Midas Investments is shutting down as a decentralized finance platform and pivoting to so-called CeDeFi, a hybrid type of structure that combines centralized finance (CeFi) and DeFi.

The decision is significant. It could indicate the direction that the decentralized finance (DeFi) sector may be taking in order to stay afloat at a time of increased regulatory scrutiny and project failure. Midas focused on DeFi yields.

Also read: Why Market Collapse Doesn’t Signal the End of Centralized Crypto Exchanges

Founder and CEO Iakov Levin revealed in a long blog post on Dec. 27 that Midas lost 20%, or $50 million, of the assets it managed under its decentralized finance portfolio earlier in year due to bad market conditions.

In this article, we want to share with you the story of what led us to this difficult decision, provide you with an overview of our balance sheets, P&L, and DeFi portfolio composition, and give you some insight into our plans for the future.

Link: https://t.co/Oa6uTDYN6L pic.twitter.com/3mIg4fAK7l

— Midas.Investments (@Midas_platform) December 27, 2022

The firm had a total of $250 million assets under management. Losses worsened after the demise of several crypto projects in 2022. Levin, also known as “Trevor”, said the collapse of Terraform Labs, Celsius, and FTX made it difficult for Midas to sustain its fixed yield model.

Users withdrew 60% of their assets from under Midas’ management after the trio went under, “creating a large asset deficit.” According to the CEO, Midas lost a further $14 million in Ichi protocol and $15 million due to the devaluation of the DeFi Alpha portfolio position.

“Based on this situation and current CeFi [centralized finance] market conditions, we have reached the difficult decision to close the platform,” Levin wrote.

Midas pivots to CeDeFi

Midas is the latest victim of cryptocurrency’s most dramatic year, which has seen more than $2 trillion of value wiped from the industry. The list includes prominent crypto firms Voyager Digital, Three Arrows Capital, and BlockFi.

Following its closure, Levin revealed that the company would pivot to a new on-chain project “that aligns with our vision for CeDeFi” starting in 2023.

“This project will be fully transparent, on-chain, and built with the goal of offering a new and improved investment experience,” he said.

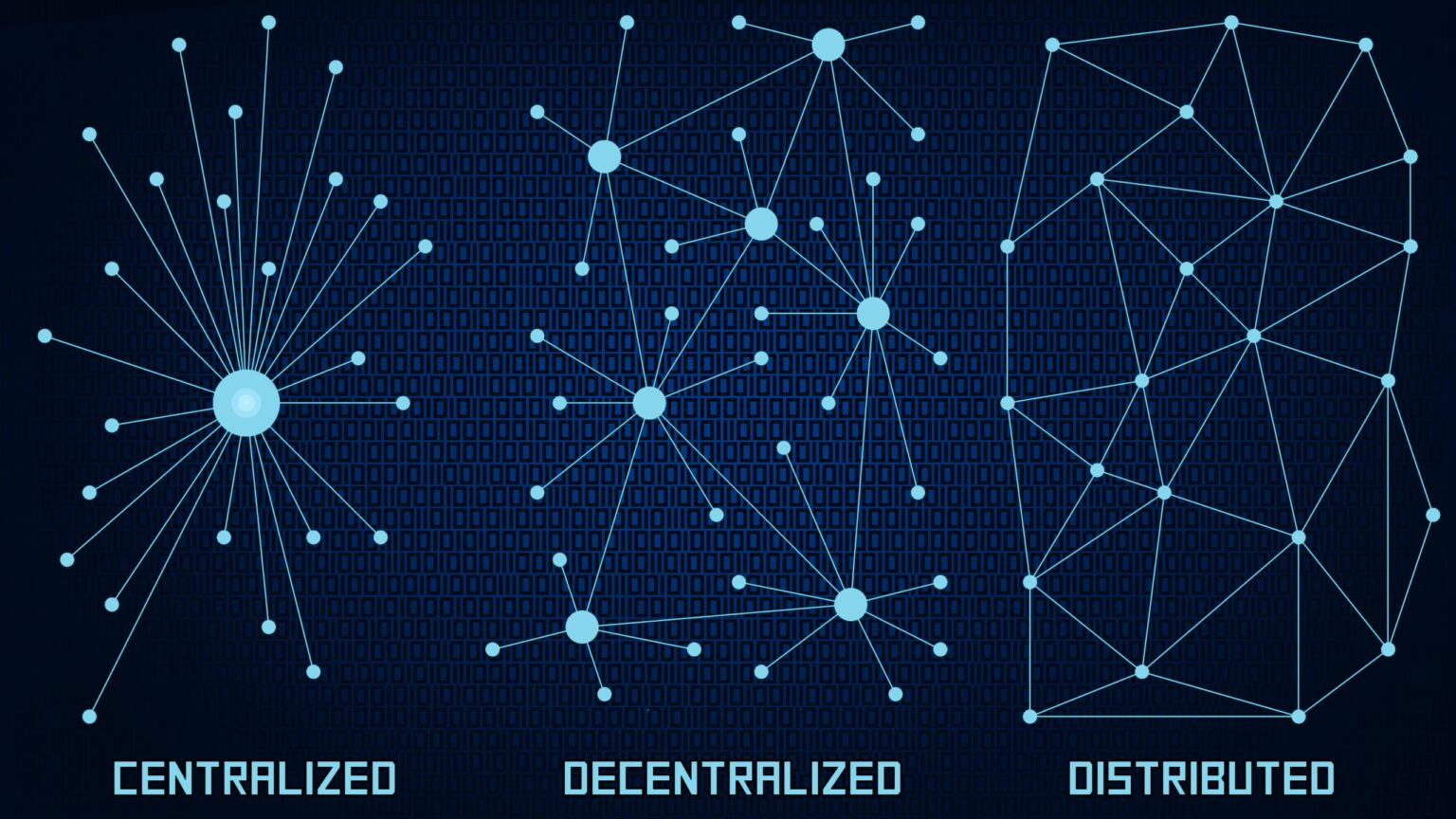

CeDeFi refers to a combination of centralized finance (CeFi) and decentralized finance (DeFi). Binance CEO Changpeng Zhao, also known as “CZ”, is credited with creating the term during the launch of the Binance Smart Chain in 2019.

The structure typically leverages the advantages of decentralized finance but with more centralized decision-making at the top, according to experts. People will still get access to things like yield farming tools, lending protocols, and other DeFi products.

CeFi works just like traditional finance, allowing people to borrow or lend money, in this case crypto, from a central point, usually controlled through an exchange like Binance or Coinbase. DeFi does the exact opposite of this, facilitating peer-to-peer transactions in a decentralized way. Unlike CeFi, DeFi users have complete control over their funds.

How is Midas utilizing CeDeFi?

Midas Investments has always utilized the centralized-decentralized finance model at some level in its operations, even before its recent closure. The company uses DeFi algorithms to maintain transparency of funds and “provide viable risk projections to users.”

The centralized layer helps to keep the “conventional yield generation process intact, allowing it [Midas] to offer a seamless user experience.” In the blog post, CEO Iakov Levin said Midas “plans to offer scalable…verifiable tokenized CeDeFi strategies for both CeFi and DeFi users.”

“The goal of the new project is to create a win-win situation by connecting competing protocols with liquidity and offering a simplified yield to a range of decentralized finance and centralized finance audiences,” Levin claimed.

“The first product will be a transparent, on-chain treasury that allows users to mint tokens backed by stablecoins, Bitcoin or Ethereum by depositing collateral in ETH,” he added.

Midas is nursing a $63.3 million deficit on its balance sheet. It hopes that its pivot to CeDeFi will help to facilitate lower fees, improved security, and faster transactions. All in an effort to avoid the pitfalls that led to massive losses linked to its DeFi operations.

The end of DeFi? Decentralized or centralized.

For governments, cryptocurrency is becoming too mainstream to ignore and too chaotic to neglect. Across the world, government agencies are targeting crypto investors not only with taxes but mandatory registration and full disclosure rules.

This raises existential questions about the direction of the industry, in particular, whether decentralization as a tool for resisting censorship is a myth. Until now, the DeFi industry has continued to hold true to the founding principles of Bitcoin of privacy and decentralization.

Midas Investments pivoting to CeDeFi may be cast in a different light – a pivot that signals the beginning of a trend that eventually leads to the dismantling of decentralized finance, as the rampant failure of crypto projects invites increased government scrutiny.

Centralized financial institutions embrace regulation. In a previous blog post, renowned DeFi architect Andre Cronje explained how the industry has moved on from its pioneers’ autonomous fundamentalism and is now seeking regulation and safety.

“Instead of trying to fight regulatory bodies because of crypto regulation, we should be trying to engage and educate on regulated crypto. What should a token issuance license look like? What should an exchange’s activities be expanded to?” he said.

Satoshi would be disappointed

Although crypto was conceived as an anti-authority invention where unmediated business is conducted peer-to-peer, the lack of internal controls, requiring users to utilize their own discretion, has been exploited by those with criminal motives.

For example, hackers have stolen more than $2.32 billion from the DeFi market this year alone. Across the crypto universe, this all bundles into a disarming pretext for state control. .

The current direction of crypto mapped by government regulators is, however, a far cry from Bitcoin founder Satoshi Nakamoto’s whitepaper, which declared:

“What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

Third parties are now fully immersed in the crypto ecosystem. As the industry matures, it is becoming increasingly tangled in institutional oversight that cedes its envisioned autonomy in a big way.

and then

and then