The price of bitcoin could hit $45,000 by mid-May based on the top crypto’s past trends and as long-term investors accumulate more bitcoin. That’s according to predictions from K33 Research (formerly Arcane Research).

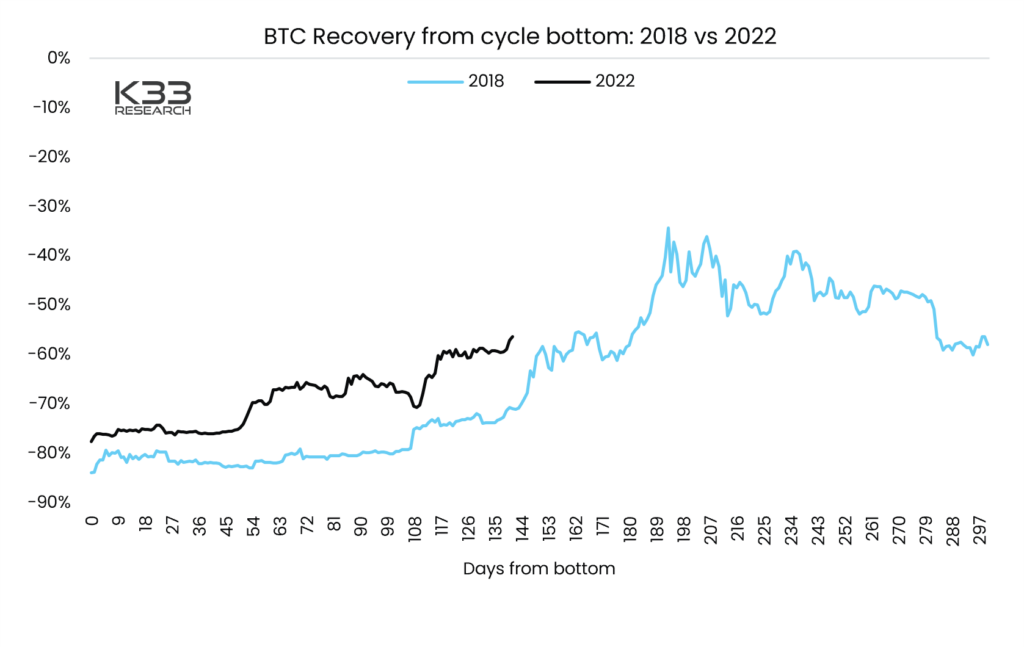

In a recent report, K33 Research senior analyst Vetle Lunde, argues that bitcoin’s decline and recovery cycle has been following a “remarkably similar” pattern to the one seen during the 2018 -19 bear market in both length and trajectory.

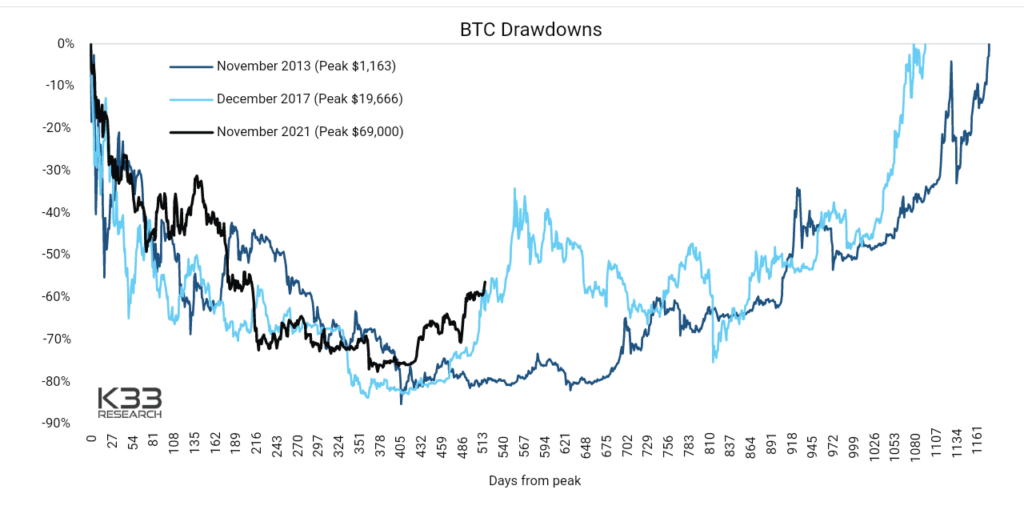

At the time, the BTC price crash from its all-time-high was more severe, tumbling 88% from the 2017 peak of $20,000. That compares with a decline of 78% in the 2022 cycle, Lunde said, describing similarities between the two top-to-bottom drawdowns as “eye-catching.”

“While no one should expect a 1:1 mirroring of the current drawdown to previous drawdowns, the resemblance to the 2018 drawdown is staggering. The two are similar in terms of duration from peak to trough, and the recovery trajectory,” he explained.

Bitcoin at $45K: Can history repeat itself?

Lunde spoke as the bitcoin price last week soared past the $30,000 mark for the first time since June 2022. The token reached $30,397 on Apr. 11, up 84% from $16,540 at the start of the year. As of writing, BTC was trading 2.5% down on the day at $28,483, per Coingecko data.

K33 Research, a crypto research firm previously known as Arcane Research, said the points at which the bitcoin price reached a bottom (or its lowest level during a cycle) in both cycles as mentioned above, lasted for approximately 370 days.

After 510 days since hitting the bottom, the price recovered and gave investors who bought at those low prices a return of 60% during the two cycles under review, said Lunde.

In 2018, the bear market rally topped 556 days after the 2017 peak, on June 29, 2019, with a 34% price decline from the peak, he added.

“While history is far from likely to repeat in a similar fashion if the fractal were to continue – BTC would peak around May 20 at $45,000,” the analyst predicted.

Bitcoin has seen wild swings since hitting an all-time high of $69,000 on Nov. 10, 2021, as panicky investors exited the market due to uncertainty over crypto regulation, a series of project collapses, the Ukraine crisis, as well as the weak global economic outlook.

Institutional investors underpin growth

Vetle Lunde explained that his prediction is based on increased demand from institutional investors. The long-term view from seasoned bitcoin investors such as Microstrategy is that a price decline of 60-80% from record highs is a chance to buy even more BTC, not sell.

Also read: Bitcoin Soars 84% To Reach 2023 High as Fed Expected to End Rate Hikes

“These investors tend not to care about the state of the global economy. They want to increase BTC exposure,” Lunde wrote on Twitter.

He admitted in his report, though, that a more “satisfying explanation behind the resemblance [in the cycles] is hard to put forward.”

“Committed long-term holders are still unwilling to sell at a 60% drawdown from the previous peak and use these periods as accumulation periods,” the analyst detailed.

“Additionally, the early 2023 rally has all the hallmarks of a hated rally – a rally where holders feel underexposed after a highly traumatic year, where investors de-risked in anticipation of further downside.”

Other analysts on Twitter have also made similar forecasts on bitcoin. One of them, PlanB, predicts that the price could reach $288,000 by the end of this year. Another, Willy Woo, is looking for a price of $300,000 by December.

Benjamin Cowen, meanwhile, thinks bitcoin will crush altcoins, since alts tend to do worse than BTC during the bear market and recovery years. The analyst points out that some altcoins seem to be in a perpetual macro downtrend when compared to bitcoin.

and then

and then