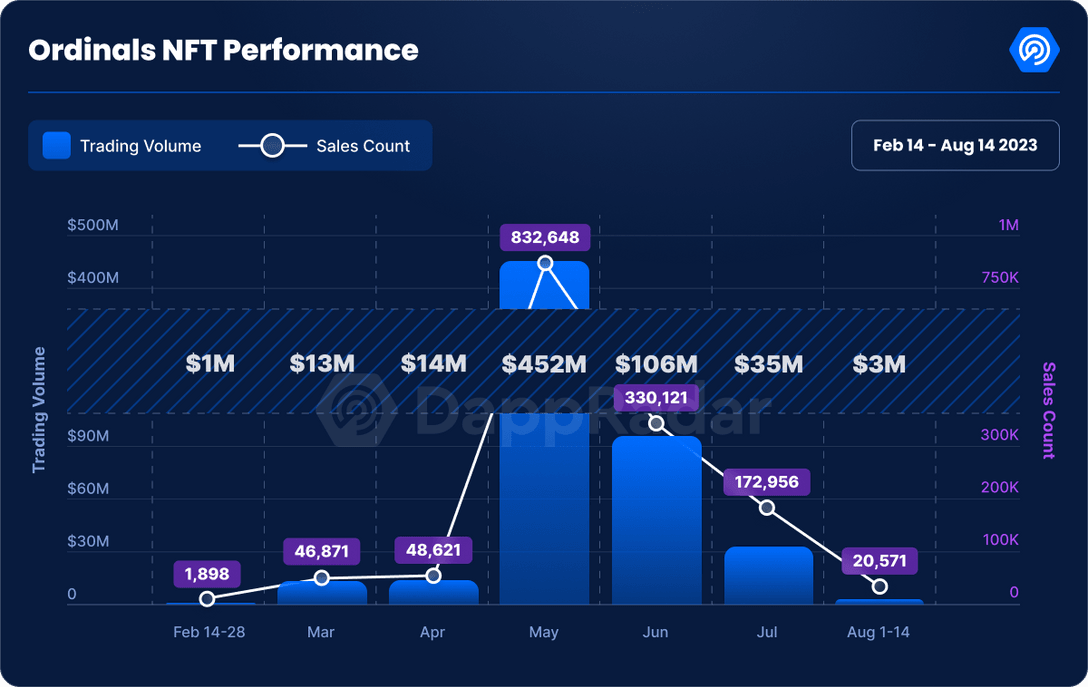

Bitcoin Ordinals non-fungible tokens (NFTs) may be losing style as trading and sales volume crashed over 99% since May, according to a new report from DappRadar. The crypto tracking platform described the decline as “alarming.”

Published Aug. 17, the report shows that total Bitcoin Ordinals sales volume slumped from a peak of $452 million in May to just $3 million as of Aug. 14. Likewise, the total number of transactions fell to 20,571 from 832,648 during the same period – showing that fewer people are interacting with the protocol.

Also read: Ordinals: Bitcoin NFT Sales Surge as ‘Inscriptions’ Hit 385K in 2 Months

Waning Bitcoin Ordinals interest

Software engineer Casey Rodarmor launched Ordinals on the Bitcoin mainnet on January 21. The protocol triggered a lot of interest, with crypto enthusiasts embedding a total of 385,000 ‘inscriptions’ on Bitcoin during the first two months of launch.

The Ordinals, or inscriptions, are Bitcoin’s own version of NFTs. They are made on the smallest Bitcoin unit known as ‘satoshis’, or “sats,’ by adding things like text, audio or images on the Bitcoin blockchain. The NFTs can be held and transferred across the network.

According to DappRadar, both trading and sales volume of the controversial Bitcoin NFTs have fallen sharply in successive months since May. Sales of Ordinals plunged 77% in June and then another 70% in July, “underscoring an evaporation of trading interest.”

“This steep decline in both sales volume and count within such a short period is alarming for Bitcoin Ordinals,” the report said. “The diminishing sales count underscores the waning enthusiasm or perhaps confidence in Bitcoin NFTs.”

DappRadar said the coming months will be critical in understanding whether the massive decline in Ordinals sales “is a temporary setback or indicative of a more systemic problem for Bitcoin-based NFTs.”

“While fluctuations in sales volume could be attributed to market dynamics, a consistent decline in transaction count may point toward broader issues,” the report said, adding:

“It suggests that fewer traders are engaging with Bitcoin Ordinals, which could raise concerns about its longevity and relevance in the NFT space.”

Divided community blamed for decline

According to DappRadar, while NFTs built on the Ethereum and Polygon blockchains also fell during the period under review, Bitcoin Ordinals faced a sharper decline. This likely “hints at possible concerns specific to its platform or the perceived utility of its NFT offering,” it said.

In addition, Bitcoin NFTs “are highly concentrated on PFPs [profile pictures], which generally speaking don’t have many use cases.” There are worries that the launch of Ordinals has caused rifts in the Bitcoin community.

“There are voices within the community that view Bitcoin primarily as ‘digital gold,’ suggesting that its primary function should remain as a store of value,” the report reads.

“On the other hand, Ethereum is often referred to as ‘digital oil,’ indicating its role in fueling the digital economy.”

Several Bitcoin NFT projects have emerged ever since Rodarmor launched the project. The list includes Bitcoin Punks, BTC Machines, Pixel Pepes and others. Many have made millions of dollars from the trade of Ordinals, including Yuga Labs, creator of the Bored Apes NFTs, with its TwelveFold collection that generated more than $16 million.

However, fundamentalists are worried that Ordinals could lead to congestion on the Bitcoin network as the NFTs compete with normal financial payments for block space. Their concerns were fulfilled when the average cost of sending a transaction over the Bitcoin blockchain spiked from $0.97 on Jan. 25, just days after the Ordinals launch, to over $2.40 by Mar.15.

As of writing, the average Bitcoin transaction fees hovered at $0.64, likely indicating the drop in Ordinals trading volume.

and then

and then