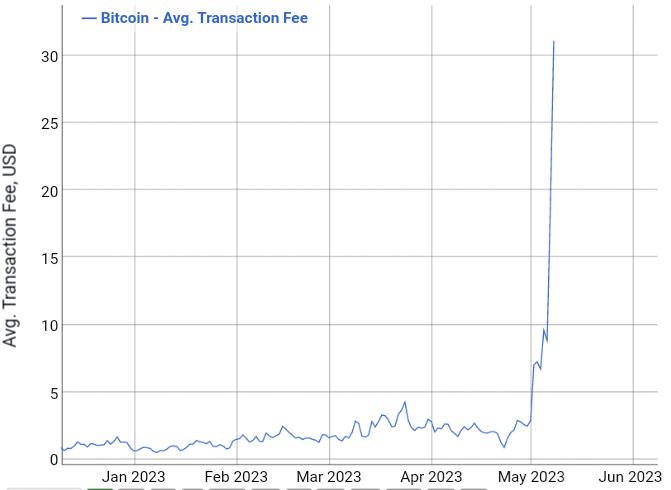

The average cost of sending a transaction over the Bitcoin (BTC) blockchain soared 960% to $31.14 since the start of this month, according to BitInfoCharts data, driven up by bitcoin NFTs made with the Ordinals protocol.

Created by software developer Casey Rodarmor, Ordinals are Bitcoin’s own version of non-fungible tokens (NFTs). The so-called “inscriptions” are created by adding things like text, audio or images on the Bitcoin network and can be stored there.

The inscriptions have generated massive hype in bitcoin circles, with more than 5 million Ordinals now embedded on the Bitcoin network, per Dune Analytics data. Bored Apes creator Yuga Labs made $16.5 million from the sale of 288 inscriptions from its TwelveFold collection.

Also read: Grayscale Bullish About Ordinals’ Impact on Bitcoin

Rising transaction costs

Ordinals have even given rise to a new standard for minting this kind of NFT on Bitcoin called BRC-20. But the NFTs have caused significant congestion on the Bitcoin network due to high demand for storage space, leading to the corresponding increase in bitcoin transaction fees.

According to data from BitInfoCharts, average bitcoin transaction fees rose to $31.14 on Tuesday, up 955% from $2.95 on May 1. Bitcoin fees have soared more than 3,000% since Rodarmor announced the launch of his Ordinals protocol on the Bitcoin mainnet on Jan. 21.

Fees are paid each time a bitcoin transaction is processed and confirmed by a miner, who pockets the fees, in addition to the block reward, as revenue. Proponents argue higher fees help keep the Bitcoin network secure.

But Bitcoin fundamentalists are unimpressed, citing high costs as a stumbling block to mass adoption. Indeed, the Ordinals-inspired congestion reportedly forced crypto asset exchange Binance to halt withdrawals for nearly two hours on May 6.

Bitcoin miners cash-in on higher fees

Apart from NFT enthusiasts, Bitcoin miners – the guys who help secure the blockchain via a global network of supercomputers – are seeing big gains from the Ordinals growth. To date, Ordinals have generated more than $21 million in fees, per available data.

Even miners that are usually averse to NFTs “are happy to process related transactions for a fee,” says OrdinalHub Strategy Lead Charlie Spears, according to industry media. For the first time since 2017, Bitcoin transaction fees have exceeded the regular mining subsidy.

BREAKING: #Bitcoin block 788695 contained transaction fees greater than the block subsidy.

6.7 BTC transaction fees + 6.25 BTC subsidy

This is a the first time in history this has ever occurred due to competitively high block space demand. pic.twitter.com/J7IcwzIVKE

— Joe Burnett (🔑)³ (@IIICapital) May 7, 2023

Miners earn 6.25 BTC every 10 or so minutes as a reward for securing the Bitcoin network – the so-called block subsidy. But they reap fewer bitcoin with each “halving”, a cyclical event that happens every four years, reducing the amount of bitcoin that enters circulation.

While the next halving is scheduled for 2024, past events left some operators on the brink of collapse. The rewards are a major revenue source for miners.

For long, some pundits have suggested that miners are using higher fees to compensate for lost revenue from the block reward cut – creating what could arguably become a future market for BTC, one based on fees. The suggestion has been met with disdain by hardliners.

Ordinals divide BTC community

There has always been questions on how Bitcoin would handle huge traffic if NFTs and other decentralized applications launched on the network. And Ordinals have spurred perhaps the most significant use of the Bitcoin blockchain since the Taproot upgrade of 2021.

“Ordinals are good; it forces the infrastructure of Bitcoin to mature, forces the scaling debate, solves the security budget issue, brings BTC back as a unit of account,” said Bitcoin analyst and investor Eric Wall, as quoted by Forbes.

But, as already noted above, that is creating a lot of problems for ordinary Bitcoin users. For example, higher fees mean that it is now very expensive for people using the Chivo wallet for transactions in El Salvador, which adopted bitcoin as legal tender in September 2021.

With base fees so high, even transactions on the Bitcoin payments layer Lightning Network are becoming impossible, according to Bitcoin developer Hampus. Lightning is the layer built to help mainstream BTC by facilitating small transactions at almost zero fees.

“Lightning completely ceases to work in a high fee environment,” he tweeted in response to Eric Wall who earlier suggested that “Lightning finally has a use case” following the rise of Ordinals.

“If the transaction fee is $100, it means every payment under $100 will be trusted & insecure. We need to talk about scaling. Not playing around with Ordinals,” added Hampus.

Lightning completely ceases to work if in a high fee env.

Because HTLCs below the dust limit won't be possible settle onchain. So if the txfee is $100, it means every payment under $100 will be trusted & insecure.

We need to talk about scaling. Not playing around with ordinals. pic.twitter.com/b8BwWMZ8sK

— Hampus (@hampus_s) May 2, 2023

Congested mempool

Indeed, it is hard to make small bitcoin transactions on Lightning when transaction fees are so high and confirmation wait times have become longer.

According to mempool.space, the number of unconfirmed bitcoin transactions is now at an all-time high, with more than 465,000 transactions waiting to be processed. The normal transaction count in the mempool is 35,000, and the rest are Ordinals.

For Bitcoin fundamentalists such as Roger Ver, nicknamed ‘Bitcoin Jesus’, and Bitcoin core developer Adam Back, their long held fears now have become a reality. Back described Ordinals as “crap” and urged miners to censor the NFTs as a “form of discouragement.”

Critics say any use of the network outside of financial transactions detracts from the original vision of the pseudonymous Bitcoin founder Satoshi Nakamoto.

In 2010, Nakamoto replied to a question on whether BTC should be used for non-financial purposes with an emphatic “No”.

and then

and then