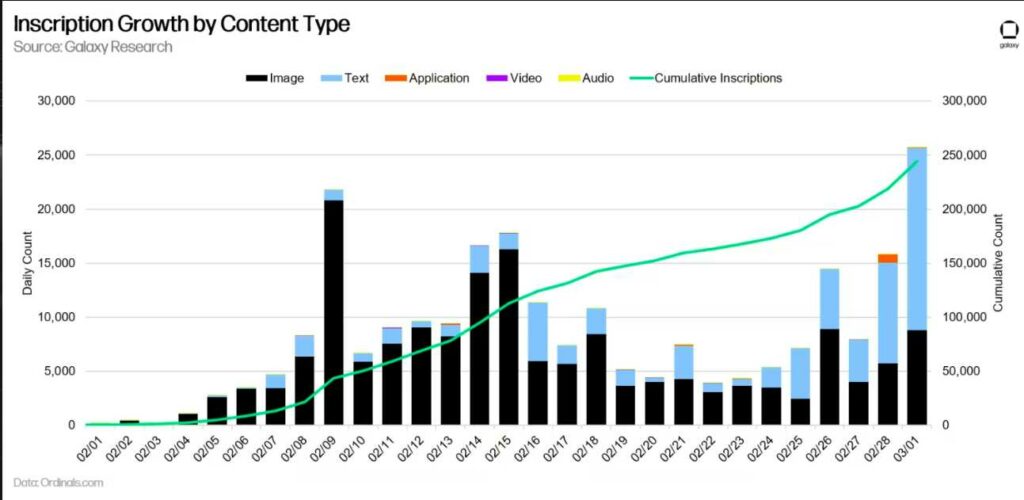

When software engineer Casey Rodarmor launched the Ordinals protocol three months ago, the NFTs market had lost steam from its 2021 peak. Now, the protocol has triggered a lot of interest, with crypto enthusiasts embedding a total of 385,000 “inscriptions” on Bitcoin.

Known as Ordinals, the ‘inscriptions’ are Bitcoin’s own version of non-fungible tokens (NFTs). Of the total inscriptions to date, 200,000 are image files and over 150,000 based on text, and 17, 000 are apps, according to Glassnode Market Intelligence, as reported by Reuters.

Also read: New Pokémon Hire Suggests Gaming Giant is Eyeing NFTs, Metaverse

Ordinals sales reach millions

Rodarmor launched Ordinals on the Bitcoin mainnet on January 21. The new protocol uses what he calls “inscriptions” to create and store NFTs on the network. Ordinals are created by adding things like text, audio or images on the Bitcoin blockchain.

He said the inscriptions are made on the smallest Bitcoin unit known as a “satoshi,” or “sats,” to create unique and “true digital artifacts [that are] decentralized, immutable, always on-chain, and native to Bitcoin.” The NFTs can be held and transferred across the network.

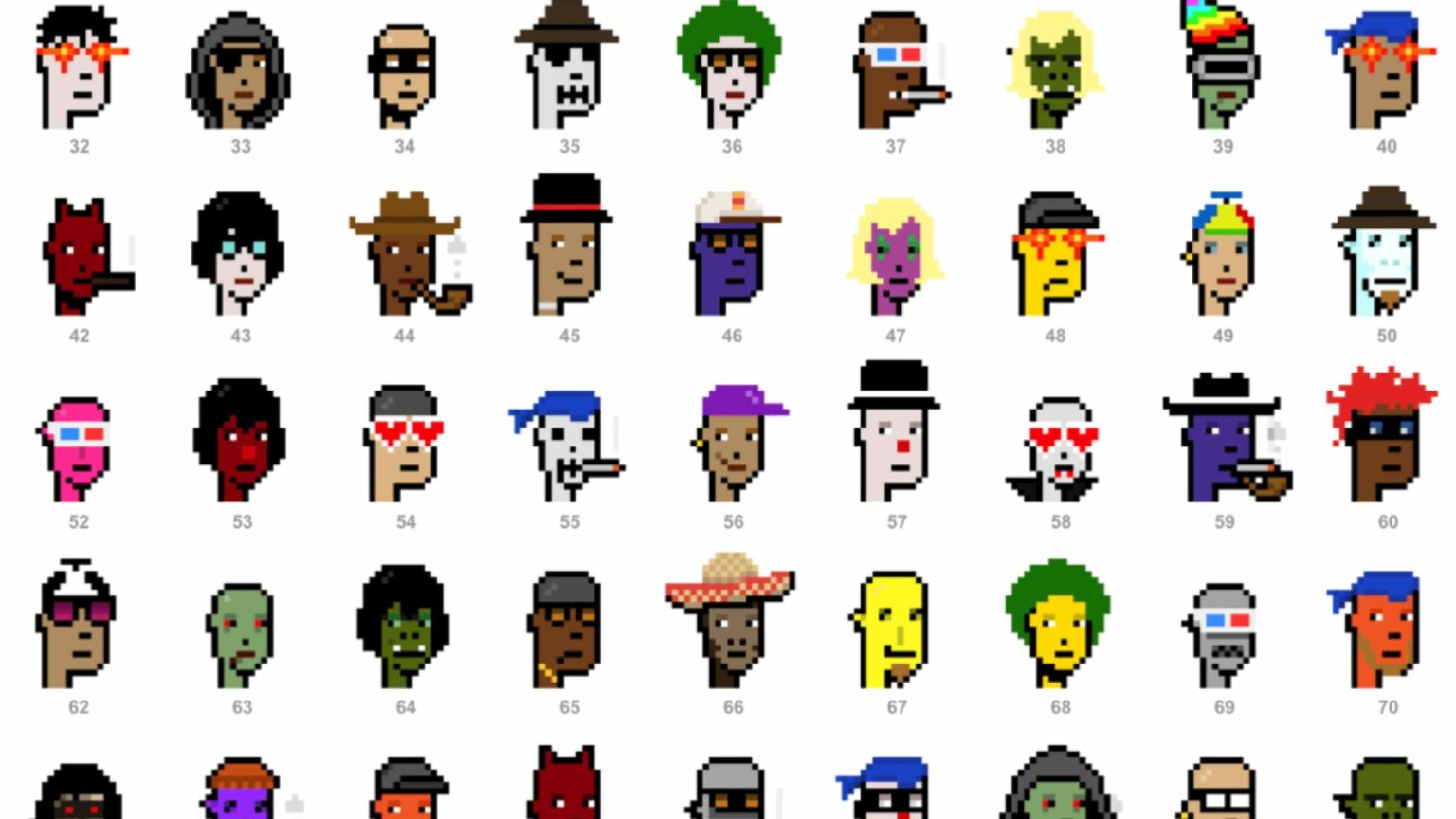

Several Bitcoin NFT projects have emerged ever since. It includes Bitcoin Punks, BTC Machines, Pixel Pepes and others. According to the Reuters report, NFT traders around the world are back in the money. Others have made millions of dollars from the trade of Ordinals. One such entity is Yuga Labs, creator of the popular Bored Apes NFTs.

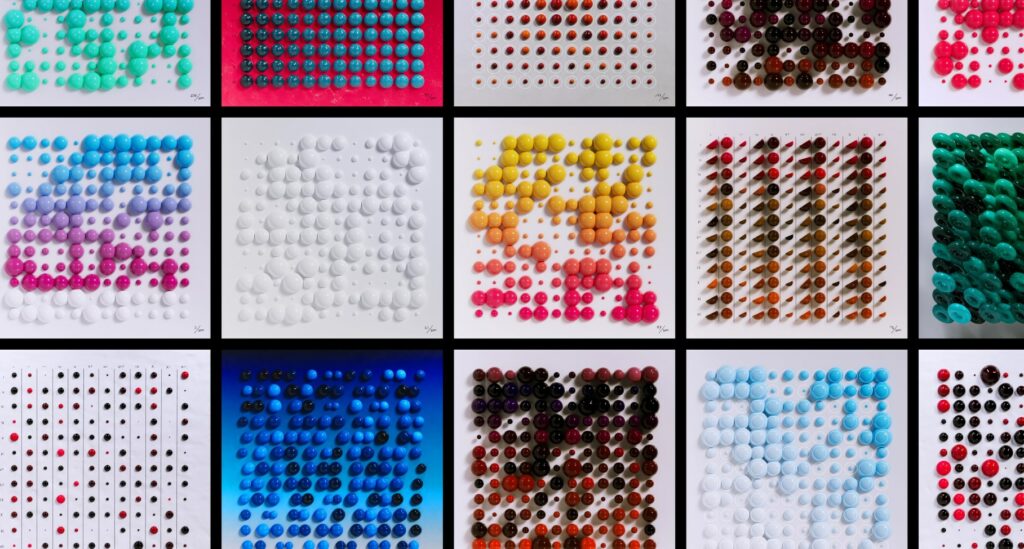

The company created a collection called TwelveFold. It is a limited edition and experimental collection of 300 generative art pieces inscribed onto satoshis on the Bitcoin network. Yuga announced it made $16.5 million, or 736 BTC, from the sale of 288 images in the collection.

“These pieces represent a complete art project and will not have other utility or interact with or be related to any previous, ongoing, or future Ethereum-based Yuga projects,” it detailed.

It’s not just Yuga Labs cashing in on Ordinals. Other Bitcoin NFTs that have fared pretty well on the market range from JPEGs of rocks to crowned shadowy images that have sold for $213,845 and $273,010 respectively, according to data from Galaxy Digital Research.

Growing Bitcoin NFT interest

Galaxy expects that the total value of Bitcoin NFTs to reach $4.5 billion by 2025, building on growth already established by Ethereum-based NFTs.

In the shadow of the Blur against Opensea conflict, “Ordinals are quietly having their own marketplace wars,” said the pseudonymous on-chain analyst Domodata. In late February, volume reached 1.5 million on the Ordinals Market platform alone.

The exchange “is using existing Ethereum infrastructure [emblem vaults & reservoir] whilst the others are embracing novel Bitcoin native solutions. As it stands, volume is roughly split between the chains,” the analyst observed.

At the beginning of March, total marketplace volume for Bitcoin NFTs surpassed $6.1 million, with around 10,000 unique users, per Dune Analytics data. By comparison, it took OpenSea, the biggest marketplace for Ethereum-based NFTs, 14 months to achieve similar volume.

In the shadow of the Blur vs. Opensea conflict, Ordinals are quietly having their own marketplace wars. 1/x pic.twitter.com/pWkZgjR0le

— domo (@domodata) March 5, 2023

In total, NFT sales – excluding Ordinals – amounted to $1 billion last month, up more than 200% from $324 million in November, according to CryptoSlam. However, the figure is still a but a fraction of the $5 billion recorded in January last year and $2.7 billion in May.

Despite joining the party late, Ordinals have proved a hit with collectors. As per Glassnode data, Bitcoin non-fungible tokens now represent 7% of the total number of transactions on the Bitcoin blockchain.

Nightmare come true

The growth is a nightmare come true for Bitcoin fundamentalists, who worried that Ordinals could lead to congestion on the Bitcoin network as the NFTs compete with normal financial payments for block space. The worry has become reality.

Ordinals have caused a significant surge in the usage, fees, and storage space of the Bitcoin network. Proponents consider this “a major breakthrough for the Bitcoin application tier and can shift the narrative from being solely a ‘store of value’ to more practical use cases.”

The average cost of sending a transaction over the Bitcoin blockchain has spiked from $0.97 on Jan. 25, just days after the Ordinals launch, to over $2.40 as of Mar.15, according to data provider Ycharts. The numbers reflect the increased trade in Ordinals.

Further data from Blockchain.com shows that the seven-day average confirmation time for Bitcoin transactions rose to more than 186 minutes in late February, a peak last seen in November following Bitcoin’s selloff. The number averaged 12 to 35 minutes in January.

Utilizing the Bitcoin Taproot upgrade of 2021, Casey Rodarmor emphasized that his Ordinals protocol posed no threat because it does not require “any changes to Bitcoin” to create a non-fungible token on the network. But not everyone is thrilled about the new kid on the block.

Ordinals face resistance

There has always been questions on how Bitcoin would handle huge traffic if non-fungible tokens and other decentralized applications launched on the blockchain. Fundamentalists argue the cryptocurrency was meant to be used only for payments.

Any use of the network outside of financial transactions detracts from the original vision of the pseudonymous Bitcoin founder Satoshi Nakamoto, they say. Prominent Bitcoin core developer and Blockstream CEO Adam Back described Ordinals as “crap” and urged miners to censor the NFT-like items as a “form of discouragement.” That tweet was later deleted.

In 2010, Satoshi Nakamoto responded to a question on whether Bitcoin should be used for non-financial purposes with an emphatic “No”. There are no quick answers as to how NFTs on Bitcoin will develop, or to what extent they could fracture the community. We’ll see.

and then

and then