In a recent analysis by data agency CCData, the South Korean digital asset platform, Upbit has surpassed leading global exchanges, Coinbase and OKX, in spot trading volume. This shift coincides with the ongoing regulatory challenges faced by Binance, the largest cryptocurrency exchange worldwide.

According to the analysis, July brought an unexpected surge in Upbit’s trading activities. Spot trading volume on the platform rose by an impressive 42.3%, culminating in a total of $29.8 billion. In contrast, its rivals, Coinbase and OKX, experienced a downturn in their trading volumes, recording declines of 11.6% and 5.75%, respectively.

Consequently, Coinbase’s and OKX’s trading volumes slipped to $28.6 billion and $29.0 billion respectively, revealing a clear break from previous trends.

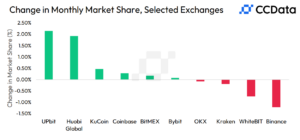

Additionally, the increase in Upbit’s volume denotes a positive sentiment and reflects a shift in the broader power dynamics within the cryptocurrency exchange ecosystem. This newfound success reportedly catapulted Upbit’s market share to 5.78%, marking the most substantial increase among centralized exchanges.

While Upbit dominated the gains, other platforms, such as Huobi Global and Kucoin, also witnessed a growth in market share by trading volume, albeit to a lesser extent, reaching 3.84% and 2.21%, respectively.

Regulatory challenges impede Binance

While Binance remains the leading platform for spot trading in cryptocurrencies, with a volume of $208 billion, it has been losing ground. Over the past five months, Binance’s market share has steadily dwindled to 40.4%—the lowest point in a year. This downturn comes from a peak of 57.5%, representing a significant shift from the dominance it once enjoyed.

Moreover, Binance faces potential legal hurdles, with U.S. Department of Justice officials contemplating fraud charges against the exchange. However, the potential ramifications of such charges, including a potential bank run akin to the collapse of FTX in November 2022, have made prosecutors tread cautiously. The priority is to avoid repeating FTX’s situation, where consumer losses were significant, and a panic in the crypto markets ensued.

The crypto exchange landscape in a regulatory world

The fall of FTX led to a migration of users to other centralized exchanges like Binance and decentralized exchanges (DEXs). However, recent regulatory pressures and lawsuits against major CEXs, including Binance and Coinbase, sparked a 444% increase in trading volume on DEXs in June.

With authorities deliberating on potential penalties, such as fines and deferred or non-prosecution agreements, the legal and regulatory challenges emphasize the evolving and complex nature of crypto regulation and enforcement. According to experts, the landscape is where firms operate in a legal gray area, and consumers lack protection in the traditional banking system.

Recognizing this shifting regulatory environment, other exchanges like OKX actively seek regulatory approval. OKX is reportedly expanding its Middle East operations and is keen on gaining regulatory approval in Dubai. According to people familiar with the matter, Tim Byun, OKX’s Global Head of Government Relations, noted;

“We would like to get ahead of that curve and be regulated soundly.”

The evolving regulatory backdrop, coupled with the market’s dynamic nature, means the balance of power among exchanges is constantly in flux. Upbit’s recent comeback is a testament to this shifting landscape.

Whether Upbit can maintain its growth and how other exchanges will adapt to the changing regulatory environment remains to be seen. As Binance grapples with potential legal challenges, one thing is clear: the cryptocurrency trading world is undergoing a transformative phase with outcomes yet to unfold.

and then

and then