In a significant development for the cryptocurrency market, BlackRock, the world’s largest asset manager, recently filed for a Bitcoin Exchange-Traded Fund (ETF) with the SEC.

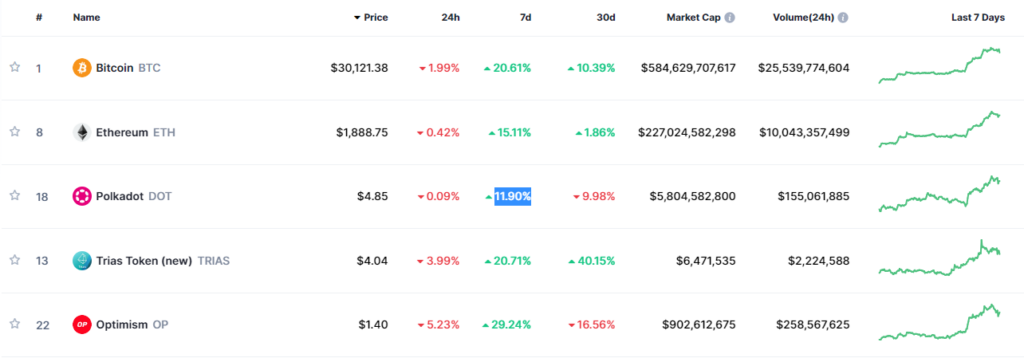

The move has sparked a rally in the crypto space, attracting the attention of investors worldwide. Bitcoin, the leading cryptocurrency, has once again taken the spotlight. With a market capitalization of over $581 billion, Bitcoin remains the benchmark for the entire crypto market. Despite a recent significant pullback, it has remarkably recovered, gaining 20.16% in the past seven days.

Ethereum holds strong in second place

Ethereum, the second-largest cryptocurrency, has been making waves as well. With a market cap of $226 billion, Ethereum remains a favorite among investors and developers. Despite a slight decrease in the last 24 hours, it has shown resilience, boasting a 15.11% increase in the past week.

Polkadot gains momentum

Polkadot (DOT), ranked 13th on CoinMarketCap, has been making steady progress. With a market cap of $5.7 billion, Polkadot has witnessed an 11.90% surge in the past seven days. As an innovative multi-chain platform, Polkadot offers blockchain interoperability, making it an intriguing investment option.

Polkadot has also introduced new referendums, inviting the community to participate in the decision-making process through voting. DOT investors have been enjoying favorable market conditions, finding opportunities for growth and potential gains.

Trias Token shows potential

Trias Token (new), ranked 902nd, has piqued the interest of investors. With a circulating supply of 1.6 million coins, this crypto has shown a ‘bullish’ rating on the investors observer sentiment score. Trias Token has demonstrated its potential by earning a positive sentiment through volume and price movement analysis.

However, the Trias pair currently trades at $4.00, with a 24-hour trading volume of $2,236,210. Trias Token dropped by 4.27% in the last 24 hours.

Optimism gains traction

Optimism, ranked 44th, has seen a surge in popularity. With a live market cap of $891 million, Optimism has experienced a 29.24% increase in the past week. As the native Layer 2 digest token, Optimism aims to address scalability issues in the Ethereum network, providing a promising solution to transaction congestion.

As the crypto market evolves, these trending cryptocurrencies have garnered attention from investors looking for new opportunities. With Bitcoin and Ethereum leading the pack, other digital assets such as Polkadot, Trias Token, and Optimism are gaining traction and showing growth potential.

BlackRock`s ETF filing is reigniting the market

The recent BlackRock ETF filing has significantly boosted positive sentiment in the market. BlackRock’s status as the largest asset manager, with over $8.5 trillion in assets under management, adds credibility to the potential success of a Bitcoin ETF. Additionally, the firm’s decision to utilize Coinbase for BTC custody further solidifies the industry’s confidence in established crypto service providers.

As the SEC’s decision on a spot Bitcoin ETF remains pending, BlackRock’s application has sparked renewed interest. Previous applicants like ARK and 21Shares, as well as Grayscale, have faced rejections. It may be the case, however, that BlackRock’s extensive resources and influence in the financial industry may hold the key to securing approval for an ETF.

and then

and then