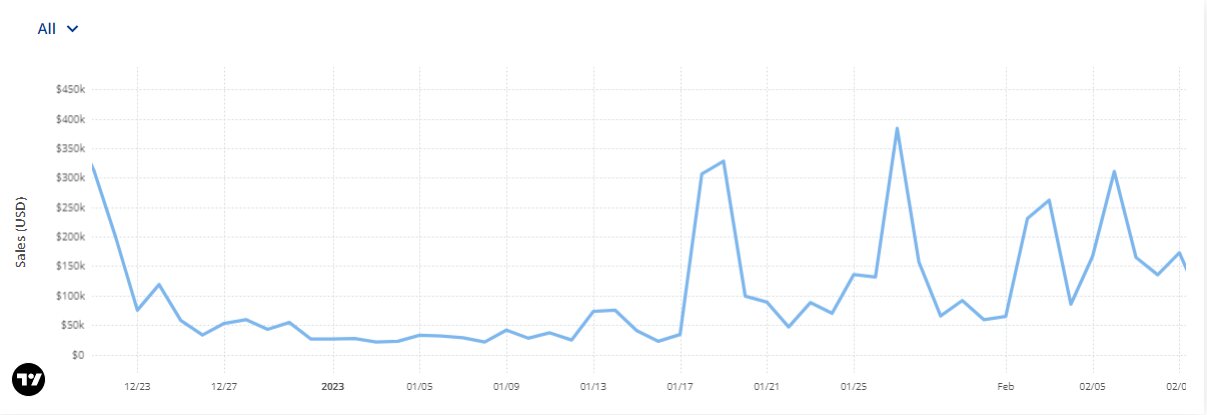

Trump Digital Trading Card non-fungible tokens (NFTs) tumbled in January 2023 after it generated around $2.6 million in sales.

For a project built around one of the most recognizable names across the globe, the statistic was tagged as a huge disappointment by many industry analysts after falling 73% below December 2022’s milestone of $9.9 million.

As a result, Trump NFTs, like other digital collectibles failed to maintain their sales momentum, and in dollar terms fell by around $7.3 million.

Unique buyers for Trump Digital Trading Card NFTs were slashed by more than 80%

In December 2022, the NFTs saw 6,892 unique buyers pour liquidity into the collectibles. Unfortunately, as new projects entered the space and others saw renewed interest from stakeholders of the NFT Community, Trump NFT’s unique buyers dwindled by 86% to 946. In the process, 5,946 unique buyers were lost from the previous month.

Total transactions descended heavily

The number of transactions an NFT is involved in is highly instrumental in determining its trading volume. Trump Digital Trading Cards saw huge demand during the last month of the year and this culminated in 29,205 transactions.

The total transactions for the NFTs stood at 5,626 in January 2023 which was less than 5 times the total transactions from December where active owners stood at 19,156 compared to January’s 2,751.

Trump Card NFT floor price has spiked

Despite the plunge in cumulative monthly sales volume, the floor price of the NFTs has increased significantly moving from 0.0785 ETH (around $117) on Dec. 15 to 0.64 ETH (approximately $951) on the largest NFT marketplace OpenSea, as of press time on Feb. 13.

This is why the average sale value spiked from 38% in December’s $340.03 to January’s $469.2.

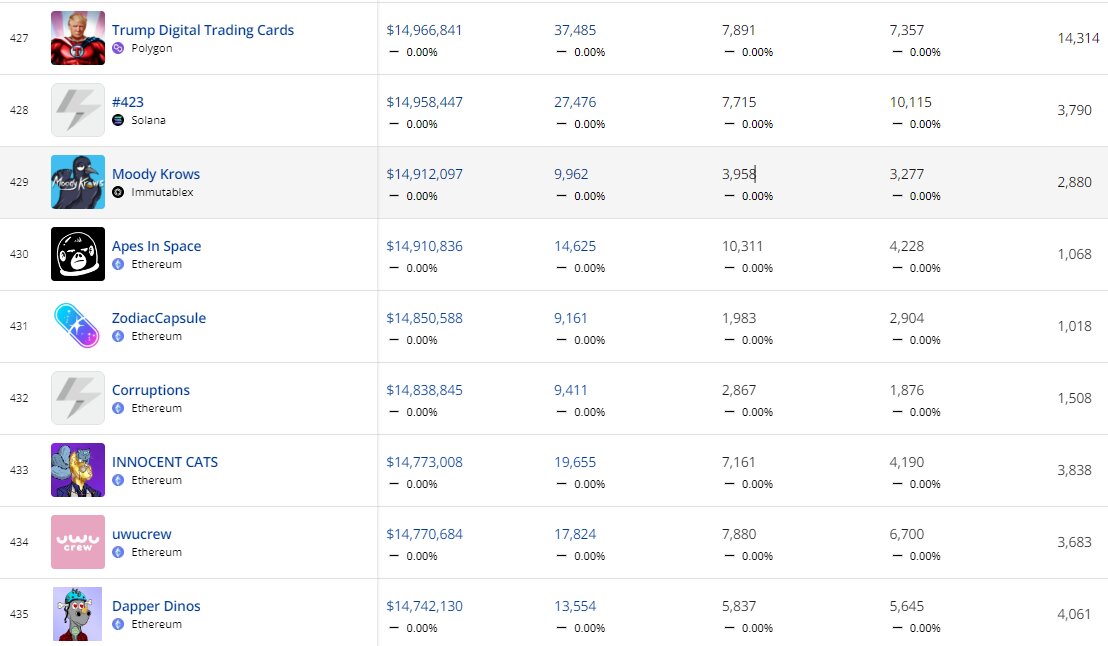

NFTs are currently ranked below 400 in all-time sales

Due to the decrease in monthly trading volume, Trump NFTs are way behind mainstream collections such as the Bored Ape Yacht Club (BAYC), Axie Infinity, Mutant Ape Yacht Club (MAYC), Otherside for Otherdeed, Moonbirds, and NBA Top Shots.

Despite this, it is above Solana-based #423, Immutable X-based Moody Krows, and Ethereum-based NFTs like Apes in Space, ZodiacCapsule, Corruptions, INNOCENT CATS, uwucrew, and Dapper Dinos.

New to Trump Digital Trading Cards?

Launched in December 2022, the digital trading cards comprise 45,000 unique NFTs by the 45th President of the United States Donald John Trump. The NFTs were inspired by his career as well as his life as a businessman and later a politician.

Trump Trading Cards, Limited One-of-Ones, Gold & Silver Autographed Cards, Business Trump, Astronaut Trump, and Cowboy Trump. Each card had a starting price of $99.

As part of the perks associated with the project, lucky collectors could have a chance of meeting Donald Trump at some of his residences at Mar-a-Lago or enjoy a zoom call with him.

The NFTs continue to see more than $100,000 in daily sales. As of Feb. 13, Trump NFTs had more than $2.4 million in sales throughout February and had total sales of more than $14 million.

and then

and then