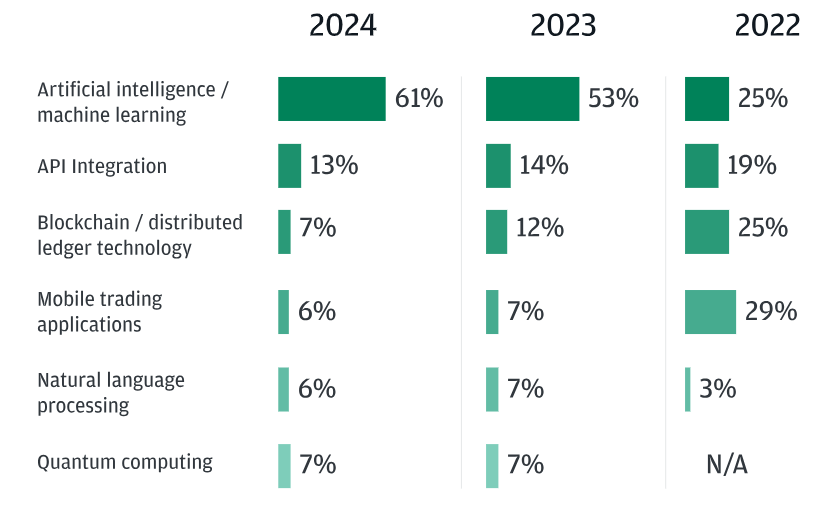

According to a recent JPMorgan poll, institutional investors are increasingly leaning towards artificial intelligence to shape the future of trading, with 61% of respondents anticipating AI and machine learning to become the key technologies in the next three years.

This observation, whose origin is more than 4,010 institutional traders across 65 countries, highlights the role of technological development as a strategy in the trading game. The survey, named “e-Trading Edit: Insights from the Inside,” further mentions other technological developments like API integration and blockchain as influential to future workplace technologies, but to a lesser degree.

Also read: New Survey Shows AI’s Growing Adoption is Freaking People Out

The ascendancy of AI and machine learning

The incorporation of AI and ML into the trading practice has been evident, and the confidence level of the technology has shown an increasing trend. Just two years ago, it constituted only 25% of the focus, but now it is a critical area of the development of future trading technologies. This proves that AI as a trading tool is being taken seriously due to its capability to identify the likelihood of future trades and risks in the market in real time. AI has been an essential factor in this since it can process large data sets promptly and accurately.

As a result, traders can make better decisions, which could result in high profits and lower risks in the long run. Moreover, the research report’s findings indicate that there are inconsistencies in the evaluation of different technologies. While AI and ML are getting popular, other traditional methods like mobile trading apps and blockchain are losing their capitalization. This shift raises a critical question: What makes AI and ML more appealing to institutional traders than other technologies?

A changing landscape for trading technologies

As AI is increasingly integrated into the trading field, other technologies like API integration, blockchain, and quantum computing are also relevant in the trading arena, but to a lesser degree. API integration, for instance, mentioned by 13% of the participants, is considered necessary by some people, demonstrating a growing appreciation for the system to run smoothly and exchange data.

Evolving technology landscape. (Source: JPMorgan)

Evolving technology landscape. (Source: JPMorgan)

Concurrently, blockchain technology and mobile trading software are becoming less attractive for investors, who might reassess the short-term usefulness of these investment instruments. This demonstrates traders’ multidisciplinary perspective and their interest in newly discovered technologies. In this context, AI and ML are at the forefront, as the focus is now on technologies that could help in trading, such as predictive ability and real-time data processing.

Skepticism and slow adoption of cryptocurrencies

The survey also highlights the careful attitude of institutional investors towards cryptocurrencies. Intriguingly, 78% of the surveyed population has no plans to trade crypto assets like bitcoin in the next five years, which is a slight increase in the rate of hesitancy as compared to last year. This warning is distinct from a slight increase in the number of traders actively involved in cryptocurrency trading.

Crypto investments insights. (Source: JPMorgan)

Crypto investments insights. (Source: JPMorgan)

It signals the complex linkage between ancient trading systems and the crypto market. The divergent approach of JPMorgan in its endorsement of cryptocurrencies versus its critical viewpoint, as expressed by Jamie Dimon, is indicative of the financial industry’s mixed opinion on digital currencies. Although the bank may seem skeptical regarding such ventures, engaging in such projects shows that it realizes the sector’s value, but with a careful strategy.

and then

and then