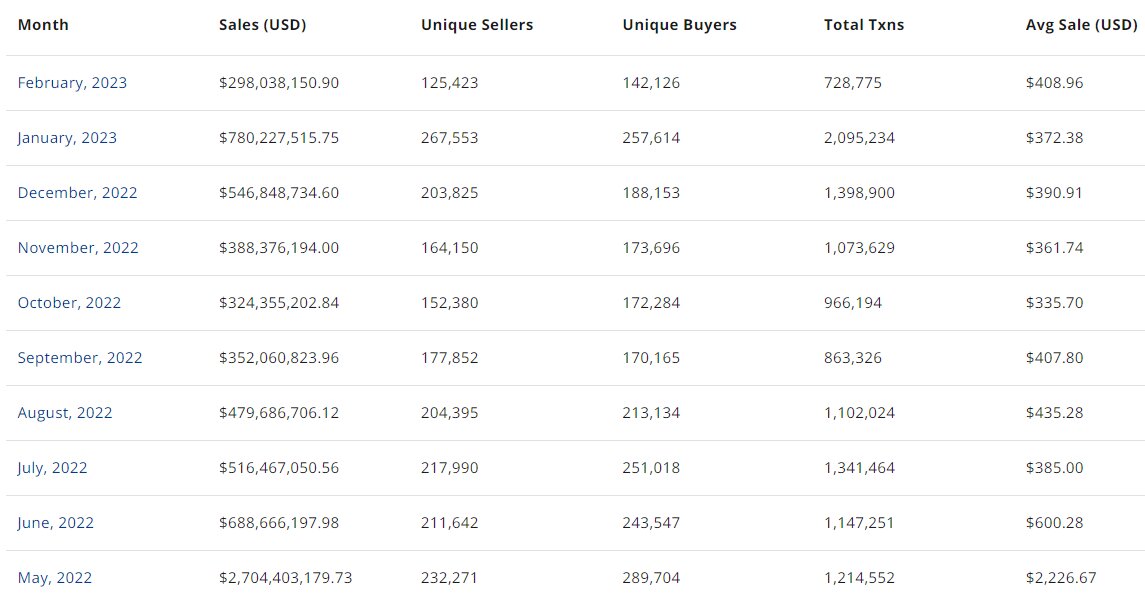

Ethereum is the NFT blockchain by all-time sales volume. After a difficult period in the second half of 2022, Ethereum NFTs surpassed more than $700 million in monthly sales volume for the first time since May 2022.

Ethereum NFT sales in January 2023 were approximately $780 million and this was a 43% increase from December 2022’s $547 million.

Ethereum NFT sales came from a spike in the demand for top digital collections

Eight of the top ten highest-grossing NFT sales in the form of the Bored Ape Yacht Club (BAYC), CryptoPunks, Mutant Ape Yacht Club (MAYC), Art Blocks, Otherside for Otherdeed, Azuki, CloneX, and Moonbirds are deployed on Ethereum.

While BAYC has overtaken CryptoPunks on the all-time sales rankings, the two digital collectibles continue to see sales in the millions of dollars. In the early days of February, BAYC #7090 exchanged hands for around 800 ETH (which at the time had a dollar value of $1.3 million). Within the same period, CryptoPunk #5066 also sold for around 857 ETH (was worth approximately $1.4 million). Much of the sales came at the back of a rebounding NFT market in January.

Despite the uncertainty surrounding digital collectibles as we head into a new year, CryptoPunks added $23 million to Ethereum NFT sales in January. There was a spike in unique buyers, average sale value, and total transactions from February.

BAYC did not fail to impress as it also added $67 million while its sister project MAYC and Art Blocks added $68 million and $26 million respectively.

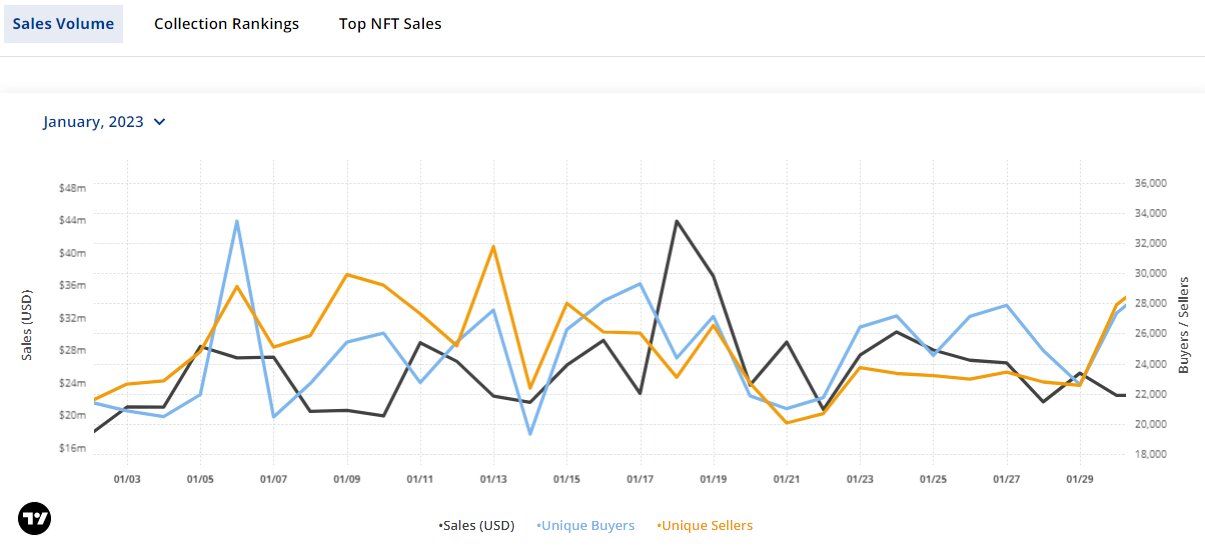

Ethereum NFT unique buyers reached a 7-month high

A total of 257,614 unique buyers bought NFTs on Ethereum. This was the first time since July 2022 that unique buyers had surpassed 250,000. While average sale value remained low when compared to statistics from December 2022, more NFTs were involved in transactions during the first month of 2023 (more than 2 million).

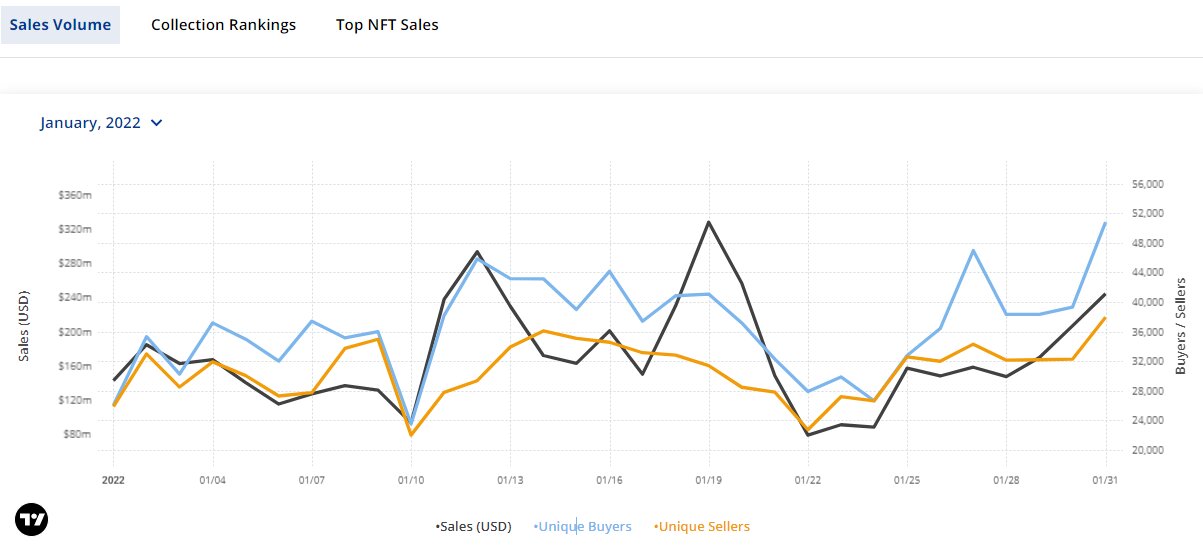

Sales volume is still far below January 2022 milestones

Ethereum NFTs reached a peak of $5.3 billion in January 2022. Despite the recovery of the market in 2023 which has led to the soaring of sales on many blockchains, January 2023’s metric was 85% below NFT sales on Vitalik Buterin’s blockchain during the first month of 2022. In mathematical terms, 2023 sales were $4.5 billion below 2022’s.

Ethereum NFT sales could rebound with new projects

With new projects such as Beauteous Girl, Crypto Crytterz, Drakoz, Lucky Elephant Club Jungleverse, Genesis Collection, Exoniks, Breaking David, Own Your Quirk, Headphone Hero, Superlotis, Undeads, Panda Jewels, Mystic Motors, and SHE launching on the now Proof-of-Stake (PoS) blockchain, Ethereum NFT sales could be on its way to surpassing billions of dollars in monthly revenue.

As of Feb.10, Ethereum NFT sales for the second month of the year stood at $298 million with all-time sales pegged at $36 billion from the activities of 2.1 million buyers involved in over 26 million transactions.

With total global NFT market sales having crossed $48 billion, Ethereum controls around 75% of the entire digital collectibles space, and continues to play an integral role in the growing metaverse sector.

and then

and then