In a stark contrast to the prolonged quietness, the NFT market is witnessing a surprising upturn, led by notable collections like Bored Ape Yacht Club (BAYC) and CryptoPunks.

For months, the NFT market had been eerily quiet, with minimal activity and declining interest. However, Recent data, highlighted by blockchain enthusiast Felixreads, shows a significant increase in Ethereum-based NFT transactions, pointing towards a potential market revival.

Also read: BAYC Bounces Back With $10M in Sales during 1st Week of July

The rise of Bored Ape Yacht Club

The Bored Ape Yacht Club has distinctly ascended to the apex of this awakening. Boasting a market valuation of $1.4 billion, the recent exploits of BAYC are nothing less than astounding. On the 4th of November, the collection witnessed an unprecedented surge in activity, culminating in 459 transactions, amassing an aggregate volume of $21.56 million.

“The top NFT collection by market cap, Bored Ape Yacht Club $BAYC, valued at $1.4 billion, achieved a record high of 459 transactions on November 4th, with a volume of $21.56 million.“

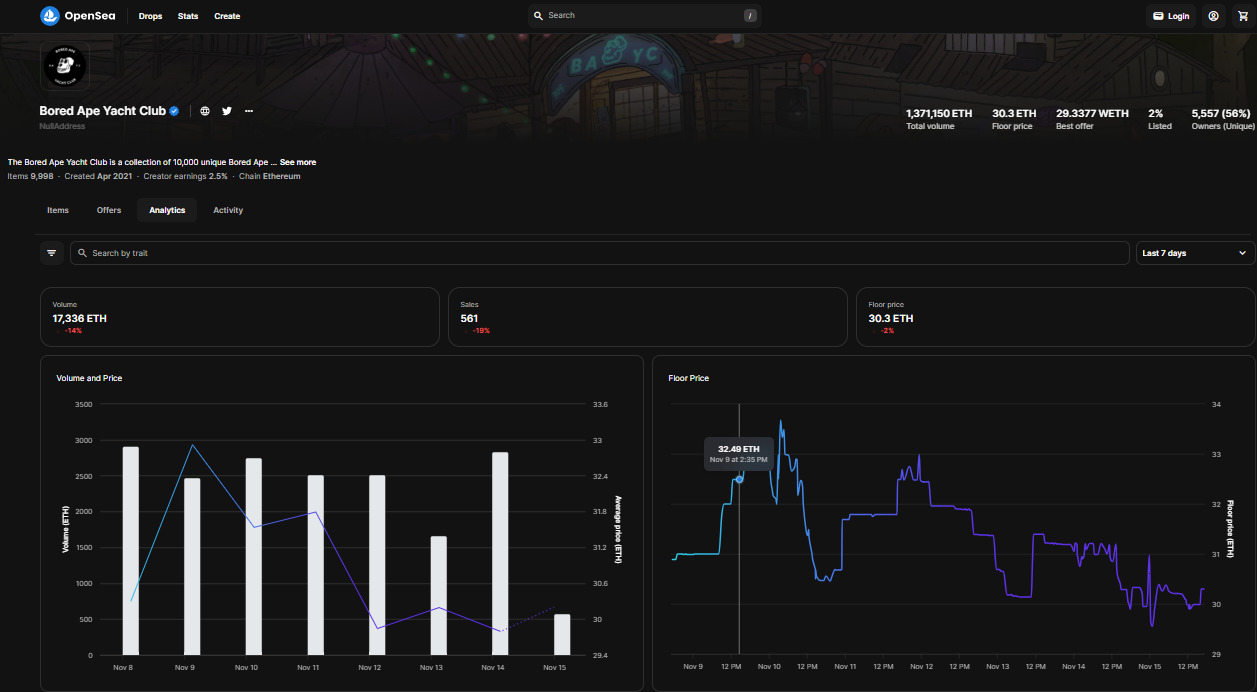

This figure not only demonstrates the collection’s leverage but also signifies the market’s overall upward trajectory. Interestingly, the latest data from OpenSea indicates that the collection has reached a trading volume of 17,336 ETH, a 14% increase from the previous period. However, sales dropped by 19%, with only 561 transactions recorded, suggesting a higher average value per NFT.

Bored Ape Yacht Club (Source: OpenSea)

Bored Ape Yacht Club (Source: OpenSea)

In addition, the floor price of Bored Ape NFTs experienced a slight dip to 30.3 ETH, a decrease of 2%. This may be indicative of broader market sentiments or a change in the liquidity preferences of digital asset investors. Despite these fluctuations, the Bored Ape Yacht Club continues to lead the NFT market. With a total volume of 1,371,150 ETH and a solid community of 5,557 unique owners, BAYC remains a significant player in the digital asset arena.

The Cryptopunks craze

Hot on the heels of BAYC, CryptoPunks has also experienced a notable comeback. This revival has elevated the collection’s market value to an impressive $1.28 billion, indicating a solid rebound in the NFT marketplace.

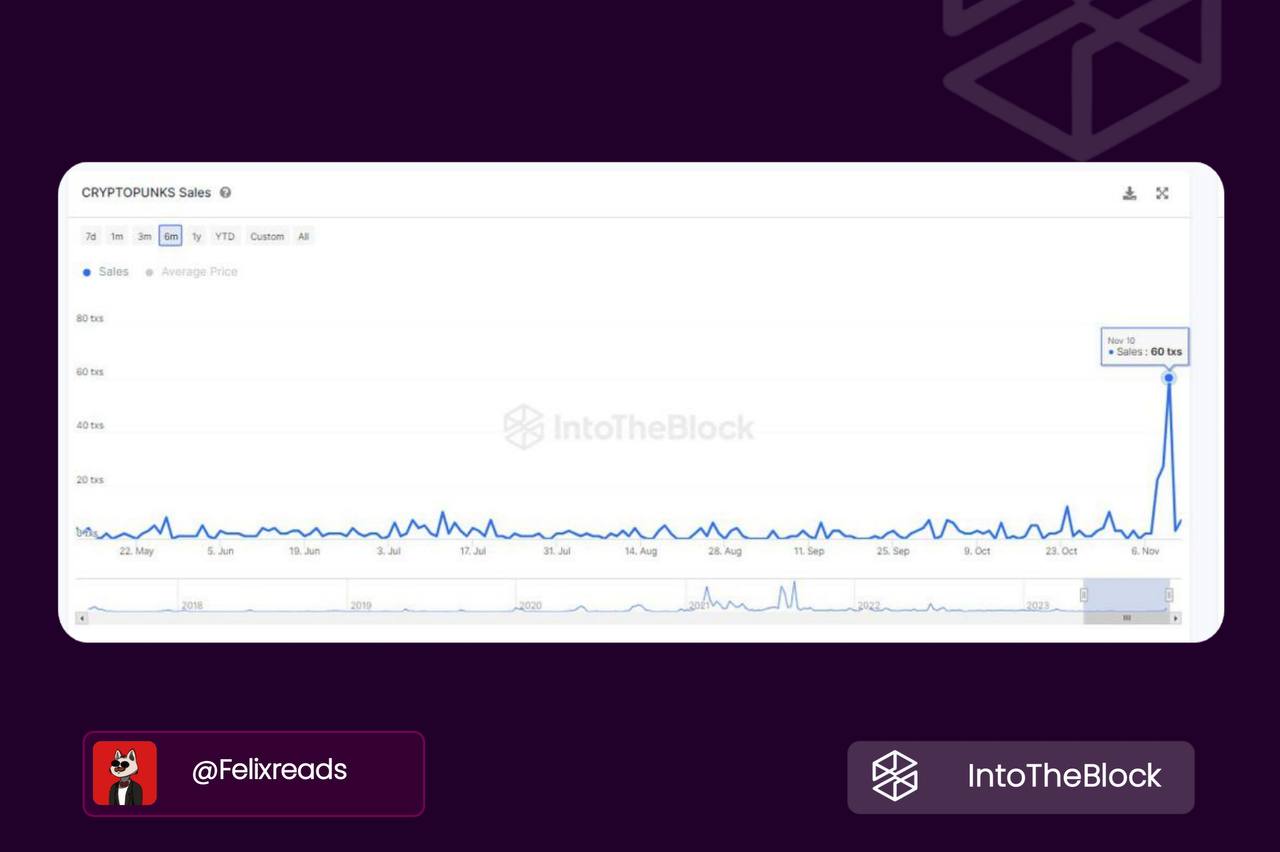

Source: Felixreads

Source: Felixreads

According to the reports, the collection recorded 60 transactions with a total volume of $8.32 million. This surge in sales has set a new six-month high for CryptoPunks, reflecting a broader positive trend in the NFT space.

“Following closely is Cryptopunks, with a market cap of $1.28 billion, which also set a new six-month high with 60 transactions in sales and a volume of $8.32 million.“

Moreover, CoinGecko data reveals that as of November 2023, the total market cap of the CryptoPunks collection is approximately $1.24 billion. This valuation derives from the collective worth of all 9,994 NFTs in the collection, currently held by 3,713 unique owners.

Binance Ordinals’ ripple effect

While not explicitly mentioned by Felixreads, the recent introduction of Binance ordinals cannot be overlooked as a contributing factor to the market’s revival. Binance venturing into NFTs adds a new dimension to the market. This move could be drawing more investors back into the fold, intrigued by the integration of Bitcoin ordinals into the NFT space.

Furthermore, Data from Dune Analytics reveals a substantial uptick in the activity surrounding Bitcoin Ordinals Inscriptions, with the count soaring to a new high of 505,000. This surge is primarily driven by the adoption of BRC-20, a critical factor in this remarkable growth.

Notably, as of November 16th, the overall number of Bitcoin Inscriptions has surpassed the 40 million mark, a clear indicator of the burgeoning interest in the Bitcoin NFT space. As Binance leads this new charge, the future of NFTs and their role in the broader crypto ecosystem appears more dynamic and promising than ever.

and then

and then