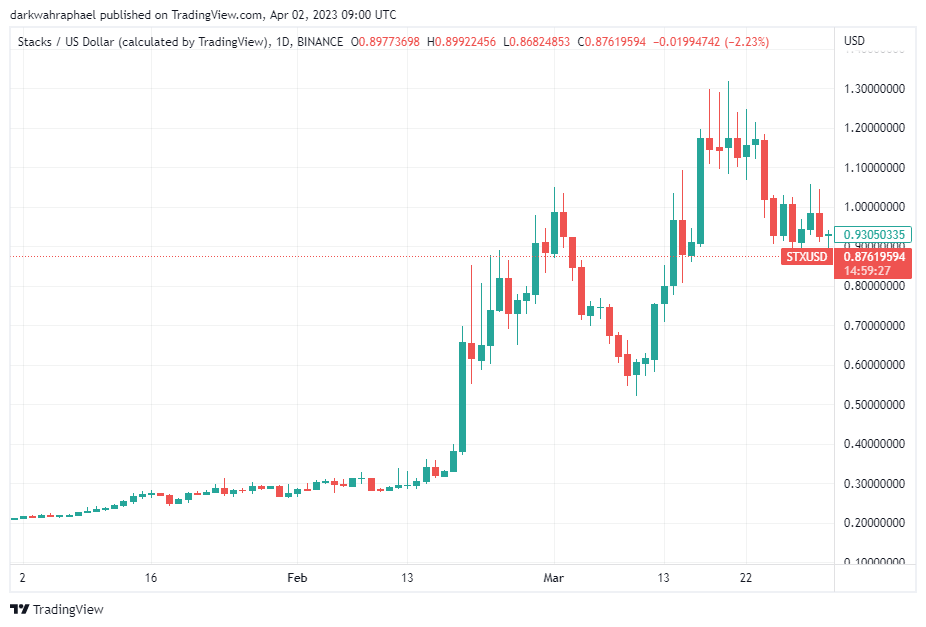

Stacks Crypto (STX) has gone from being a lesser-known altcoin to a viral sensation, having brought triple percentage gains to holders during the first quarter of 2023 – despite ups and downs in the crypto economy.

The token soared by 344% in Q1, beating the likes of The Graph (GRT), many big data and AI tokens, and other metaverse-powered assets in the process. Largely due to its close association with the most popular blockchain network, Bitcoin.

The gains came after STX closed on March 31 with a trading price of $0.9314, having opened the year at just $0.2095.

While STX remains a low-cap digital asset (less than $2 billion in market value) by market capitalization, the project’s valuation of approximately $1.27 billion is impressive given it started 2023 with a market cap of around $288 million.

Stacks’ March rise tied to Ordinals NFT project

When the Stacks blockchain launched in January 2021, it marketed itself as a Bitcoin layer for smart contracts.

While Bitcoin remains a popular fixture in the blockchain economy, it was known for using its layer one solution to process less than ten (10) transactions per second (TPS) involving its native crypto asset BTC.

With the Stacks layer, millions of developers can not only create smart contracts but build decentralized applications (dApps) on Satoshi Nakamoto’s innovation.

These features have contributed to Stacks bringing decentralized finance (DeFi) to Bitcoin and in the process, the project has unlocked more than $300 billion in capital and provided a platform for Bitcoin’s economy activation.

Aside from Bitcoin DeFi, Stacks also introduced Bitcoin non-fungible tokens (NFTs). Bitcoin Ordinals was launched this January and was followed by the launch of the first Bitcoin Ordinals NFT collection on crypto exchange OKX in early March.

A few weeks later, a Bitcoin NFT marketplace was launched by the popular NFT platform Magic Eden due to the growth of Ordinals. Through the possibilities of Stacks Protocol, users have minted 650,000 Bitcoin NFTs.

“All these NFTs are auto-hashed to Bitcoin layer one (L1) and secure by Bitcoin in a scalable way,” says Muneeb Ali, co-founder of Stacks.

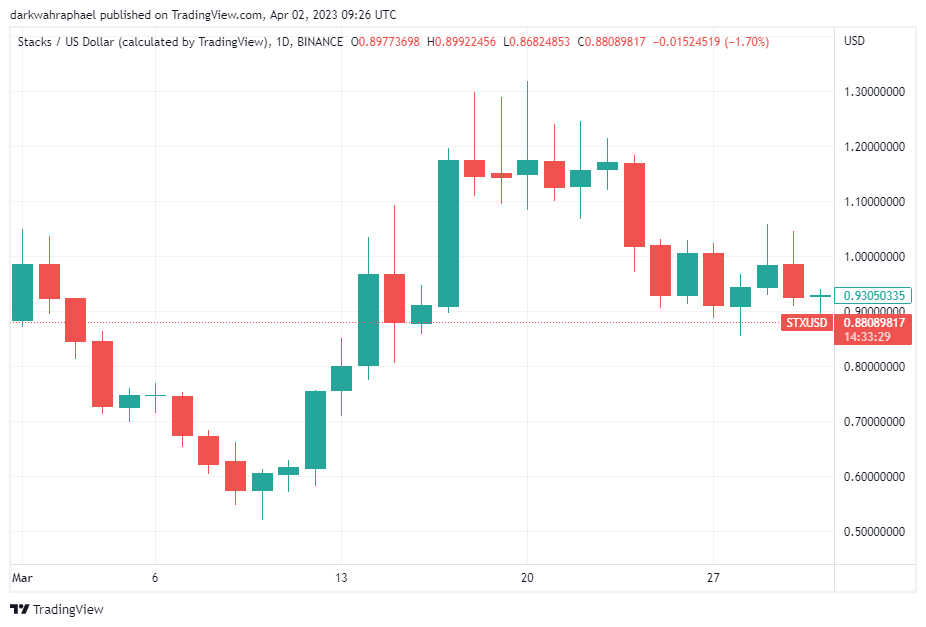

This explains why Stacks Crypto rose by 47% in 20 days to a quarterly and yearly high price of $1.3006 after opening March with a trading price of $0.8831.

During the third month of the year, daily trading volume spiked to a peak of approximately $713 million. Overall, traders and investors that decided to pocket profits during the third week of March saw 521% gains from January 1.

Stacks Crypto TVL shoots by over 250% in Q1

In crypto, total value locked (TVL) measures the amount of liquidity locked up by investors in a DeFi protocol.

The growing ecosystem of Stacks led to an injection of $18.4 million into Stacks dApps within 90 days. This accounts for the $25.53 million TVL during the end of March, after opening the year with a TVL of around $7.1 million.

While decentralized exchange (DEX) ALEX dominates dApps on Stacks, others such as Arkadiko, CityCoins, StackSwap, and UWU Protocol have also been contributing their quota in TVL.

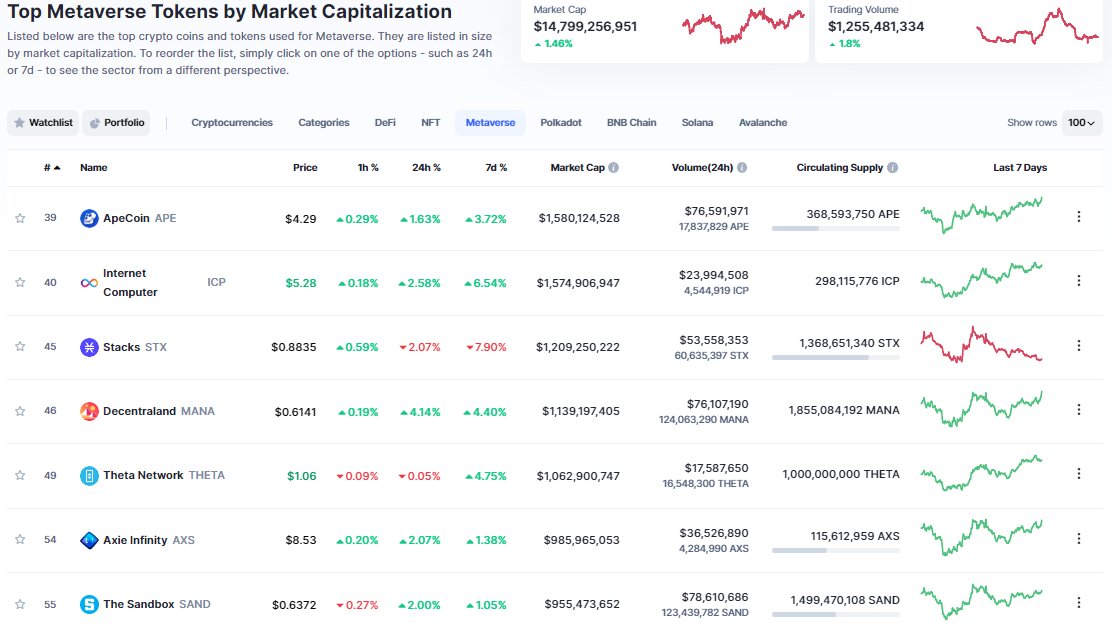

The latest development in Stacks Crypto bodes well for the project. As of late March 2023, STX trailed only ApeCoin (APE) and Internet Computer (ICP) in the ranks of the top metaverse tokens by market capitalization.

The token commands a higher share of the metaverse crypto market than Decentraland (MANA), Theta Network, Axie Infinity (AXS), and the Sandbox (SAND).

and then

and then