Big Data Token Injective (INJ) brought more than 200% gains to investors on the back of an ecosystem fund launch as well as the inauguration of a Hackathon towards the end of March that will grow its project in 2023 so that the protocol can compete with others in the saturated crypto market.

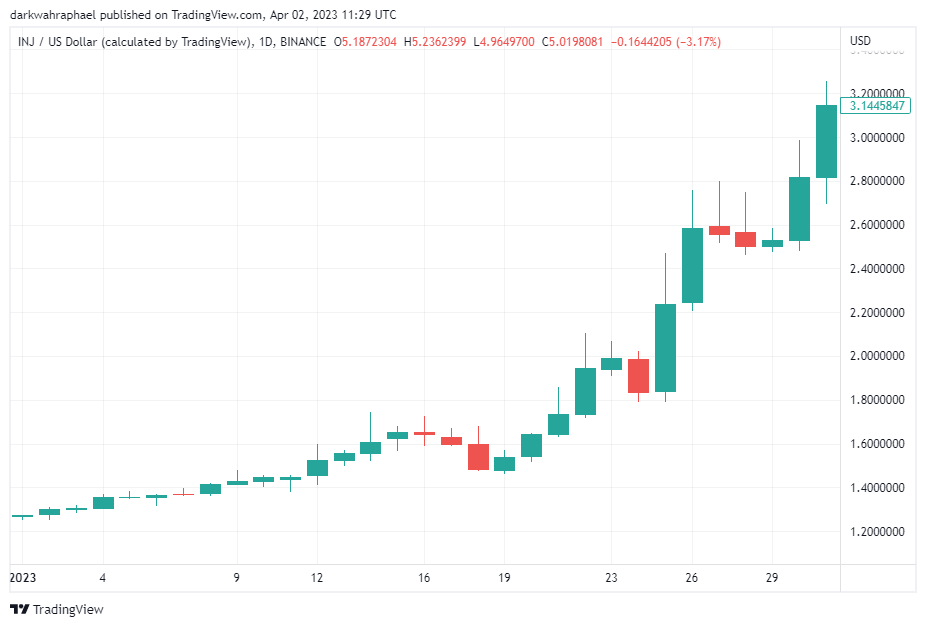

Big Data Token Injective (INJ) spiked by 272% during the first quarter of 2023 largely due to increased investor interest that reflected in daily trading volume, data from cryptocurrency price tracker CoinMarketCap showed.

As the novel token behind Injective, a layer one (1) blockchain shaping the future of finance, INJ closed on March 31 with a trading price of $4.7252 after opening in 2023 with a relatively lower price of $1.2714.

While trading volume remained below $100 million for most of January, volume spiked to a daily high of around $120 million in March.

This led to INJ soaring to a much-improved market capitalization of about $345 million after beginning the year with a paltry $93 million as the project’s market valuation.

Big Data Token Injective’s rise began with the ecosystem fund launch

Big Data Token INJs parent company Injective announced on January 25 that it has launched a $150 million ecosystem fund.

The purpose of the fund is to expedite interoperable decentralized finance (DeFi) and infrastructure adoption. Aside from that, projects under the trading and scaling solutions banner will also benefit from the fund.

Crypto firms that backed the funding included digital asset research-driven firm Delphi Labs, the investment arm of KuCoin Exchange KuCoin Ventures, crypto firm Kraken Ventures, Web3 infrastructure development and investment firm Jump Crypto, and American hedge fund Pantera Capital.

The resultant effect of this was the first sign of an extensive market rebound that saw INJ soar by 150% to a then-yearly high price of $3.1778 on January 31.

The token eventually fell to an intraday low of $2.6987 but went up to close the first month of the ecosystem fund launch with an improved price of $3.1599. INJ market capitalization by the close of January stood at about $230 million.

Big Data Token INJ’s move towards $5 in March inspired by Hackathon launch

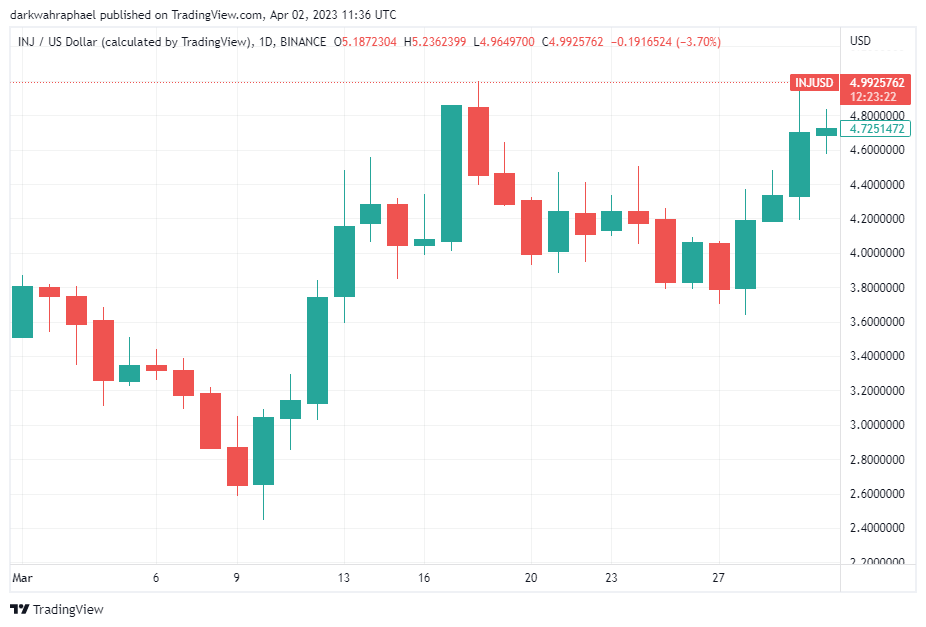

Big Data Token Injective hit an uptrend in March which resulted in a 34% rise in its price in 30 days in large part to an innovative strategy employed by many development teams to grow their respective ecosystems called Hackathon.

While news of the Injective Global Virtual Hackathon hit the market on January 27, 2023, the main event began on March 20.

A Hackathon is an event where several stakeholders of blockchain technology collaborate to add innovative solutions to an existing blockchain project.

Overall, $1 million in prizes and seed funding have been set up to support the brightest developers that want to make substantial contributions to the development of the Web3 sector.

Areas of Injective’s ecosystem where much emphasis has been placed include exchanges, DeFi, yield generation, real-world assets, prediction markets, derivatives, options, and lending.

The project has a lifespan of four weeks and has moved from its Launch week to Learn week with Buidl week and Demo week (presentations of projects to panel and peers) lined up in the coming weeks.

This explains the more than 30% rise from $3.5171 on March 1 to a quarterly and yearly high price of $4.9215 on March 30.

Despite the increment in value, INJ is still 80% below its all-time high price of $25.01 in April 2021.

INJ has displaced Fetch.ai (FET) and others in AI and big data token ranks

The ecosystem fund and Hackathon have impacted Injective’s valuation positively. As of the end of the first quarter of 2023, INJ is behind only Render Token (RNDR), SingularityNET (AGIX), and The Graph (GRT) in the ranks of the top artificial intelligence (AI) and big data tokens by market capitalization.

Despite its relatively lower market cap, INJ currently commands a higher market share than Oasis Network (ROSE), Fetch.ai (FET), and Ocean Protocol (OCEAN) among others.

and then

and then