OpenSea volume during the second month of Q3 was the lowest it has recorded in the past two years, and the new low has reduced its standing in the ranks of the largest NFT marketplaces in the sector.

OpenSea, a non-fungible token (NFT) marketplace, recorded a trading volume of approximately $83 million in August, according to data from blockchain data tool Dune Analytics.

While this figure looks impressive considering the lack of demand for NFTs by collectors industry-wide and the monthly volumes of competitor marketplaces such as Foundation, Magic Eden, LooksRare, SuperRare, Zora, and others, it was far below the values from the same periods in previous years.

In August 2022, OpenSea volume was around $502 million, and roughly $1.6 billion was traded on the platform during the peak of the markets in August 2021.

Although many analysts have attributed the plunge in volume to a significant decline in global NFT market sales ($395 million) in August compared to $747 million in August 2022 and $5.5 billion in August 2021, the once-go-to marketplace for digital collectibles was mired in several issues during the eighth month of the year.

OpenSea ended its partnership with Binance

On Aug. 18, OpenSea terminated its support for NFTs deployed on the Binance Smart Chain. The digital art marketplace has lost its place as the largest NFT marketplace to Blur. As a result, it wants to effectively allocate its resources to the most promising NFT blockchains.

While Binance Smart Chain provided awesome NFTs, the cost associated with supporting digital arts built on the chain was greater than the benefits it brought to OpenSea’s quest to regain its crown.

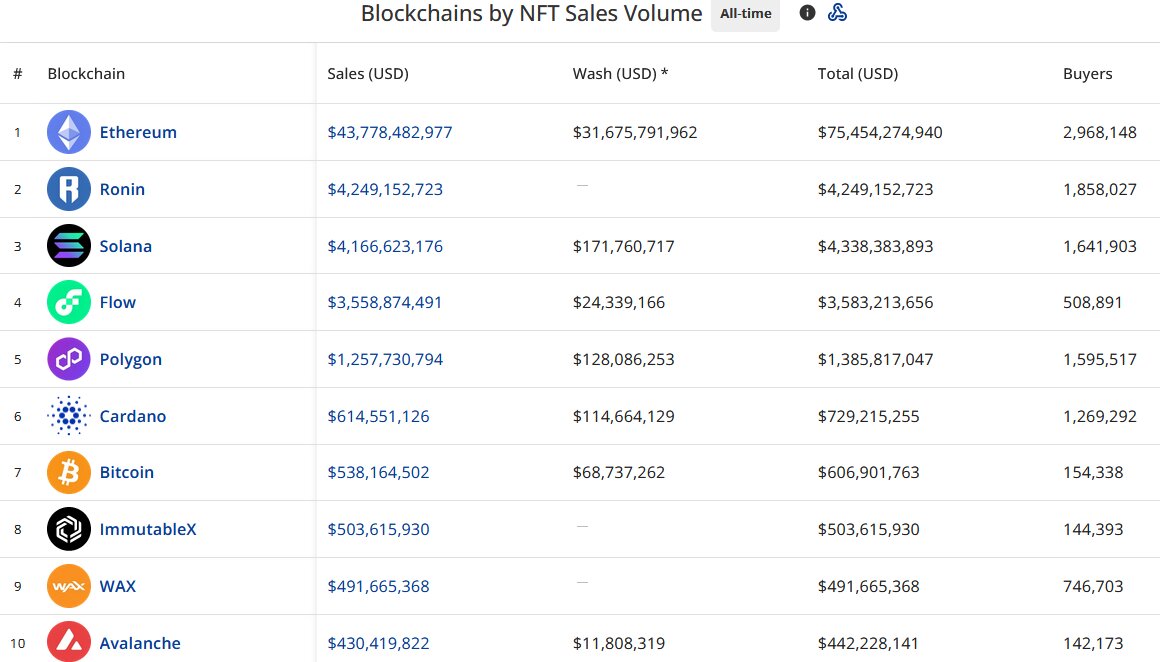

Once a major player in the digital collectibles’ sector, Chanpeng Zhao’s blockchain has fallen out of the top NFT chains by all-time sales volume.

It has lost its place in the rankings to Avalanche, WAX, Immutable X, Bitcoin, and Cardano while trailing Polygon, Flow, Solana, Ronin, and Ethereum by billions of dollars.

As of the end of August, BNB Chain NFTs had an all-time sales volume of around $258 million.

OpenSea and BAYC Creator were involved in a fee row

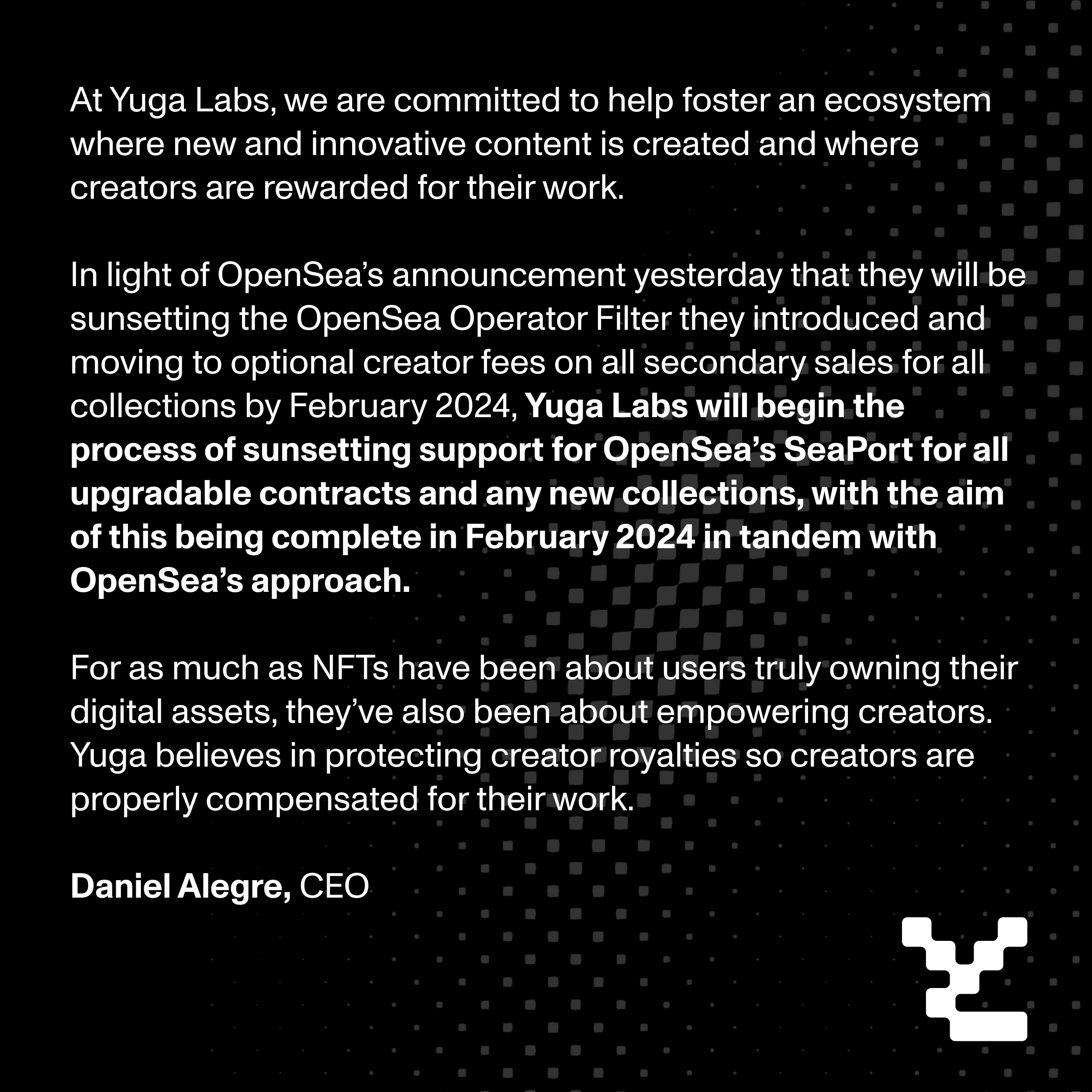

On the same day as OpenSea and BSC NFT’s partnership ended, Yuga Labs, the development team behind the Bored Ape Yacht Club (BAYC), released a statement on OpenSea’s decision to sunset their Operator Filter.

On August 17, OpenSea disclosed that it would be stopping the collection of resale fees for the original creators of NFTs. Seeing this as a huge blow to its business, Yuga Labs said, “It will begin the process of sunsetting support for OpenSea’s SeaPort for all upgradable contracts and any new collections, with the aim of this being complete in February 2024 in tandem with OpenSea’s approach.”

While NFTs have become an integral part of the blockchain-powered economy, Daniel Alegre, CEO of OpenSea, believes the original creators of the collectibles should be duly compensated for their work.

BAYC closed August with total sales of $26 million, which came from the activities of 372 unique buyers and 480 unique sellers involved in 568 transactions at an average sale value of $46,200.

OpenSea is gradually becoming the second-best NFT marketplace

Despite launching OpenSea Pro in April as an advanced marketplace that will target professional NFT traders and comes with a new level of optionality, selection, and control, it still trails Blur as the second-largest marketplace based on current volume data.

Out of a total market volume of around $411 million, Blur commanded the lion’s share with about $246 million, or about 60%.

If OpenSea does not find agreement with the major players in the industry, it could gradually fall off and become one of the most patronized NFT marketplaces instead of the go-to trading platform for digital collections.

and then

and then