Unveiled recently by US Senators Jack Reed, Mike Rounds, Mark Warner, and Mitt Romney, a controversial bill aims to apply stringent anti-money laundering (AML) measures to the nascent domain of decentralized finance (DeFi).

However, the Crypto Council for Innovation (CCI), an alliance of leading industry players, has swiftly countered. They argue the bill needs to offer a feasible framework for curbing illicit finance in the DeFi landscape.

2/ TL;DR: the proposal fails to provide a workable framework to actually address illicit finance in these sectors. https://t.co/CIbbbYuIkk

— Crypto Council for Innovation (@crypto_council) July 19, 2023

The CCI emphasizes that the new bill counters a viable approach. It lays legal duties indiscriminately on individuals who lack the means to influence protocols post-deployment. According to the CCI, this needs to account for the unique attributes of blockchain-backed systems.

The council suggests that leveraging the transparency and programmability inherent in blockchain could foster effective compliance measures rather than imposing impractical obligations. The CCI highlights that the volume of illicit finance in crypto is minor compared to traditional finance (TradFi). However, they express that the proposed bill needs to take a different route to address this concern.

Vague definitions and unworkable obligations: CCI’s stand

The CCI criticizes the bill for its vagueness, particularly regarding the definition of “facilitators.” It takes issue with obligations laid on “Digital Asset Protocol Backers” and “Digital Asset Transaction Facilitators.”

According to the bill, a Digital Asset Protocol Backer holds over $25 million of a DeFi protocol’s governance token or has invested the same amount into its development. On the other hand, a Digital Asset Transaction Facilitator has control over the protocol or offers an application enabling transactions on the said crypto protocol.

6/ (ii) has invested $25m+ into a protocol’s development. “Digital Asset Transaction Facilitators” are any person who “controls” a digital asset protocol or who makes available an application designed to facilitate transactions using a digital asset protocol.

— Crypto Council for Innovation (@crypto_council) July 19, 2023

The CCI finds these obligations unrealistic and believes they need to provide actual guidance for DeFi protocols to comply with Bank Secrecy Act (BSA) reporting requirements. They explain that collecting personal identification information from such protocols is unfeasible, and the bill fails to offer solutions for this technical complexity.

“There is no actual guidance in the proposal on technical ways for decentralized protocols to comply with BSA reporting requirements.” It is impossible to gather personal identity information from such protocols, and the law neither addresses nor proposes remedies to this issue.” noted the Crypto Council.

While expressing its reservations, the CCI is willing to collaborate with industry experts and regulators globally to develop a sound approach to counter illicit finance in DeFi.

Navigating the DeFi regulation quagmire

Despite the severe criticism, the CCI recognizes that the bill is in its early stages. They note that the authors are open to discussions about improvements. Consequently, they expect the bill to undergo significant edits in the future.

22/ CCI will continue to work tirelessly to ensure policymakers have accurate info about the operations of DeFi protocols and crypto ATMs. It is critical that regulation strike the careful balance between establishing safeguards and fostering innovation in the U.S.

— Crypto Council for Innovation (@crypto_council) July 19, 2023

While the Senate’s initiative to regulate the DeFi space mirrors controls applied to traditional banks, it encounters significant resistance. The CCI, representing industry leaders, calls for a technologically sound approach that respects the unique attributes of blockchain-backed systems.

However, the road to acceptable regulation seems long and complicated, underscoring the complexity of integrating innovative technology with existing financial frameworks.

DeFi TVL is on a rebound

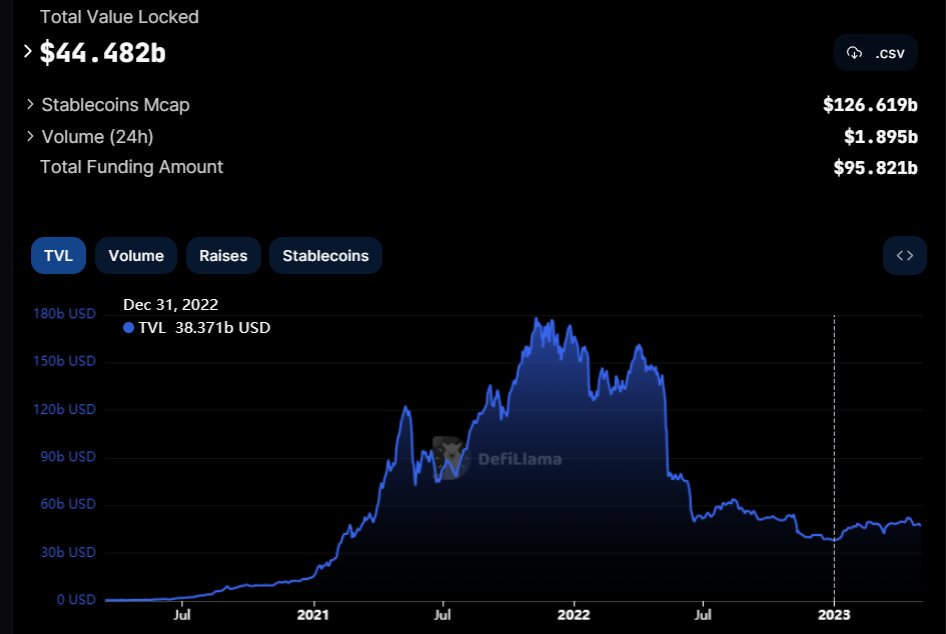

The clash in DeFi regulation has done little to affect the total value locked (TVL) in this sector of the crypto economy in 2023.

After shedding 76% of its overall TVL from approximately $164 billion on January 1, 2022, to around $39 billion on the last day of the year thanks to the collapse of the market led by the implosion of the Terra ecosystem, value locked is on the rise.

As of July 20, TVL has improved by 14% to about $44 billion, a $5 billion rise in 10 months in large part to the consistent patronage of decentralized applications (dApps) under the lending, exchange, and yield aggregation banners such as Lido Finance, Aave, MakerDAO, Curve Finance, Compound Finance, and Uniswap among others.

and then

and then