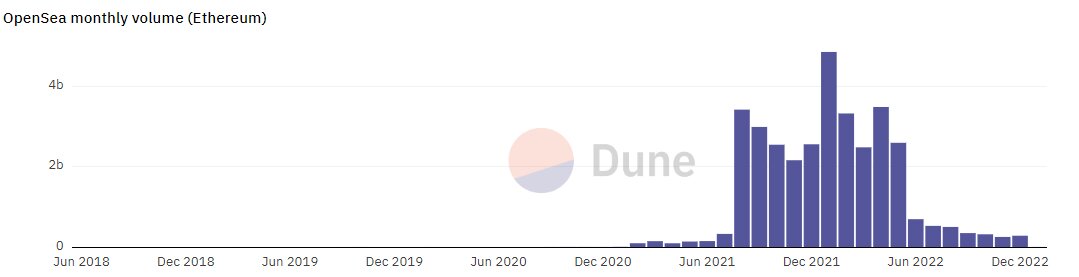

OpenSea’s volume in the last three months of 2022 failed to breach the $1 billion milestone. As of the end of 2022, OpenSea’s volume for Q4 2022 was approximately $872 million, and much of the sales came from OpenSea Ethereum. Other blockchains that contributed to the volume included Solana and Polygon, two of the highly scalable platforms in the crypto space.

While this was a great statistic when compared to the volumes of other non-fungible token (NFT) marketplaces such as Rarible, SuperRare, Foundation, and Known Origin among others, volume from Q4 2022 was 38% below that of Q3 2022 volume.

During the third quarter of 2022, OpenSea’s volume was around $1.4 billion. Aside from this, there was an 88% plunge in volume from the last quarter of 2021 which saw the spike in price in cryptocurrencies reflect positively in the values of non-fungible tokens. OpenSea’s volume for October to December 2021 was roughly $7.4 billion.

Drop in the sales of top collections on OpenSea responsible for the volume decline

Some of the top collections on OpenSea with the most volume include, but are not limited to, CryptoPunks, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Otherdeed for Otherside, Azuki, Moonbirds, The Sandbox, Doodles, Meebits, and CloneX.

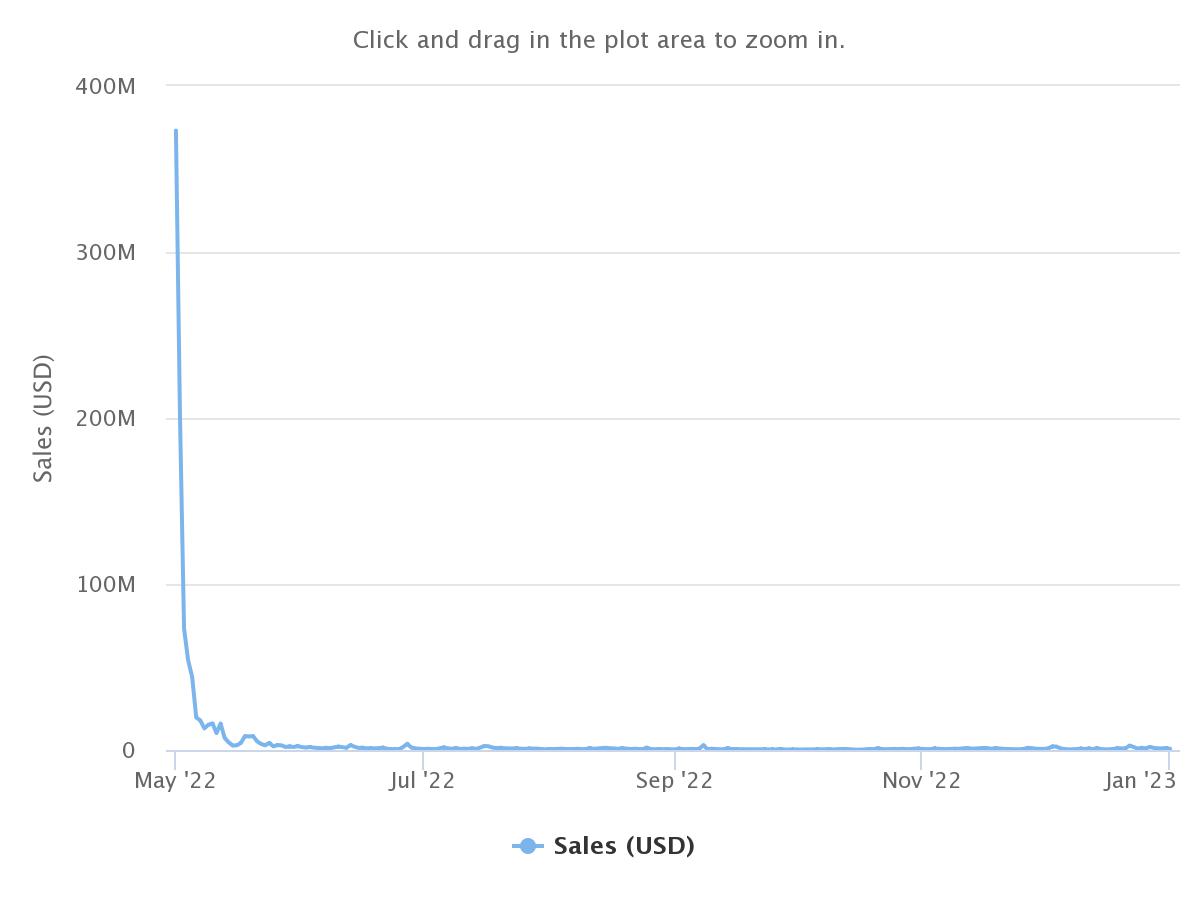

Among these, Otherdeed from the Otherside metaverse launched by Yuga Labs on the last day of April 2022 contributed significantly to the declining fortunes of OpenSea throughout Q4 2022.

As an integral part of the advancement from Web2 to Web3, the sale of virtual land deeds brought in about $931 million in sales from more than 20,000 unique buyers involved in over 40,000 transactions in May 2022.

This metric constituted 35% of OpenSea’s volume of $2.6 billion in May 2022. The same could not be said in December as Otherdeed sales from the Otherside metaverse fell by more than 90% of May’s value to around $31 million.

Having failed to breach the $50 million mark in monthly sales in the last seven months, Otherdeed sales contributed to just 11% of OpenSea’s volume of $286 million throughout the last month of the year.

Aside from this, it also contributed to 8% of OpenSea’s volume for Q4 2022. While Otherdeed average sale value was $21,191 during the fifth month of the year, this figure dropped by 85% in October to $3,157, 89% in November to $2,313, and 88% in December to $2,480.

X2Y2 and others are closing in on OpenSea

While OpenSea remains the largest NFT marketplace by all-time sales volume, its status as the go-to platform for the buying and selling of digital collectibles could be under threat in 2023. MetaNews has previously reported on how Fidelity is seeking trademarks in the NFT world.

X2Y2, a marketplace launched in February 2022 surpassed OpenSea in monthly volume during the third quarter of the year. The total X2Y2 volume for Q3 2022 was $1.8 billion and this was $400 million more in sales than OpenSea.

In October and November 2022, OpenSea launched NFT marketplaces on Avalanche and Binance Chain respectively.

While X2Y2 has made a strong push towards dethroning OpenSea as the king of NFT marketplaces, the platform’s expansion onto other chains which are part of the biggest blockchains by all-time NFT sales volume certifies the marketplace’s status as the largest in the NFT space – at least for the time being.

and then

and then