Bored Ape Yacht Club (BAYC), one of the most popular non-fungible token (NFT) collections saw its first quarter sales fall more than $500 million by the end of March 2023 from the same period in 2022. This was the first time in a quarter that monthly sales from Bored Apes failed to break the $70 million milestone due to a difficulty in industry-wide recovery from the negative shades of 2022.

Bored Ape Yacht Club comprises 10,000 unique Bored Apes which are housed by the blockchain technology of Ethereum. After reaching a record high of $346 million in monthly sales in January 2022 (before the Russia/Ukraine crisis and the collapse of TerraUSD and FTX), sales of the popular digital collectible have been on a downward spiral.

The effects of a fall in global NFT market sales have resulted negatively in BAYC sales and explain why the once-in-demand NFT cannot break $70 million to $100 million in monthly sales.

BAYC’s first quarter sales in 2023 fell below $200 million

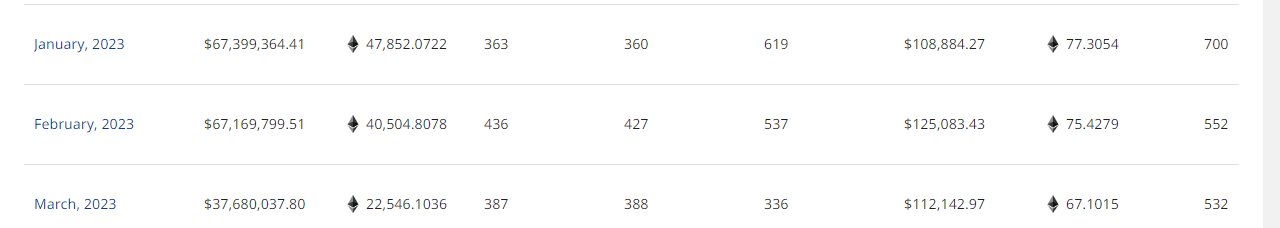

In January 2023, BAYC sales stood at approximately $67 million from 360 unique buyers involved in 619 transactions. The NFT’s average sale value was $108,884.27. While the number of unique buyers spiked by 19% to 427 in February, there was a 13% decline in total transactions to 537. Despite this, the average sale value soared by 15% to $125,083.43, and this culminated in monthly sales of around $67 million.

With global NFT market sales falling below $1 billion for the first time in 2023 in March which signaled a decrease in demand for digital collectibles, BAYC felt the heat and generated about $38 million in sales. Overall, first-quarter sales from the monkey-themed NFTs during the first three months of the year totaled $172 million. The total number of buyers was 976, transactions were 1,498, the total owners stood at 6,343, and the average holding time of the digital art was 62.24 days.

BAYC sales were a 77% decrease quarter-on-quarter from 2022

While $172 million in quarterly sales will be seen by the development teams behind other projects as impressive, the metrics from Q1 2023 were 77% below the figure from Q1 2022.

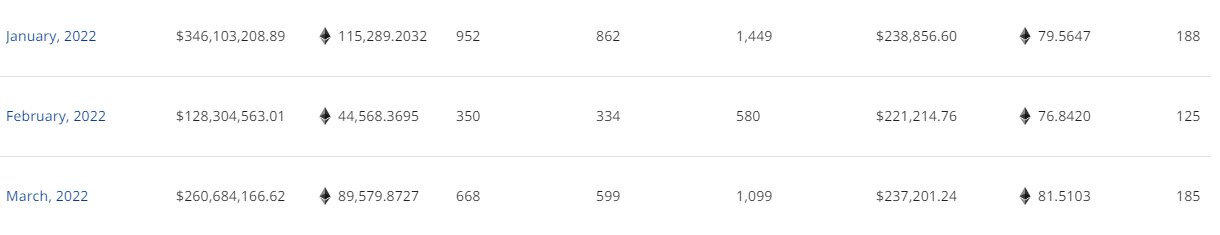

During the first quarter of 2022, BAYC sales were approximately $735 million. As mentioned earlier, the collection had its best month during the opening month of the year from the activities of 862 unique buyers who contributed to 1,449 transactions. The average sale value during January 2022 was $238,856.60, $113,773.17 more than 2023’s monthly quarterly best of $125,083.43 in February 2023.

As negative market sentiment began engulfing the market in February last year with whispers of potential approval of the first interest rate hike in more than three years by the Federal Reserve of the United States, many people started shifting their focus from the blockchain-powered economy to government bonds and bills.

The resultant effect was a 61% and 60% decline in the number of unique buyers and total transactions respectively.

BAYC sales descended to $128 million in February but rose again to about $260 million in March after demand led to improvements in unique buyers, total transactions, and average sale value.

Overall, BAYC sales within the two quarters dropped by $563 million due to lesser sales from the first three months of 2023.

Bored Ape led the way despite mild sales

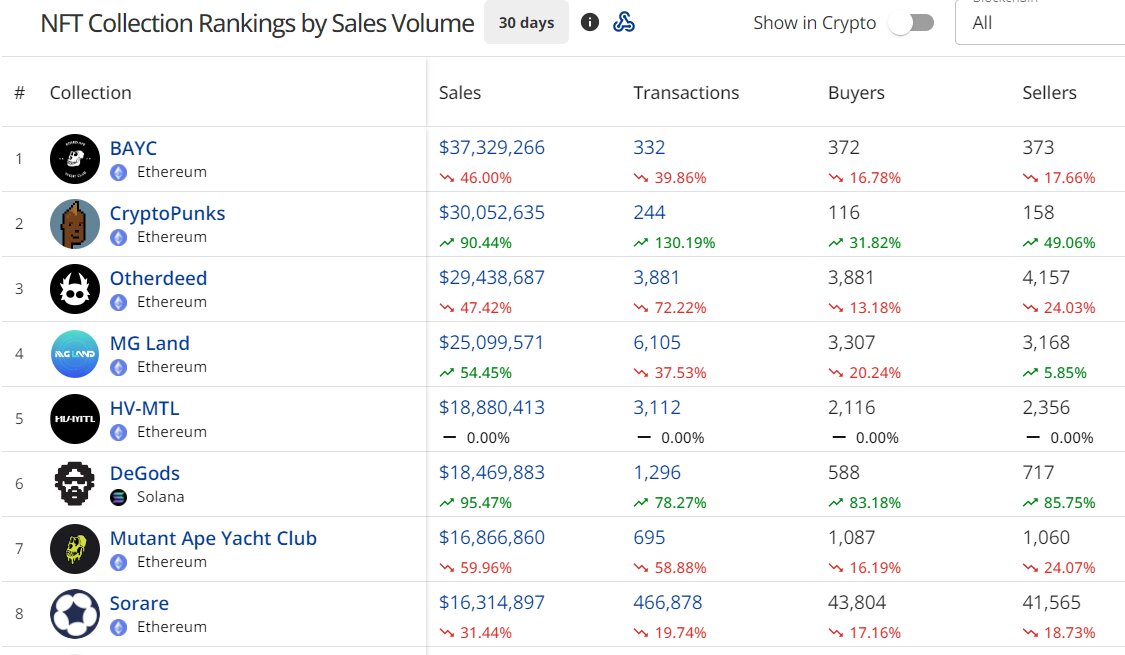

Despite seeing monthly sales fall below $40 million for the first time since October 2022, BAYC still led the NFT collection ranking by sales volume during March.

Bored Apes had more than $7 million in sales than CryptoPunks and Otherdeed from the Otherside Metaverse and over $20 million more than sister project Mutant Ape Yacht Club (MAYC) and Sorare (all housed in the Ethereum ecosystem).

As of April 2023, BAYC has started the month and second quarter strong as it has generated sales of more than $1.5 million.

and then

and then