As cryptocurrencies face scrutiny worldwide, the unique enrollment method of Worldcoin, the brainchild of Sam Altman, has taken a toll on its market value.

The novel token of Worldcoin, a protocol that uses iris-scanning orbs for user enrollment, WLD crashed by more than half amid growing concerns over data privacy and potential breaches of data protection laws. The balance between innovation and ethical standards is once again in the spotlight.

Several regulators across the globe have zoned in on the Worldcoin project as many have questioned the project’s unique biometric data collection method. Sam Altman, also behind the AI Chatbot ChatGPT, introduced the eyeball-scanning orbs as a means of user enrollment in July.

However, the lack of clear consent in collecting such intimate biometric details is now a potential violation of data protection laws. Investigations are underway in several European nations, including Germany, France, and the UK.

A dismal market performance

As of writing, WLD was exchanging hands for $1.28, data from CoinMarketCap showed. This was a significant drop from its opening day’s high price of $3.58 when the cryptocurrency became a tradable asset on mainstream exchanges on July 24. This downward trajectory, if sustained, threatens to plummet the token’s value further to single-digit figures in the future.

Notably, the initial hype around Worldcoin’s launch saw 2 million sign-ups for World ID, with 143 million WLD tokens being distributed. However, this euphoria was short-lived, as the value of the tokens declined due to an overall bearish market for most of August. With the project’s privacy concerns, it’s no surprise that short sellers have engulfed WLD, leading to even more market instability.

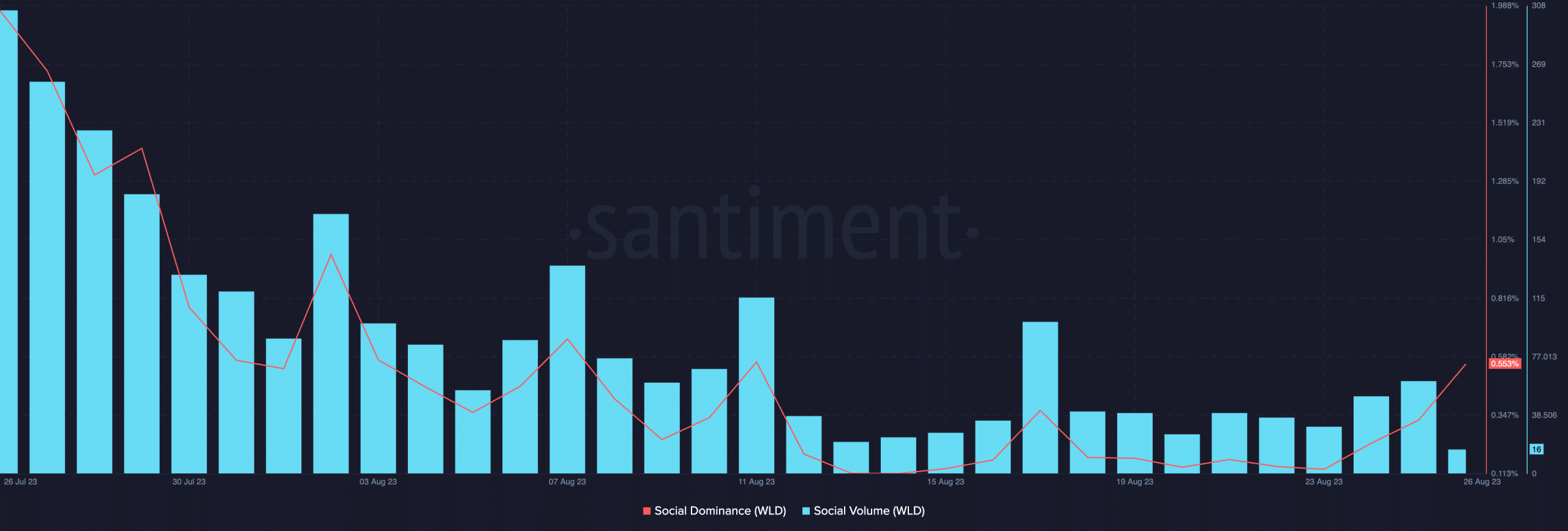

Insights from on-chain data source Santiment further underscore the fading enthusiasm. In the past month, Worldcoin’s social volume plummeted by 95%, and its social dominance decreased by 74%.

Source: Santiment

Price Analysis: A Glimpse of Hope or a Mirage?

The price dynamics on August 28 showed a slight spike in WLD’s price. However, Worldcoin’s token has mainly been trading inside a dwindling channel, with successive lows and highs painting a grim picture. An attempt to rally saw the WLD token touch an intraday high of $1.47, but it soon retracted, settling at around $1.39.

The WLD/USDT chart reveals a pattern of short-lived rallies, as evident from the recent price surge followed by a swift decline. Worldcoin trades below the critical 10-day and 50-day moving averages on its 4-hour chart, per Trading View analysis. Indicators such as the Moving Average Convergence Divergence (MACD) further emphasize the bearish trend gripping the token.

WLD/USD 4-hour price chart, Source: Trading View

For potential buyers, resistance levels loom at $1.45, followed by $1.50 and $1.57. Conversely, if the token breaks the $1.35 support, the market could slide to $1.30 and possibly $1.22.

In conclusion, the immediate future for WLD appears bleak. Yet, if key support levels hold, a buyer-led recovery might be possible.

As Worldcoin’s value dances on a knife-edge, it becomes paramount for investors to keep an eye on hourly charts. Any abrupt shifts in price trajectories could signify impending reversals.

It remains to be seen if Worldcoin can navigate these tumultuous waters, especially given its controversial stance on data privacy.

and then

and then