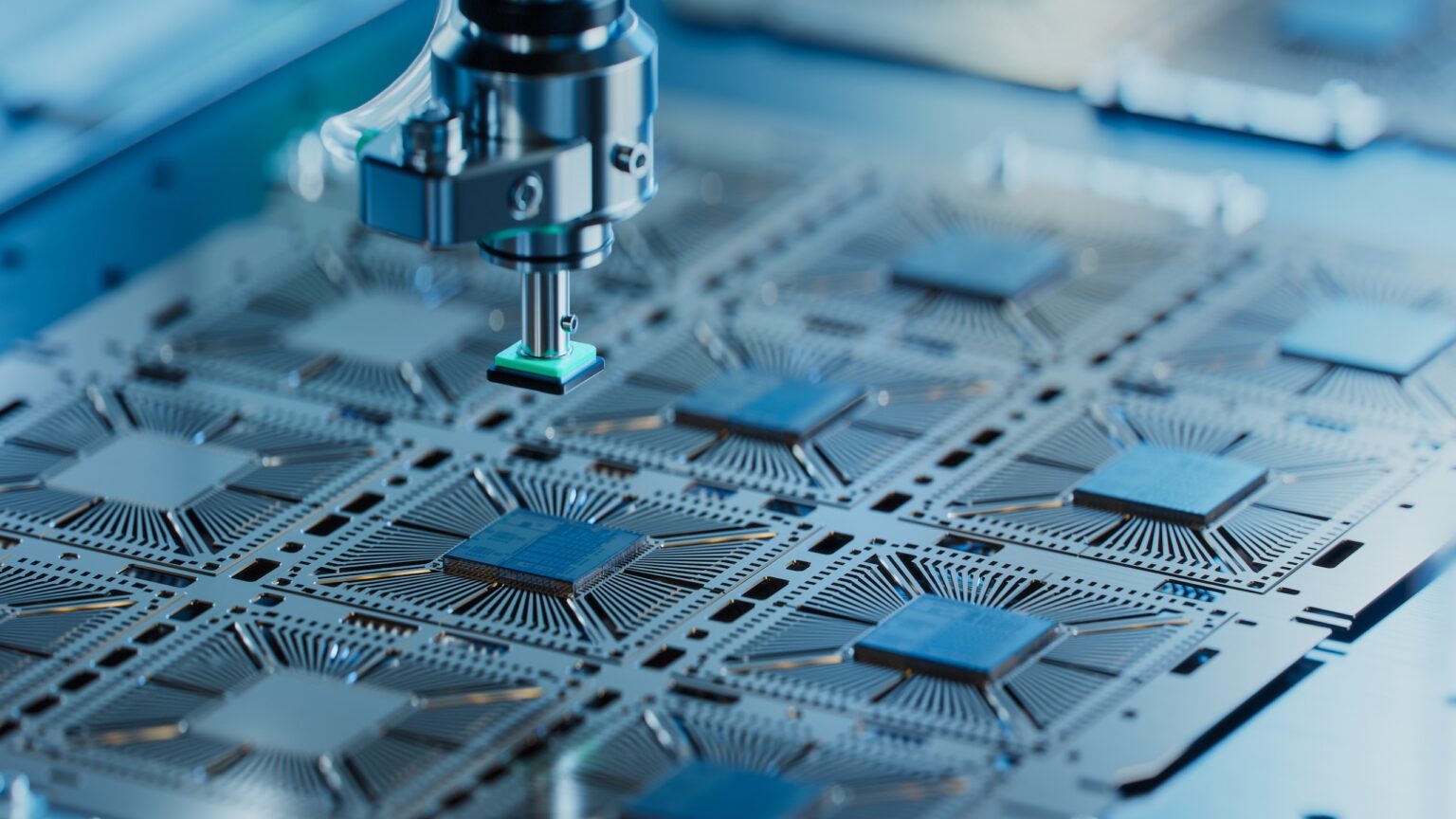

Manufacturing challenges

Beyond designing an AI chip lies the challenge of manufacturing. Establishing a fabrication plant is a colossal task, as evidenced by TSMC’s three-year timeline and $40 billion investment in its Arizona plant. Additionally, securing the necessary chipmaking equipment, such as the extreme ultraviolet lithography machines from the Dutch company ASML, involves long wait times and enormous costs.

The patent wall: TSMC’s impenetrable defense

Patents allegedly form the most daunting barrier. With over 52,000 patents, TSMC’s intellectual property, especially in advanced packaging crucial for AI chips, is a major obstacle for newcomers. Their eight-year investment in this technology has significantly raised the entry threshold.

As Nvidia and TSMC continue to reinvest their substantial profits into research and development, the technological gap between them and potential competitors only widens. This momentum is seen in Nvidia’s third-quarter results, showcasing its dominance, especially in the data center segment.

The road ahead for OpenAI and the industry

Altman’s OpenAI faces a steep climb in this competitive landscape. Creating a viable chip alternative involves designing, manufacturing, and navigating a complex web of patents and resource constraints. OpenAI’s ambition to develop its own AI chips places it among a select group of tech giants like Google and Amazon that have ventured into custom chip design. However, the path is long and fraught with challenges, as even established players like Meta have experienced setbacks in their custom chip initiatives.

Sam Altman’s pursuit of building a chip rival with a $100 billion investment underscores the strategic importance and immense challenges of the AI chip market. While the endeavor promises to reshape OpenAI’s technological landscape, it also highlights the formidable moats that Nvidia and TSMC have built over the years.

and then

and then