Azuki and Nakamigos NFTs went in the opposite direction to the overall digital collectibles market in April, after seeing a more than 100% spike in sales volume.

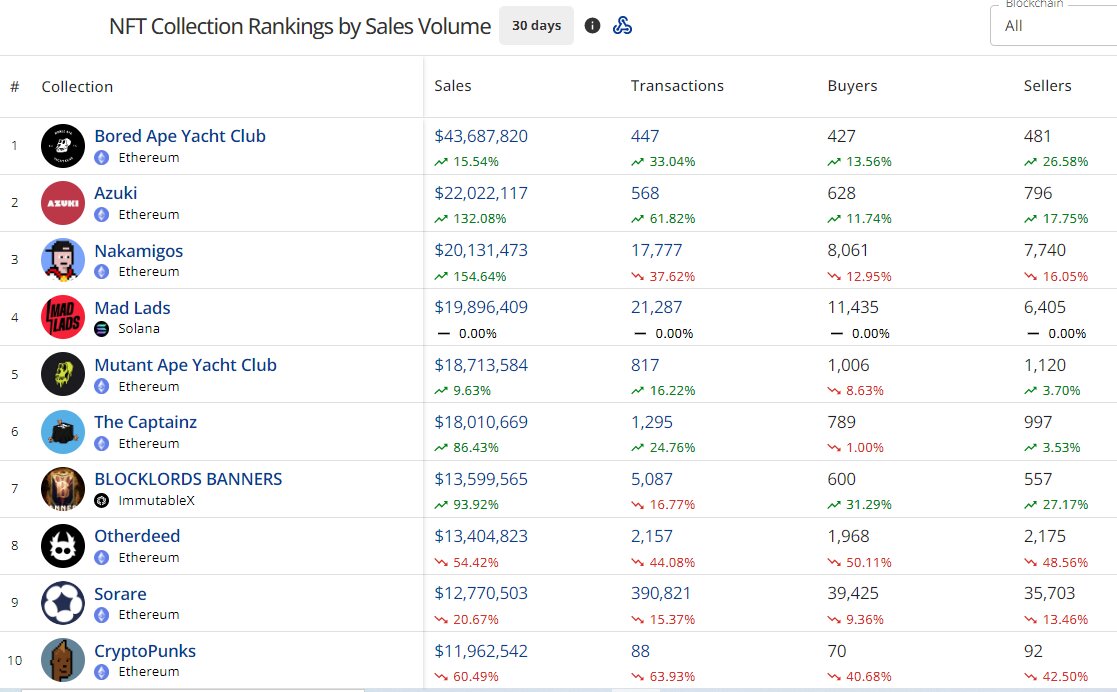

NFTs from Azuki and Nakamigos saw sales volume increases of over 130% and 150% respectively in April, data from CryptoSlam shows.

Within the period, Azuki NFTs brought in approximately $22 million in sales while Nakamigos generated around $20 million.

Sales in Azuki were primarily influenced by an 11% ascension in the number of unique buyers (628), which led to transactions soaring by 61% to 568.

While there was a reduction in the number of unique buyers and total transactions for Nakamigos NFTs, April’s average sale value of $1,134 was more than four times that of March, which stood at $267.

Azuki and Nakamigos improve global NFT market’s monthly sales

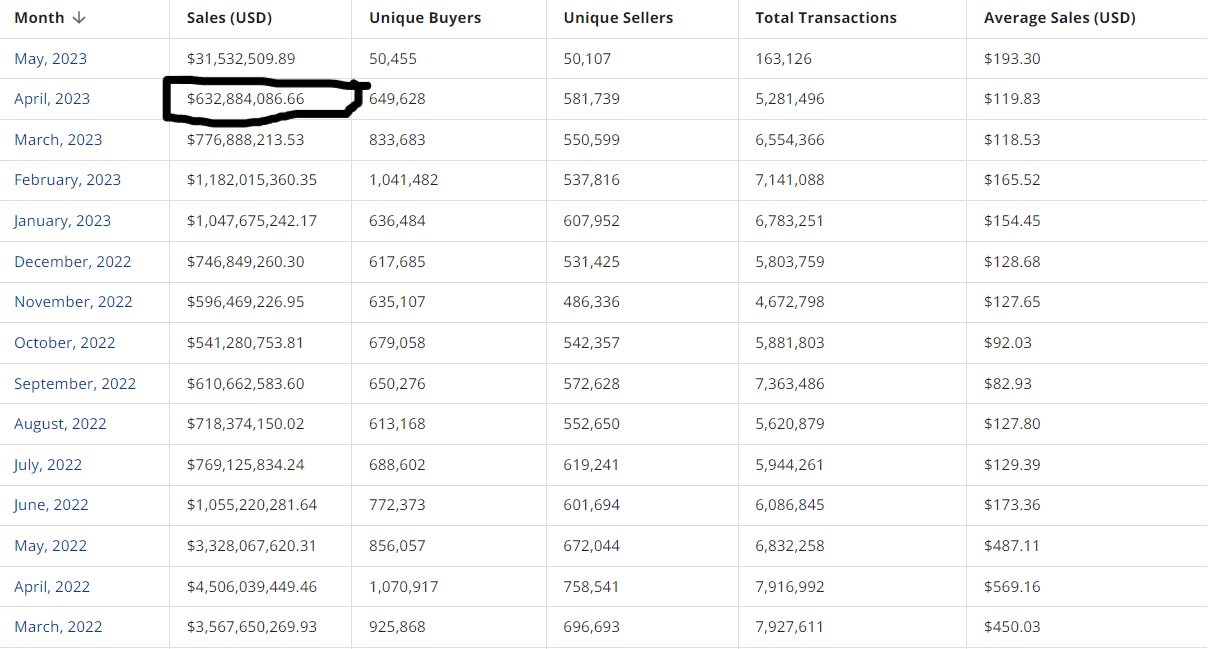

Azuki and Nakamigos NFTs contributed massively to global NFT market sales for April.

While heavy hitters like Yuga Labs’ Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Otherdeed and CryptoPunks made the top 10 NFTs by volume in April, many of the top projects were missing.

Sales from Azuki and Nakamigos brought a combined $42 million which was 6.6% of total sales of around $633 million.

Sales from the biggest NFT collections Axie Infinity ($2.1 million), Art Blocks ($6 million), National Basketball Association (NBA) Top Shot ($2.3 million), CloneX ($5 million), and Moonbirds ($3.1 million) were not impressive.

Despite this, other lesser-known projects made substantial contributions to sales such as Solana-based Mad Labs, Immutable X-based Blocklords Banners, and Ethereum-based the Captainz and Sorare which brought in more than $46 million in combined sales.

After plunging to a five-month low in global monthly sales, many traders have shed light on the future value of the NFT market.

What is the future value of the NFT market?

Reports by Grand View Research and Verified Market Research suggest the NFT market will be worth over $200 billion in value by 2030. Major players highlighted included Onchain Labs, Inc., Gemini Trust Company, LLC., Dapper Labs, Inc., Takung Art Co., Ltd., Ozone Networks, Inc., Funko, Dolphin Entertainment, Inc., PLBY Group, Inc., Cloudfare, Inc., and YellowHeart, LLC.

Areas the research focused on included video and audio clips, gamification, pixel art, fractal/algorithmic art, computer-generated painting, 2D/3D painting and computer graphics, GIFs, trading card games (TCG), video games, strategy role-playing games (RPG), tickets, domain names, and assets ownership.

Clearly the NFT market is much bigger than the tradable tokens we see on popular NFT marketplaces.

The entire blockchain-powered economy may be down. But while $633 million looks like small beer due to previous NFT industry milestones, it is one of the only areas that has brought consistent gains to traders during the protracted crypto winter.

and then

and then