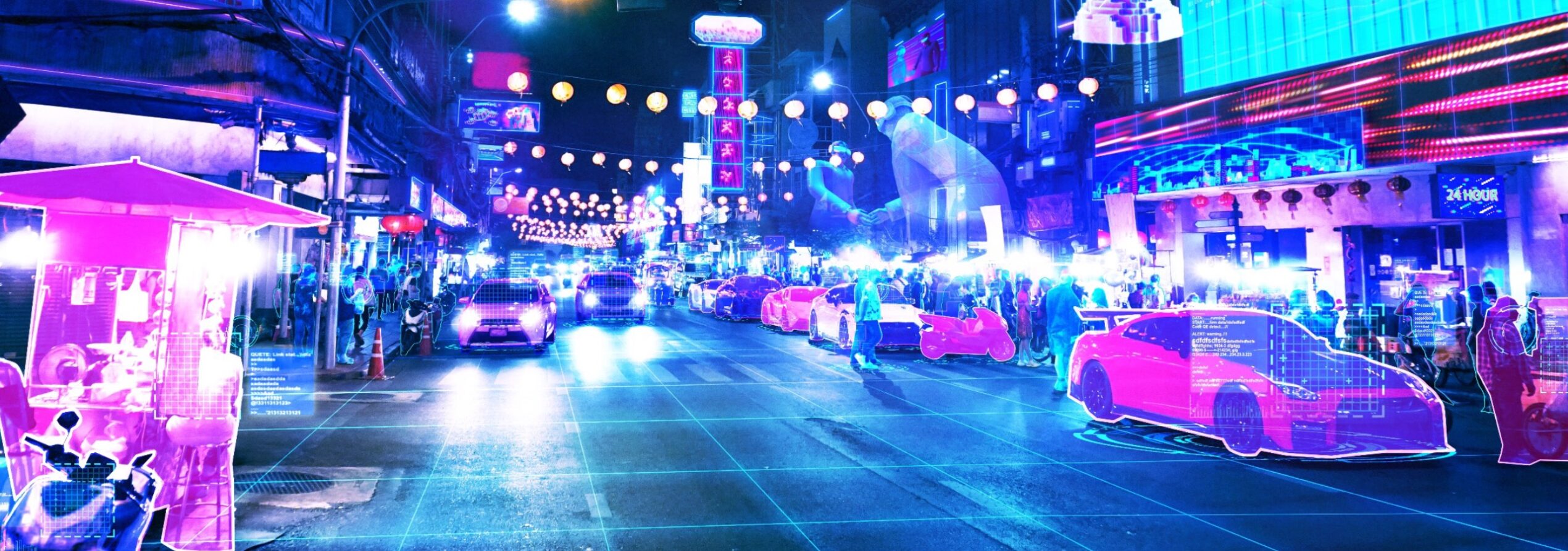

Chinese metaverse entrepreneurs are turning to overseas markets as the strict regulatory landscape back home is pushing them away.

World over, metaverse and Web3 have become the buzzwords with tech companies and entrepreneurs scrambling for exciting business opportunities.

Parent firm of TikTok – Byte Dance has designed two metaverse apps while other tech giants Tencent Holdings, Alibaba Group and Baidu are investing in metaverse and Web3 projects.

Also read: What Are Hypernetworks?

Developing these and more projects is however difficult with Chinese authorities taking a tough stance on cryptocurrency.

Regulations in some markets have become strict after a combination of factors caused a freefall on some crypto asset prices as well as collapse of some high profile crypto currencies, rising inflation and impact of the conflict in Ukraine.

In China, the regulations have made investors think twice about digital assets and look elsewhere like Singapore for security of their investments.

What is the metaverse?

The metaverse is a fully immersive, persistent virtual world where with the help of high tech goggles and other kit, people interact, work and play via online avatars of their real world selves.

Web3 is the term used for a new, decentralized internet based on blockchains. Businesses, investors and developers predict the metaverse could form the next generation of the internet.

Mark Zuckerberg has become the most famous promoter of the metaverse. The renaming of Facebook as Meta in October 2021 has accelerated the race among tech giants in the US and Asia to turn the idea of the metaverse into reality.

A report by consulting firm, McKinsey & Company says global investment in metaverse businesses topped $120 billion during the first half of the year, which was more than double what was recorded in the whole of 2021.

Gaming in particular is projected to continue growing with 3.2 billion people expected to be active players for 2022, spending a combined $196.8 billion according to Newzoo.

Chinese warm up to metaverse

According to China Briefing, Chinese technology companies have started testing the water by developing metaverse type apps, trademarking metaverse related phrases and investing in the virtual reality (VR) or augmented reality (AR) segment.

Baidu was the first Chinese firm to launch a metaverse app in December 2021, under the name “Land of Hope.”

Tencent has taken several initiatives to make its offerings more virtual.

So vast is the excitement around metaverse that it has also attracted more scrutiny from regulators. Concerns are these tech developments may be used for illegal activities such as money laundering.

Tencent laid off staff at its NFT purchase and collection platform Huanhe amid strong regulatory scrutiny of transactions in digital assets in Chinese mainland. The firm has since invested in Australian NFT startup Immutable, which is developing a blockchain based online game where NFTs can be sold.

Earlier this year, Hong Kong Chinese listed livestreaming company Inkeverse Group launched an NFT project called Hootlabs selling NFTs that can be used as profile pictures by social media users. However, Inkeverse has forbidden Chinese mainland-based users from accessing its services.

Paradise in Southeast Asia

Countries in Southeast Asia have become a primary destination for Chinese Metaverse and Web3 companies due to looser oversight on cryptocurrency and proximity to China.

Market insiders say a lot of Chinese coders have either moved to Singapore for Web3 projects or are working on them remotely from China.

“Singapore is the best place for Chinese nationals to start a Web3 business in terms of culture and operation cost,” said a Singapore based Chinese Web3 entrepreneur cited by PingWest.

Some Chinese private equity investors have joined global venture capital investors to set up offices in Singapore and invest in local Web3 projects, according to market insiders.

“There are more and more investible metaverse and Web3 projects most of which are founded by Chinese entrepreneurs,” said Li of Initiate Capital.

Chinese metaverse entrepreneurs in a fix

While Southeast Asia has been more accommodating, the Chinese entrepreneurs are now facing a shifting regulatory framework for cryptocurrency.

In November, Singapore’s financial regulator issued a warning on risks in cryptocurrencies trading after FTX’s dramatic failure. The crypto exchange fell from a $32 billion valuation to insolvency as customers who scrambled for withdrawals dried up its liquidity.

This caused rival exchange Binance, which is the world’s largest cryptocurrency exchange to walk away from potential bailout.

The Monetary Authority of Singapore has since ordered Binance to stop registering users in the country as it has not been licensed.

Experts say this stance could dent prospects for metaverse and Web3 enterprises. Ning Xuanfeng, a partner at a law firm King & Wood Mallesons told Caixin that these enterprises also need to pay close attention to legal issues including anti-money laundering, tax compliance, intellectual property rights and anti-monopoly.

and then

and then